In what case is a separate division created? Organization of activities of a separate unit. Legal status of separate divisions

Structural territorially separate division of an organization

As part of the organization's activities, part of its functionality can be transferred to structural units. At the same time, it is important to maintain a line between separating part of the company as a new legal entity and territorial and organizational relocation of the unit, which will remain an integral part of the company.

One of the differences between such actions is the information that is entered into the Unified State Register legal entities (Unified State Register of Legal Entities): a new entry is made about the creation of a company as a result of reorganization, and about a separate division, the tax authorities make notes in the lines reserved for information about the parent organization.

From this, the subordinate position of the units is obvious. It is also emphasized by law. In Art. 55 of the Civil Code of the Russian Federation states that separate divisions are not legal entities, although they have a number of individualizing characteristics.

The list of required features is short:

- administrative isolation, expressed in the presence of the separated part of the company of its own management, acting in accordance with the requirements of Art. 55 of the Civil Code of the Russian Federation on the basis of a power of attorney;

- territorial separation, in which the legal address of the allocated branch of the company differs from the address executive body legal entity.

By internal decision, a part of the company may be endowed with other isolating characteristics. For example, such signs could be:

- separate balance;

- own personal account;

- personal calculation of payments to employees and other persons.

Legal status of the separated parts of the company in entrepreneurship and labor relations

Legal status a separate unit follows from its dependent status:

- The rights of the dedicated part of the company are significantly limited compared to the functionality of the parent organization.

For example, separate divisions have the right to file claims in court only if they act on behalf of the organization. Separate divisions are not recognized as proper defendants, although Art. 29 of the Code of Civil Procedure of the Russian Federation and allows for filing a claim in court at their location. - The activities of separate divisions are the same work that the company performs in accordance with the codes of economic activities assigned to it, as well as the activities of employees (secretaries, lawyers, accountants, etc.) to create conditions for the performance of such work, or only part of such activities . Providing separate units with powers to carry out established types of activities is carried out by a legal entity.

- Separate units are intermediaries in labor relations, not their sides. The separated part of the company is not endowed with the legal capacity of a legal entity, and therefore separate divisions cannot act as employers.

If a worker is sent to conduct labor activity to a separate unit, then this qualifies as being sent on a business trip (see Regulations on the specifics of sending on business trips, approved by Government Decree No. 749 of October 13, 2008).

Types of separate divisions under the Civil Code and Tax Code of the Russian Federation

Civil Code (Article 55) and laws on certain types legal entities recognize the existence of 2 types of separate divisions:

- A branch of a company is a separate division created to carry out the activities of an organization outside its location, the functions of a representative office, or only part of these functions, depending on the scope of powers transferred by the company.

- A representative office of a company is a separate division dedicated to protecting and representing the interests of the company. Representative offices are especially common in organizations operating in several countries.

The Tax Code (Article 11) recognizes any territorially separated parts of legal entities as separate divisions if they have stationary workplaces. Place of work according to Art. 209 of the Labor Code of the Russian Federation is the place where the employee carries out his work duties or in which he needs to be in order to perform work. The place of work must be controlled by the employer.

A workplace is stationary if it is created for more than a month. Last requirement is related to the deadline for registering a separate division for tax purposes. In accordance with Art. 23 of the Tax Code of the Russian Federation, a legal entity notifies the tax authorities about the allocation of branches or representative offices within a month from the moment of their creation. If workplace created over short term, then it makes no sense to carry out its tax accounting as a separate division. If it was created for a period of more than a month, then the tax service recognizes it as a separate division.

What does it mean to recognize a separate division as such for tax accounting purposes?

Despite the fact that in accordance with Art. 11 of the Tax Code of the Russian Federation, a territorially delimited part of a company with a workplace created for a month or more is recognized as a separate division, its legal capacity differs from the rights and obligations of a branch or representative office.

Don't know your rights?

The separated part of the company, recognized as such for tax purposes, usually does not have an administrative management apparatus, own property and funds, cannot independently exercise the powers of the company or protect its interests. The reason for this is the purpose of recognizing by the Federal Tax Service the territories with existing jobs as a division of the company.

As stated in Art. 11 of the Tax Code of the Russian Federation, recognition of a separate division as such is carried out for the purpose of implementing the legislation on taxes and fees.

For example, if an organization is developing subsoil on Far East, and its executive body is located in Central Russia, then paying taxes at the location of the legal entity is inappropriate for the implementation of tax control, as well as for other reasons. According to Art. 335 of the Tax Code of the Russian Federation, the company is registered at the place of mining. Obviously, their production stretches over more than a month, and the employees’ workplace will be a mine, quarry, etc. Then, for the purposes of paying mineral extraction tax, the tax authorities may recognize the presence of a separate division of the company.

The procedure for creating a separate division

Unlike separate divisions, which acquire this status at the direction of the tax authority, branches and representative offices are created according to a more complex procedure. The following stages are distinguished:

- Making a decision on the separation of a part of the company according to the procedure established by law or internal regulations of the company.

For example, the law “On companies with limited liability» dated 02/08/1998 No. 14-FZ defines the following decision-making procedure:

- submitting the issue for consideration by the General Meeting of Shareholders 30 days before its convening;

- reviewing the question;

- agreement of 2/3 of the meeting participants with the opening of a separate division.

In Art. 65 of the Law “On Joint Stock Companies” dated December 26, 1995 No. 208-FZ states that the creation of branches and representative offices may fall within the competence of the board of directors if this is provided for by the company’s charter.

- Adoption of a local act regulating the work of a separate division of the company. Typically this is a branch/representative office provision.

- Appointment by order of the head of the parent organization of the management of a separate division. Usually, at the same time, a power of attorney is issued in the name of the head of the department, since without it the head will not be able to manage the department of the company (Article 55 of the Civil Code of the Russian Federation).

- Submitting an application to the Federal Tax Service in form P14001, approved. by order of the Federal Tax Service “On approval of forms and requirements...” dated January 25, 2012 No. ММВ-7-6/25@, on inclusion in Unified State Register of Legal Entities information about the division. As indicated in the letter of the Department of Tax Policy of the Ministry of Finance of the Russian Federation dated December 16, 2009 No. 03-02-07/1-541, a separate division of a legal entity is considered created from the moment of making additions to the state register.

- Submitting form S-09-3-1 to the Federal Tax Service, approved. by order of the Federal Tax Service dated 06/09/2011 No. ММВ-7-6/362@ within a month after the allocation of part of the organization. This is done to register a separate division with the tax service.

Sample regulations on a separate division of LLC, JSC

In Art. 5 of Law No. 14-FZ determines that an LLC operates on the basis of a regulation approved by the parent company. Usually the situation is similar with other legal entities (see Article 91 of Law No. 208-FZ, etc.).

- general provisions as a set of information about the parent organization and the allocated part, such as: names, addresses, etc.;

- purpose of creation, for example, ensuring compliance with the interests of a legal entity;

- legal status as a combination of rights, duties and responsibilities;

- the procedure for control carried out by the head office;

- data on management procedures, management competence;

- participation in labor relations;

- the procedure for disbanding a unit;

- other provisions as necessary.

Reporting of separate divisions in 2020

One of the manifestations of control over branches and representative offices by a legal entity and government agencies is a reporting check.

For external reporting, a separate division of a legal entity provides the following documents on a monthly basis in 2020:

- Tax returns, if the unit is obligated to:

- pay transport tax and property tax of the organization;

- transfer tax withheld from employees' earnings to their income.

- Form according to KND 1151111, approved. Order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11/470@, on the payment of insurance premiums to the Federal Tax Service.

- Form 4-FSS, approved. by order of the FSS dated September 26, 2016 No. 381, for reporting to the Fund social insurance on payment of contributions for insurance of the risk of occupational injuries.

- Form SZV-M, approved. by resolution of the Board of the Pension Fund of the Russian Federation dated 01.02.2016 No. 83p, for information Pension Fund on contributions to employee pension insurance.

- Other documents.

Internal reporting is determined in accordance with the instructions of the parent company. It includes the transfer of accounting documentation, information on the implementation of plans, etc., which means for a separate division of the organization the need to prepare additional reports in the forms established in the organization.

Let's summarize. Separate structural subdivision a legal entity is a part of a company that is separated territorially and administratively for the purpose of carrying out activities similar to the activities of the parent company, and, if necessary, also representing its interests.

In addition to those allocated in civil law branches and representative offices as types of separate divisions, tax authorities for the execution of the Tax Code of the Russian Federation and other acts on taxation may recognize territorially allocated parts of a legal entity as separate divisions if they have stationary workplaces.

V.E. Polyakova legal adviser

DI. Paramonov MCA lawyer

A.A. Susarova lawyer

"FBK Legal"

Article from the magazine "Financial and accounting consultations", № 6 (46), 2013

Often companies are faced with the need to create a separate division. And in this case, the key question is the choice legal form, in which the corresponding unit can function: branch, representative office, etc. Let's consider this situation on a specific example.

The company is registered in the Moscow region and plans to create a separate division in Moscow. It is assumed that the division will be responsible for the marketing of products and management of the company, i.e. will actually perform some of the functions that society itself performs. The separate division will employ a financial director, a sales director, a production director, sales specialists (managers, supervisors, leading sales managers). key clients and others), product certification specialist, accountants.

In this regard, the lawyers were asked the question of what legal form is most acceptable for organizing the activities of a separate division of the company in Moscow.

Legal status of a separate division

The Civil Code of the Russian Federation distinguishes two types of separate divisions of an organization - a branch and a representative office.

In accordance with paragraph 1 of Art. 55 of the Civil Code of the Russian Federation, a representative office is a separate division of a legal entity located outside its location, which represents the interests of the legal entity and protects them.

A branch is a separate division of a legal entity located outside its location and performing all or part of its functions, including the functions of a representative office (Clause 2 of Article 55 of the Civil Code of the Russian Federation).

Thus, the representative office may be assigned the functions of negotiating; conclusion of transactions; conducting advertising campaigns for the activities of the parent organization; conducting marketing research aimed at studying the market for relevant goods (works, services) in the region of its location; protection of the rights and legitimate interests of the organization in the courts.

In addition to the specified functions of the representative office, the branch is directly involved in production and other entrepreneurial activity legal entity, which it maintains in accordance with the law and its constituent documents.

It is expected that employees of a separate structural unit will perform not only the functions of the company’s representative office in Moscow, but also manage current activities (directors), and deal with decisions financial issues (financial division) and issues of product certification (product certification specialist), organize accounting (accounting). Thus, a separate structural unit will perform part of the functions of a legal entity. In this regard, in our opinion, the most acceptable legal form of functioning of a separate structural unit is a branch.

At the same time, we note that civil legislation does not contain either a direct prohibition on the creation of separate divisions of an organization other than representative offices and branches, or a mandatory norm containing closed list types of separate units. From this we can conclude that the organization has the right to create separate divisions of the organization other than representative offices and branches, for example, branches, bureaus, offices, consultation and information points. This conclusion is confirmed by arbitration practice.

At the same time, the legislation does not contain restrictions regarding what functions can be performed by other separate divisions that do not have the status of a legal entity.

Thus, one should not exclude the possibility of creating a separate division of the company in Moscow, which does not have the legal status of a branch or representative office.

There are no mandatory conditions under which the creation of a separate division in one legal form is allowed and the creation of a division in another legal form is excluded. However, there are minor differences in legal status separate divisions that allow one or another form to be considered the most preferable.

Documents required to create a separate division

Documents required to create a branch

- The decision to create a branch. According to paragraph 1 of Art. 5 of the LLC Law, a branch is created by decision general meeting members of the company, adopted by a majority of at least 2/3 of the votes of the total number of votes of the company's participants. This decision should indicate the location of the branch being created. In this case, it can be designated by the name of the city/town where the branch is located without indicating the exact address.

- Amendments to the company's charter. By virtue of clause 3 of Art. 55 of the Civil Code of the Russian Federation, branches must be indicated in the constituent documents of the legal entity that created them. Thus, when creating a structural unit with the status of a branch, it is necessary to make changes to constituent documents society. Changes to the constituent documents are subject to state registration in accordance with the provisions of Art. 17 of the Law on State Registration.

- Regulations on the branch. From paragraph 1, clause 3, art. 55 of the Civil Code of the Russian Federation it follows that a branch of the company acts on the basis of the relevant regulations. Approval of such regulations on the branch, which is internal document society, sub. 8 paragraph 2 art. 33 of the LLC Law also falls within the competence of the general meeting of company participants (the sole participant of the company).

It is recommended that these decisions: on the creation of a branch, amendments to the charter of the company and approval of the regulations on the branch be formalized in one decision of the general meeting of participants (decision of the sole participant) of the company. - Power of attorney for the head of the branch. The head of the branch is appointed by the company and acts on its behalf on the basis of a power of attorney (Clause 4, Article 5 of the LLC Law). The decision to appoint a branch manager must be formalized by order of the general director of the company (Article 68 of the Labor Code of the Russian Federation).

- Tax registration. When creating a branch, the company must register for tax purposes at the location of the separate division.

Registration with the tax authority at the location of the branch is carried out on the basis of information entered into the Unified State Register of Legal Entities when the constituent documents of the company are changed. Providing additional documents It is not required to register the company for tax purposes at the location of the branch. - Notification to government off-budget funds.

It is necessary to note that a company is subject to registration at the location of the branch only if it has a separate account, balance sheet and accrues payments and other remunerations in favor of individuals (Clause 11 of Article 15 of the Law on Insurance Contributions). Having a separate account and independent balance is not mandatory for a branch. The decision to allocate a branch to a separate balance sheet and open a separate account is made depending on the degree of independence of the branch, which is determined by the head office when creating the branch. When making an appropriate decision, the following factors are usually taken into account: the number of employees working in a separate unit; remoteness of separate divisions from the main office; functions performed by a separate division.

Registration in extra-budgetary funds is carried out by sending appropriate notifications to the Pension Fund of the Russian Federation and the Social Insurance Fund.

Registration with the Compulsory Health Insurance Fund is carried out through the territorial bodies of the Pension Fund of the Russian Federation (clause 4 of Article 17 of the Law on Compulsory Health Insurance). In this regard, the provision of additional documents when registering a company at the location of the branch in the Compulsory Medical Insurance Fund is not required.

Documents required to create another separate division

- The decision to create a separate division. The procedure for creating structural units that are not a branch or representative office is not regulated by civil law. In accordance with sub. 8 paragraph 2 art. 33 of the Law on LLC approval (acceptance) of documents regulating internal activities of the company (internal documents of the company) falls within the competence of the general meeting of participants.

In our opinion, an order (instruction, decision) on the creation of a structural unit, information about which is not included in the charter, is an internal document of the company. Thus, in order to create a separate division, the general meeting of company participants should make an appropriate decision. - Regulations on a separate division. The law does not provide for the procedure for approving the regulations on a separate subdivision. However, the possibility of approving such a provision is also not excluded. In connection with this meeting of company members or general director the company may approve a regulation on a separate division.

- Power of attorney for employees of a separate division. If to execute labor responsibilities employees of the company may need a power of attorney; it must be issued to them by the sole executive body of the company.

- Notice of the creation of a separate division. When creating a separate division that is not a branch or representative office, the Company must notify the tax authority at the location of the Company (clause 3 of the Registration Procedure). The form of the message was approved by order of the Federal Tax Service of Russia dated 06/09/2011 N ММВ-7-6/362@ (Appendix 3).

Upon receipt of information about the creation of a separate division, the tax authority at the location of the company is obliged, no later than the next working day after the day of receipt of such information, to send it to the tax authority at the location of the separate division of the organization for registration. There is no need to send an additional message to the tax authority at the location of the separate division.

From the above description of the documents required to create a separate division, it follows that the creation of a branch involves the preparation of a larger number of documents than is required when creating another separate division. Meanwhile, when creating a branch, several decisions can be formalized in one document (on the creation of a branch, amendments to the constituent documents, appointment of a manager). There is no need to re-apply to the tax authority in order to register the company at the location of the branch (these actions will be performed when registering changes to the constituent documents of the company). Consequently, the number of documents issued when creating a branch, and the labor costs for their preparation, will slightly exceed the number of documents drawn up when creating another separate division, and the corresponding labor costs.

In the case of separating a branch into a separate balance sheet, opening a separate account and accruing payments in favor of individuals, registration of the company in territorial authorities state extra-budgetary funds (PFR, FSS of Russia).

Separate division account

The Company has the right to open bank accounts for carrying out banking operations by the branch (clause 4.3 of the Instructions on opening bank accounts).

Another separate division is not considered as a division of a legal entity through which payments can be made. However, the right of a legal entity to open bank accounts in other constituent entities of the Russian Federation is not legally limited. Consequently, the possibility of opening a company account in a Moscow bank cannot be ruled out. In this case, it will be considered that payments are made through the company itself, but not through its separate division.

Thus, the use of a specific legal form of a separate division does not affect the fundamental possibility of disposing of a bank account. However, opening a separate account for a separate division allows you to separately account for funds spent for purposes related to the activities of the separate division. For this reason, in practice, when a need is identified to open a bank account at the place of operation of a separate division, as a rule, a branch (or representative office) is created and an account is opened for the branch to carry out banking operations.

The need to allocate a separate division to a separate balance sheet

In accordance with paragraph. 20 clause 2 art. 11 of the Tax Code of the Russian Federation, a separate division of an organization is any territorially separate division from it, at the location of which stationary workplaces are equipped. A separate division of an organization is recognized as such regardless of whether or not its creation is reflected in the constituent or other organizational and administrative documents of the organization, and regardless of the powers vested in the specified division. In this case, a workplace is considered stationary if it is created for a period of more than one month.

Thus, the characteristics of a separate division of an organization for tax purposes are:

- territorial isolation from the parent organization;

- availability of equipped stationary workplaces.

From the above it follows that from the point of view tax accounting Separate divisions include branches, representative offices and other divisions, including those whose creation is not reflected in the constituent documents, subject to compliance with the criteria of Art. 11 of the Tax Code of the Russian Federation.

Thus, to recognize that an organization has a separate division of the organization for tax purposes, the civil legal status of such a division does not matter.

At the same time, the Tax Code of the Russian Federation does not make the recognition of a particular division of an organization as separate dependent on the latter having a separate balance sheet and current account (see letters of the Ministry of Finance of Russia dated August 3, 2010 No. 03-03-06/1/513 and dated July 7 2006 No. 03-01-10/3-149).

In accordance with clause 33 of PVBU and clause 8 of PBU 4/99, the organization’s financial statements must include performance indicators of branches, representative offices and other structural units, including those allocated to separate balance sheets.

As the Ministry of Finance of Russia indicated in letter dated March 29, 2004 No. 04-05-06/27, a separate balance sheet should be understood as a list of indicators, established by the organization for their divisions allocated to a separate balance sheet.

Thus, the decision on the need to allocate a separate division to a separate balance sheet, as well as the determination of the indicators that will be established for it, must be made by the company itself; the legislation does not contain a requirement for the mandatory allocation of separate divisions to a separate balance sheet.

Let us note that the presence of a separate division of a taxpayer in itself leads to the need to pay some taxes at the location of such a separate division. At the same time, the presence of a separate balance sheet for a separate division will entail the need to pay additional taxes and fees at the location of the separate division.

Procedure for taxation of a separate division

Registration of a separate division with the tax authorities. In accordance with paragraph 1 of Art. 83 of the Tax Code of the Russian Federation, organizations that include separate divisions located on the territory of the Russian Federation are subject to registration with the tax authorities at the location of each of their separate divisions.

Thus, the company will be registered for tax purposes in Moscow with the tax authority that is responsible for the territory where jobs for the company’s employees will be organized.

Value added tax (VAT). Current rules Chapter 21 of the Tax Code of the Russian Federation does not provide for the payment of VAT and the submission of VAT returns at the location of separate divisions.

As indicated in the letter of the Ministry of Taxes of Russia dated November 4, 2002 No. VG-6-03/1693@, the entire amount of VAT is paid by an organization that has separate divisions, centrally at the place of registration of the parent organization without distributing the tax among separate divisions.

Consequently, regardless of whether the company has separate divisions, whether they are allocated to a separate balance sheet or not, the submission of VAT returns and payment of tax are carried out by the company at its location without distribution among separate divisions.

Personal income tax (NDFL). As is known, organizations act as tax agents in relation to personal income tax, payable on the income of employees (clause 1 of article 226 of the Tax Code of the Russian Federation). However, the performance of the duties of a tax agent for personal income tax by an organization that includes separate divisions in relation to the employees of these divisions has a number of features.

In accordance with paragraph 7 of Art. 226 of the Tax Code of the Russian Federation, a Russian organization, which includes separate divisions, is obliged to transfer calculated and withheld personal income tax amounts to the budget both at its location and at the location of each of its separate divisions.

The amount of personal income tax payable to the budget at the location of a separate division is determined based on the amount of income subject to taxation accrued and paid to the employees of this division.

From the above legislative norms it follows that when opening an office in Moscow, which is a separate division, the company will be obliged to pay personal income tax at the location of its separate division in Moscow in relation to income received by employees of this division.

Let us note that the company will have to fulfill this obligation regardless of whether the separate division has a current account and a separate balance sheet, since there are no exceptions to clause 7 of Art. 226 of the Tax Code of the Russian Federation does not contain any provisions in this regard.

Corporate income tax. In accordance with paragraph 2 of Art. 288 of the Tax Code of the Russian Federation, payment of advance payments, as well as tax amounts subject to credit to the revenue side of the budgets of the constituent entities of the Russian Federation and the budgets of municipalities, is made by taxpayers at the location of the organization, as well as at the location of each of its separate divisions based on the share of profit attributable to these separate divisions .

The amounts of advance payments, as well as the amounts of tax to be credited to the revenue side of the budgets of the constituent entities of the Russian Federation and the budgets of municipalities, are calculated at the tax rates in force in the territories where the organization and its separate divisions are located.

In accordance with paragraph. 1 clause 1 art. 289 of the Tax Code of the Russian Federation, taxpayers, regardless of whether they have an obligation to pay tax and (or) advance payments for tax, the specifics of calculation and payment of tax, must, at the end of each reporting and tax period, submit to the tax authorities at their location and the location of each separate division, unless otherwise not provided for by this paragraph, the corresponding tax returns in accordance with the legally established procedure.

Consequently, since the company will include a separate division, at the end of each reporting and tax period the company must submit declarations to the tax authorities, both at its location and at the location of the division in Moscow. In this case, the declarations are submitted by the company independently (unless the company has issued a power of attorney to the head (employee) of a separate division for its representation to the tax authorities).

The specified procedure for submitting tax returns begins to apply from the reporting period to which the date the organization is registered for tax purposes at the location of the separate division (letter of the Ministry of Finance of Russia dated March 5, 2007 No. 03-03-06/2/43).

Clause 5 of Art. 289 of the Tax Code of the Russian Federation establishes that an organization, which includes separate divisions, at the end of each reporting and tax period submits to the tax authorities at its location a tax return for the organization as a whole with distribution among separate divisions.

If the share of profit for a separate division is not determined due to the fact that the value of the indicators for its calculation is zero, then the tax base and income tax, as well as advance payments to such a division are not distributed (letter of the Federal Tax Service of Russia for Moscow dated May 6 2008 No. 14-14/043984).

Transport tax. If a company plans to purchase cars (or other vehicles) that will be used by employees of a division in Moscow while performing their work duties, then it is worth paying attention to the following.

According to para. 1 tbsp. 357 of the Tax Code of the Russian Federation, payers of transport tax are persons who, in accordance with the legislation of the Russian Federation, are registered with vehicles recognized as an object of taxation in accordance with Art. 358 Tax Code of the Russian Federation.

By virtue of paragraph 1 of Art. 358 of the Tax Code of the Russian Federation, the object of taxation for transport tax includes, among other things, cars registered in accordance with the legally established procedure.

Clause 1 of Art. 3631 of the Tax Code of the Russian Federation establishes the obligation of taxpayers who are organizations, after the expiration of the tax period, to submit to the tax authority at their location Vehicle tax return. The location of vehicles (with the exception of sea, river and air) is the place of their state registration, and in the absence of such, the location of the owner (Clause 5 of Article 83 of the Tax Code of the Russian Federation).

In accordance with clause 24.3 of the Rules for registration of motor vehicles and their trailers in State Inspectorate security traffic Ministry of Internal Affairs Russian Federation registration of vehicles for legal entities is carried out at the location of legal entities, determined by the place of their state registration, or at the location of their separate divisions.

Consequently, the company has the right to choose where to register cars and (or) other vehicles - at the location of the company or a separate division.

Thus, if a company purchases and registers cars (or other vehicles) in Moscow, then it will have to submit a tax return for transport tax in Moscow. Tax is payable on the same principle by the company itself.

Organizational property tax. In accordance with paragraph 1 of Art. 373 of the Tax Code of the Russian Federation, tax payers are organizations that have property recognized as an object of taxation in accordance with Art. 374 Tax Code of the Russian Federation.

In turn, clauses 1 and 4 of Art. 374 of the Tax Code of the Russian Federation establishes that the objects of taxation for Russian organizations are movable and immovable property (including property transferred for temporary possession, use, disposal, trust management included in joint activities or received under a concession agreement), recorded on the balance sheet as fixed assets, with the exception of movable property registered on January 1, 2013.

Consequently, from January 1, 2013, only real estate taken into account as fixed assets is recognized as an object of taxation.

At the same time, the Tax Code of the Russian Federation provides for a special procedure for calculating and paying property tax and declaring it for organizations that have separate divisions.

By virtue of Art. 384 of the Tax Code of the Russian Federation, an organization that includes separate divisions that have a separate balance sheet pays tax (advance tax payments) to the budget at the location of each of the separate divisions in relation to property recognized as an object of taxation, located on a separate balance sheet of each of them.

In accordance with paragraph. 1 clause 1 art. 386 of the Tax Code of the Russian Federation, taxpayers are obliged, at the end of each reporting and tax period, to submit to the tax authorities at their location, at the location of each of their separate divisions that have a separate balance sheet, tax calculations for advance tax payments and a tax return.

Consequently, if a separate division of a company in Moscow is not allocated to a separate balance sheet, then the real estate acquired for this separate division (fixed assets) will be on the balance sheet of the company itself.

At the same time, according to Art. 385 of the Tax Code of the Russian Federation, an organization that takes into account on its balance sheet real estate objects located outside the location of the organization or its separate division that has a separate balance sheet, pays tax (advance tax payments) to the budget at the location of each of the specified real estate objects in an amount determined as the product of the tax the rate in force in the territory of the corresponding subject of the Russian Federation on which these real estate objects are located, and the tax base (1/4 of the average value of property) determined for the tax (reporting) period in accordance with Art. 376 of the Tax Code of the Russian Federation, in relation to each piece of real estate.

This means that the company will have an obligation to calculate, pay and declare property tax at the location of the real estate, i.e. in Moscow, regardless of whether a separate division will have a separate balance sheet, which will account for fixed assets in the form of real estate used by such a separate division.

At the same time, the company will not have the obligation to calculate, pay and declare property tax at the location of a separate division that does not have a separate balance sheet in relation to fixed assets in the form of movable property acquired before January 1, 2013. If the separate division has a separate balance sheet on which the specified fixed assets used by such a separate division will be taken into account, then property tax will be paid by the company in Moscow.

Contributions to state extra-budgetary funds. By virtue of clause 11 of Art. 15 of the Law on Insurance Contributions, separate divisions that have a separate balance sheet, current account and accrual payments and other remuneration in favor of individuals, fulfill the organization’s responsibilities for paying insurance premiums (monthly mandatory payments), as well as the responsibilities for submitting calculations for insurance premiums at their location .

Thus, if a separate division of a company in Moscow does not meet the requirements established in the above norm (it will not be allocated to a separate balance sheet and (or) it will not have a current account), it will not be entrusted with fulfilling the company’s obligations to pay insurance premiums ( monthly mandatory payments), as well as obligations to submit calculations for insurance premiums at their location.

If a separate division of the company in Moscow meets the requirements established by the above norm (it will be allocated to a separate balance sheet and will have a current account), it will be entrusted with fulfilling the company’s obligations to pay insurance premiums (monthly mandatory payments), as well as obligations to submit settlement of insurance premiums at your location.

Consideration of disputes with the participation of society

In relation to separate divisions having the status of a branch, special rules of jurisdiction are provided. A claim against a legal entity arising from the activities of its branch located outside the location of the legal entity may be brought to the arbitration court at the location of the legal entity or its branch (clause 5 of Article 36 of the Arbitration Procedure Code of the Russian Federation).

Claims arising from the activities of another separate division of a legal entity are brought at the location of the company (Article 35 of the Arbitration Procedure Code of the Russian Federation). Consideration of disputes based on the location of the branch allows the company to provide evidence in the most efficient manner.

Literature

See, for example, FAS Resolutions Northwestern district dated November 18, 2008 in case No. A42-1739/2008, dated November 28, 2005 No. A56-45775/2004, FAS North Caucasus District dated September 16, 2009 in case No. A53-22572/2008, FAS Moscow District dated April 30. 2009 No. KA-A40/3057-09, Federal Antimonopoly Service of the Central District dated 05/06/2003 No. A09-585/03-30.

Federal Law of 02/08/1998 No. 14-FZ “On Limited Liability Companies”.

See Resolution of the Federal Antimonopoly Service of the Volga District dated 04/09/2010 in case No. A65-28861/2009 (in this case the situation with representation was considered joint stock company, however, this practice is also applicable to a branch of a limited liability company).

Federal Law of 08.08.2001 No. 129-FZ “On state registration of legal entities and individual entrepreneurs».

The procedure for registration and deregistration with the tax authorities Russian organization according to the location of their separate divisions, real estate and (or) vehicles belonging to them, individuals - citizens of the Russian Federation, as well as individual entrepreneurs using a simplified taxation system based on a patent (approved by letter of the Federal Tax Service of Russia dated September 3, 2010 No. MN-37- 6/10623 “On the organization of accounting with tax authorities of organizations and individuals in connection with the entry into force of Federal Law No. 229-FZ dated 27.07.2010 on September 2, 2010” (hereinafter referred to as the Procedure for Registration)). With the entry into force of Law No. 229-FZ, the procedure for tax registration at the location of a separate division was changed. Meanwhile, it has not yet been approved new order registration. Until the tax authority approves the relevant procedure, it is recommended to apply the Registration Procedure approved by letter of the Federal Tax Service of Russia dated September 3, 2010 No. MN-37-6/10623.

Please note that registration with the funds is required only if all three listed conditions are met: a separate account, balance sheet, accrual by a branch wages(letter from the FSS of Russia dated 05.05.2010 No. 02-03-09/08-894p).

Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund.”

The procedure for registration and deregistration in the territorial bodies of the Pension Fund of the Russian Federation of insurers making payments to individuals (approved by Resolution of the Board of the Pension Fund of October 13, 2008 No. 296p).

Administrative regulations of the Social Insurance Fund of the Russian Federation for the provision public services on registration and deregistration of policyholders - legal entities at the location of separate divisions (approved by order of the Ministry of Health and Social Development of Russia dated September 20, 2011 No. 1052n).

Federal Law of November 29, 2010 No. 326-FZ “On Compulsory Health Insurance in the Russian Federation.”

Instruction of the Bank of Russia dated September 14, 2006 No. 28-I “On opening and closing bank accounts, deposit accounts” (hereinafter referred to as the Instruction on opening bank accounts).

Regulations on accounting and financial statements in the Russian Federation approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n.

Regulations on accounting“Accounting statements of an organization” PBU 4/99 was approved by order of the Ministry of Finance of Russia dated July 6, 1999 No. 43n.

Many large enterprises opening separate divisions. What this is is explained in Art. 11 clause 2 of the Tax Code. Let us next consider the definition and features of OP.

Definition

Separate division- this is an enterprise that is geographically separated from the main company and equipped with stationary workplaces at its location. The latter must be created for a period of more than 1 month. The location is the address at which the main company conducts its business through this established entity.

Key Features

The main criteria by which a separate division is determined are:

- Territorial separation from the main enterprise.

- Availability of stationary places for employees to carry out professional activity. Moreover, they must be formed for a period of at least 1 month.

These criteria have their own specifics. Let's look at them in detail.

Territorial separation

The Tax Code does not contain an explanation of this concept. We can talk about territorial separation after determining the corresponding (smallest) unit of division. In this case, it is advisable to turn to another related concept. The Charters of the regions of the Russian Federation use the term administrative-territorial unit. This category includes areas in cities, settlements of regional subordination, rural settlements, towns. However, from an analysis of the provisions of the Charters, it follows that the definition used in them cannot be used when explaining tax issues. Considering separate and structural divisions, the territorial unit is established in accordance with the purposes of taxation. In this case we're talking about about the location of the enterprise geographically separate from the main company, outside the boundaries of the administrative unit in which registration was made and which is controlled by a specific tax office. Thus, we can draw the following conclusion. A separate division is a company created by the head office in the territory where supervision is carried out by a different Federal Tax Service than the one in which the latter is registered as a taxpayer.

Workplaces

Their presence is the second mandatory sign of a separate unit. In this case, workplaces must be stationary. To clarify the concepts, please refer to Art. 209 TK. In accordance with the norm, a work place is considered to be a place where the employee must arrive or where he needs to be in connection with the performance of his professional functions and which is controlled by the employer indirectly or directly. The key element in the definition is the employee of the enterprise. Accordingly, if there are no employees, then there are no jobs and no separate division. If there are no employees or no activity is carried out, then the location of the enterprise cannot be determined. It follows from this that we are not talking about creating an OP.

Nuance

Taking into account the above, a question arises regarding the moment at which a separate thing is created. This nuance is not explained in the Tax Code. However, it seems that it would be logical to consider the date of commencement of work activities as the moment of formation of the EP. In this case, the relevant information must be obtained not from the address of the main office, but from the geographically separated enterprise opened by it.

Important point

Recognition of an enterprise as a sole proprietorship does not depend on whether the constituent documentation contains indications that a separate division has been created and is operating. A separate balance sheet and account also do not act as integral features of a created company. As stated in the Rules for Maintaining Accounting Reports, the documentation must include data on the work of all operating facilities available to the enterprise. This, among other things, applies to those that were allocated to separate balance sheets. Explanations on this concept are given in Letter of the Ministry of Finance No. 04-05-06/27 dated March 29, 2004. A separate balance sheet is a list of indicators that are established by the main enterprise for its divisions. It follows from this that decisions regarding issues related to the allocation of EP and the establishment of calculated values are made by society independently. The law does not require the mandatory creation of specific lists for each company within the corporation.

Registration with the Federal Tax Service

Let's look at how a separate division is registered. In accordance with Art. 83 clause 1 of the Tax Code, a company that has territorial branches opened by it, located within the Russian Federation, is obliged to register with the tax office at the address of each of them. To do this, you must submit to control body corresponding statement. It should be sent within a month from the date of establishment of the enterprise. This need arises if the main company is not registered with the Federal Tax Service, located within municipality, in which a separate division has been created. Copies of the constituent documentation and the certificate of registration with the tax office are attached to the application. Checkpoint of a separate subdivision - code of the reason for registering an enterprise with the Federal Tax Service. It is tied to the location of the company. When registering, the OP has a TIN identical to the number of the main company. However, the checkpoint of a separate division will differ from the code of the main enterprise.

Responsibility

In case of violation of the deadline for submitting the established list of papers, a fine in the amount of 5 thousand rubles is imposed on the payer. If the subject is late by more than 90 days, he is charged with a penalty of 10 thousand rubles. These rules are established by Art. 116 NK. In addition, the subject may be involved in administrative responsibility por art. 15.3 Code of Administrative Offences. Also, within a month, the main enterprise must report the formation of a unit to the Federal Tax Service at its location. This rule is provided for in Art. 23, clause 2.3 of the Tax Code. The message is drawn up according to a special form C-09-3. If the specified deadline is missed, the company faces a fine of 1 thousand rubles, and the manager - 300-500 rubles. These sanctions are provided for in Art. 15.6 Code of Administrative Offences.

additional information

If an enterprise has created a division and it is registered with the tax office at its location, there is no need to re-submit the application when subsequent separate companies are formed within the same municipality. In this case, the company sends a written message in accordance with Art. 23 clause 2 of the Tax Code. It is addressed to the Federal Tax Service at the location of the main office.

Termination of the activities of the OP

The enterprise must report the closure of the division to the Federal Tax Service at its location. In Art. 23 clause 2.3 of the Tax Code sets a month period for this. It seems that this period should be calculated on the dates of actual termination of work through the OP. A key sign of a unit's closure will be the dismissal or transfer of all employees. This event is equated by law to the liquidation of an OP. In addition, the closure should be reported to the Federal Tax Service, where the separate divisions were registered (at their location address). For this purpose, a corresponding application is sent. However, the legislation does not establish a specific deadline for sending it.

Tax accounting of separate divisions

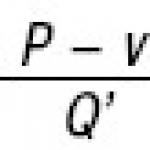

In Art. 288 of the Tax Code defines the rules for making deductions from the profit of an enterprise to the budget. In accordance with in general, provided for in paragraph 2 of this norm, payment of advance and principal amounts is carried out by taxpayers at their address, as well as the location of each unit. The calculation of deductions is carried out in accordance with the shares of profit attributable to these OPs. They are calculated as the arithmetic average of the share of the average (average) number of employees and the residual rate of depreciable property established in Art. 257 (clause 1) of the Tax Code, for the taxpayer as a whole. The share of profits is thus calculated exclusively in the part to be credited to regional budgets (corresponding to a rate of 17.5%).

Legal status

The Civil Code provides for the following forms of separate divisions: branch and representative office. Their definitions are indicated in Art. 55 Civil Code. A representative office is a division located outside the location of the main company. His activities are aimed at representing the interests of the head office and protecting them. A branch is a division of a legal entity located outside its location and implementing part or all of its functions. These also include representation. The first type of OP can thus:

- Negotiate.

- To make deals.

- Conduct advertising campaigns, marketing research oriented to studying the market within the region of its location.

- Protect the interests of the head office in court.

The branch, in addition to the above functions, carries out direct business, production or other economic activity in accordance with the constituent documents and legislation.

Property tax

In accordance with Art. 373, clause 1 of the Tax Code, payers are persons who have material values, classified as objects of taxation under Art. 374 NK. Clauses 1 and 4 of this norm stipulate that they recognize real estate and movable property, including those transferred for temporary use, disposal, possession, trust management, contributed to joint activities or acquired under a concession agreement, held on a separate balance sheet as fixed assets. Normally, however, there are exceptions. They are movable material assets adopted from 01/01/2003. Accordingly, from this date only real estate classified as fixed assets acts as objects of taxation.

Rules for reflection in documentation

The Tax Code establishes a special procedure for calculating and paying tax on the property of an OP. In addition, there are rules in accordance with which a declaration for a separate division is drawn up. An example of the application of the provisions can be illustrated as follows. Within the meaning of Art. 384 of the Tax Code, a company that includes dedicated OPs pays tax (advance amounts) to the budget at the address of their location in relation to the property classified as the object of taxation. In this case, material assets must be on a separate balance sheet. The reporting rules are established by Art. 386, clause 1, para. 1. According to the norm, payers must, at the end of the tax and reporting period, send to the Federal Tax Service at their location, as well as at the address of each allocated OP, calculations for advance amounts and tax. A declaration is also attached to them. An enterprise may not create a separate balance sheet for a division. In this case, the acquired property of the OP will be reflected in the reporting of the head office.

Specifics of payment

In accordance with Art. 385 of the Tax Code, a company that takes into account on its balance sheet real estate located outside the location of its own or a designated OP, pays tax (advance amounts) to the budget in the territory where these objects are present. The amount of payments is determined as the product of the rate that is valid in a given region and the base (1/4 of the average value of real estate) established for the reporting/tax period according to the rules of Art. 376 NK. The calculation is carried out for each object separately. Thus, the main enterprise calculates, pays and declares tax at the location of the property, regardless of whether separate reporting will be provided for a separate division for the fixed assets that it uses.

Contributions to off-budget state funds

In accordance with federal legislation, in order for separate divisions to make the specified payments, the OP must meet a number of requirements. Contributions to extra-budgetary state funds are made if the representative office/branch:

- Calculate payments and other remuneration to individuals.

- They have a separate balance and account.

In this case, the OP must also provide calculations of contributions at its location. If a unit does not meet these requirements, it does not have corresponding responsibilities.

Electronic reporting

How is a separate division reflected in 1C? Let's consider the accounting of a government agency. The program supports the reflection of two types of EP: allocated and not allocated to an independent balance sheet. Reporting on the former can be carried out both in a separate information base and in one with the main enterprise. Data is entered about both the main office and the OP. The balance sheet, general ledger and other registers, as well as regulated reports can be generated in a consolidated manner for certain group institutions or separately for the main enterprise and separate divisions. If OPs are not allocated, then reporting on them is carried out in the same database as the main office. The corresponding data is entered into the Divisions directory with the assignment of the “Separated” category. Based on this parameter, the program will distinguish them from other additional offices.

Basic information

For separate divisions allocated to the balance sheet, the following data is indicated:

- Name for primary documentation.

- Information on registration with the Federal Tax Service at the location of the OP.

- Criteria for maintaining individual document numbers.

- Responsible persons of the OP. This may be the head of a separate department or another employee who has the right to sign.

- Contact details.

For divisions that are not allocated to a separate balance sheet, the following information is indicated:

- Maintaining separate plans for financial and economic activities.

- Indication of OP details in the documentation.

- Possibility of separate document flow.

The program also provides an option for setting up analytics in the context of OP by expense and income items. The information also indicates payment documents that are prepared by a separate division (invoice, etc.). They are formed by personal account of the OP in the treasury or in the bank.

Register

The cash desk of a separate division is maintained in accordance with regulatory requirements and instructions of the Central Bank. According to the order of the Central Bank, OPs must maintain a book and provide the enterprise with a copy of the sheet according to the rules defined financial policy companies. In this case, the reporting period is taken into account. A separate section should be maintained for each division. on her title page the number or name of the OP is indicated. The form of the separate division is transferred to the main office. It compiles a single book for the entire enterprise. (receipt and debit orders) are issued by the department cashier independently. They are numbered in the order prescribed by the financial policy of the enterprise. is generated in 2 copies. One of them remains in the OP, the second is transferred to the main office with the attached documentation. 1C provides for maintaining a separate book for f. 0504514 and registration according to f. 0310003. They are used by units with established criterion separate numbering. For other representative offices/branches, documentation is recorded in a book and journal, which are prepared at the main office. It must be said that in primary documents and reports that contain the column “Structural unit”, the name of the separate unit is displayed in it by the program. If missing, it will be added to the name of the main enterprise.

"New accounting", 2005, N 5

When creating a separate division, an organization must fulfill a number of requirements for tax registration. You will learn from this article about the time frame for this to be done, what documents will be required, and how to deregister a division.

We are accustomed to perceiving a separate division as a separate structure created by an organization in the process of carrying out its activities. But at the same time, it is important to keep in mind that the definition of a separate division, which is contained in the Tax Code of the Russian Federation, is much broader than the civil law definition of a separate division, and in most cases, an organization must register the separate division being created with the tax authority.

Conditions for creating separate divisions of the organization

According to Art. 11 of the Tax Code of the Russian Federation, a separate division of an organization is understood as any territorially separate division from it, at the location of which stationary workplaces are equipped. A separate division of an organization is recognized as such, regardless of whether its creation is reflected or not reflected in the constituent or other organizational and administrative documents of the organization, and regardless of the powers vested in it.

From the point of view of the Tax Code of the Russian Federation, a separate division of an organization is characterized by the following characteristics:

- territorial isolation;

- availability of equipped stationary workplaces;

- carrying out the activities of the organization through a separate division.

Let's take a closer look at these signs.

Territorial isolation

Due to the fact that the criterion of territorial isolation is not established by the Tax Code of the Russian Federation, it is necessary to be guided by the explanations of the financial and tax authorities.

According to the Russian Ministry of Finance, set out in Letter No. 03-03-01-04/1/184 dated December 22, 2004, a territorially separate division of an organization should be considered a division located on a separate territory, different from the territory on which the organization itself is located, i.e. e. at a different address not indicated in the constituent documents as the location of the taxpayer himself. A similar opinion is expressed by representatives of tax authorities.

If an organization is registered with the tax authority at its location and has separate divisions in territories subordinate to other tax authorities, then it is obliged to register in the prescribed manner at the location of each of such separate divisions with these tax authorities (see Letter from the Ministry of Finance of Russia dated 16.02.2005 N 03-06-05-04/35).

If a separate division falls under the jurisdiction of the same tax authority as the parent organization, then the organization is not required to register with the same tax authority in connection with the creation of this separate division (clause 39 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated February 28, 2001 N 5 "On some issues of application of part one of the Tax Code of the Russian Federation").

Equipped stationary workstations

The main feature characterizing a separate division of an organization is the presence of equipped stationary workplaces in it.

The Tax Code of the Russian Federation does not explain what should be understood as a workplace. According to paragraph 1 of Art. 11 of the Tax Code of the Russian Federation, the institutions, terms and concepts of civil, family and other branches of legislation of the Russian Federation used in the Tax Code of the Russian Federation are applied in the meaning in which they are used in these branches of legislation, unless otherwise provided by the Tax Code of the Russian Federation.

In accordance with Art. 1 of the Federal Law of July 17, 1999 N 181-FZ “On the Fundamentals of Labor Safety in the Russian Federation”, a workplace is a place where an employee must be or to which he needs to arrive in connection with his work and is directly or indirectly under the control of the employer .

A workplace is considered stationary if it is created for a period of more than one month (Article 11 of the Tax Code of the Russian Federation), but the Tax Code of the Russian Federation does not regulate the issue of what is considered workplace equipment.

The judicial authorities believe that the equipment of a stationary workplace means the creation of conditions for the performance of labor duties, as well as the very performance of such duties by employees (see Resolutions of the Federal Antimonopoly Service of the North-Western District dated October 7, 2002 N A26-3503/02-02-07/160 , Ural District dated 01/09/2003 N F09-2799/02-AK).

Another controversial issue is whether a separate division of an organization is formed if it has only one stationary workplace outside its location or if there should be two or more such workplaces.

Previously, the judiciary expressed the opinion that if there is one workplace, a separate division is not formed (see, for example, Resolution of the Federal Antimonopoly Service of the Moscow District dated October 3, 2001 N KA-A40/5441-01).

However, later the position arbitration courts has changed in this matter. For example, the Resolution of the Federal Antimonopoly Service of the Moscow District dated January 23, 2003 N KA-A41/9052-02 states that registration of a separate division is mandatory even if one workplace has been created in it. This position was also taken by the FAS of the Central District (see Resolution of July 26, 2004 N A62-1493/04). The Federal Antimonopoly Service of the North-Western District also proceeded from the fact that the creation of one workplace is the basis for registering a separate division (see Resolution of May 27, 2002 N A26-6342/01-02-12/178).

The same point of view is set out in the Letter of the Ministry of Taxes and Taxes of Russia dated April 29, 2004 N 09-3-02/1912 “On the recognition of one workplace as a separate unit.”

According to the Ministry of Taxes and Taxes of Russia, such a criterion for a separate unit as the equipment of stationary workplaces, specified in Art. 11 of the Tax Code of the Russian Federation, also incorporated the concept of one equipped stationary workplace. In addition, the ministry believes, since Art. 11 of the Tax Code of the Russian Federation, the concept of “workplace” is also used in singular, this would be semantically incorrect if the legislator did not consider a unit consisting of one workplace to be a separate division of the organization.

Consequently, the creation of one workplace by an organization outside its location is the basis for registration with the tax authority of the organization at the location of its separate division.

Registration of a separate division of the organization

Within one month after the creation of a separate division, the organization is obliged to inform the tax authority at its location about its creation, and also register at the location of the corresponding separate division (Article 23, clauses 1, 4 of Article 83 of the Tax Code of the Russian Federation ).

Date of creation of a separate division

The moment when a separate division is considered created is not defined in the Tax Code of the Russian Federation.

According to the tax authorities, the date of creation of a separate division should be determined by the earliest document in date that recorded the presence of all the signs of a separate division established by Art. 11 of the Tax Code of the Russian Federation (see article “On registering an organization for tax purposes at the location of separate divisions”, magazine “Tax Bulletin”, 2004, No. 9).

Thus, the date of creation of a separate division will be considered the date of the decision of the general meeting of shareholders to open a branch in another city.

Some judicial authorities express the point of view according to which the date of creation of a separate division in the form of a branch is the date of amendments to the constituent documents of the organization (see Resolution of the Federal Antimonopoly Service of the Central District dated August 19, 2004 N A35-7602/03-C4).

However, in most cases the position judiciary is that the moment of creation of a separate unit should be considered the moment of equipping a territorially separate stationary place for carrying out activities through its own separate unit (see Resolutions of the Federal Antimonopoly Service of the Far Eastern District dated January 14, 2005 N F03-A04/04-2/3923, Moscow District dated 09.09.2004 N KA-A40/7836-04, Volga-Vyatka District dated 08/19/2004 N A29-8668/2003a, West Siberian District dated 05/28/2003 N F04/2319-394/A70-2003).

The creation of a separate unit is, for example, the conclusion of a lease agreement non-residential premises, used in production activities this division.

Documents submitted upon registration

The recommended form of notification about the creation of a separate unit located on the territory of the Russian Federation is approved by Order of the Ministry of Taxes and Taxes of Russia dated April 2, 2004 N SAE-3-09/255@ “On approval of recommended forms of messages used when recording information about legal entities and individuals.”

As the name of this form suggests, it is advisory in nature, i.e. The organization has the right to submit a message in any form, but this must be done. The deadline for submitting a message about the creation of a separate division of an organization is 1 month from the date of its creation (Article 23 of the Tax Code of the Russian Federation).

The form of the application for registration of a legal entity with the tax authority at the location of its separate division on the territory of the Russian Federation (hereinafter referred to as the application) and the procedure for filling it out are contained in the Order of the Ministry of Taxes and Taxes of Russia dated 03.03.2004 N BG-3-09/178 “On approval of the Procedure and the conditions for assigning, applying, as well as changing the taxpayer identification number and forms of documents used for registration and deregistration of legal entities and individuals.”

The deadline for filing an application is 1 month from the moment of creation of a separate division (clause 4 of article 83 of the Tax Code of the Russian Federation).

The application is filled out by the organization in one copy and submitted to the tax authority at the location of the separate division simultaneously with a copy of the certificate of registration of the organization with the tax authority and copies of documents confirming the creation of the separate division (if any).

Thus, an organization can be registered with the tax authority at the location of the separate division even in the absence of documents confirming the creation of a separate division.

Documents confirming the creation of a separate division of an organization include: regulations on a branch (representative office), an order on the creation of a branch (representative office), a power of attorney issued to the head of the branch (representative office), etc. If a separate subdivision is not registered as a branch or representative office, then its creation is confirmed by the presence of relevant documents (regulations, orders, powers of attorney for the right to conduct business, other documents of financial and economic activities).

The tax authority is obliged to register the organization at the location of the separate division within five days from the date of submission of all necessary documents.

In this case, a new TIN is not assigned. The registration reason code (RPC) is assigned to the organization by the tax authority both at the location of the organization and at the location of each of its separate divisions.

When registering a separate division of an organization, a notification is issued in form N 09-1-3, approved by Order of the Ministry of Taxes of Russia dated 03.03.2004 N BG-3-09/178.

Tax registration and deregistration are free of charge (Clause 6, Article 84 of the Tax Code of the Russian Federation).

Responsibility for failure to submit a notification about the creation of a unit and violation of registration deadlines

For failure to submit a notification about the creation of a separate unit within the time limit established by Art. 23 of the Tax Code of the Russian Federation, an organization can be held liable in the form of a fine of 50 rubles. on the basis of Art. 126 of the Tax Code of the Russian Federation.

At the same time, the official of the organization responsible for submitting to the established Art. 23 of the Tax Code of the Russian Federation, the deadline for reporting the creation of a separate division may be brought to administrative fine on the basis of Art. 15.6 of the Code of Administrative Offenses of the Russian Federation in the amount of 3 to 5 times the minimum wage.

If the deadline for filing an application is violated, the tax authority may impose a fine on the organization in the amount of 5,000 or 10,000 rubles. (if the delay is more than 90 days) on the basis of Art. 116 of the Tax Code of the Russian Federation. For the same violation, the head of the company can be fined in the amount of 500 to 1000 rubles. (clause 1 of article 15.3 of the Code of Administrative Offenses of the Russian Federation).

If a separate division of an organization that was created but not registered carried out income-generating activities, then the organization may be held liable under Art. 117 of the Tax Code of the Russian Federation, which provides for the recovery of 10% of income received, but not less than 20,000 rubles, and when conducting such activity for more than three months - in the amount of 20% of income received during the period of activity without registration for more than 90 days. The head of the organization may be fined from 2000 to 3000 rubles. (clause 1 of article 15.3 of the Code of Administrative Offenses of the Russian Federation).

Registration of a separate division with extra-budgetary funds

For separate divisions of the organization that have a separate balance sheet, current account and make payments and other remuneration in favor of individuals, registration is provided with the territorial branches of the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, and the Compulsory Medical Insurance Fund.

The relevant provisions are contained in Federal law dated December 23, 2003 N 185-FZ "On amendments to legislative acts of the Russian Federation in terms of improving the procedures for state registration and registration of legal entities and individual entrepreneurs" and in the regulatory legal acts of these extra-budgetary funds adopted in accordance with it.

To register with the Pension Fund of the Russian Federation, an organization must contact its corresponding territorial body. No written applications are required. The territorial authority makes a request to the tax authority with which the organization registered its separate division, and, having received the information, registers the organization no later than five days.

After registration, territorial Pension Fund body sends a notice to the organization in two copies. One of them must be transferred within 10 days to the territorial body of the Pension Fund of the Russian Federation, in which the organization itself is registered (see section II of the Procedure for registration with the territorial bodies of the Pension Fund of the Russian Federation of policyholders making payments to individuals, approved by the Resolution of the Board of the Pension Fund of the Russian Federation dated 07/19/2004 N 97p).

To register with the territorial branch of the Social Insurance Fund of the Russian Federation, an organization must submit an application in the prescribed form. The application deadline is no later than 30 days from the date of creation of a separate unit.

Along with the application, duly certified copies of the certificate of state registration of the organization are submitted; certificates of registration of the organization with the tax authority; notifications about registration with the tax authority at the location of the separate division; documents confirming the creation of a separate division (regulations on a separate division, power of attorney issued by the organization to the head of a separate division); notice of registration as an insurer of a legal entity, issued by the regional branch of the Fund at its location. If a separate division has an open bank account, a certificate from the bank about this account is also submitted.

Registration is carried out within five working days from the date of receipt of documents. When registering an organization at the location of a separate division, an extended registration number, supplemented by the code of a separate unit, and the code of subordination.

A notice of registration of an organization at the location of a separate division is drawn up in triplicate. One copy is sent to the organization, the second - to the branch of the regional branch of the FSS of the Russian Federation, which interacts with the insurer organization, the third - to regional office FSS of the Russian Federation at the place of registration of the organization (see Section II of the Procedure for registering legal entities as insurers at the location of separate divisions and individuals in the executive bodies of the Social Insurance Fund of the Russian Federation, approved by Resolution of the FSS of the Russian Federation dated March 23, 2004 N 27).