Creation of staffing schedule. Basic rules for drawing up staffing schedules. There may be vacant positions in the staffing table

Our editorial office often receives questions regarding the maintenance of such an important personnel document as the staffing table. We have provided answers to the most relevant ones in this article.

Why do you need staffing?

In accordance with the Instructions for the application and completion of forms of primary accounting documentation for the accounting of labor and its payment, approved by Resolution of the State Statistics Committee of Russia dated January 05, 2004 No. 1 “On approval of unified forms of primary accounting documentation for accounting of labor and its payment” (hereinafter referred to as the Resolution No. 1), the staffing table is used to formalize the structure, staffing and staffing levels of the organization in accordance with its Charter. It contains a list of structural units, names of positions, specialties, professions indicating qualifications, information on the number of staff units.

For the first time, a unified form of staffing was approved by Resolution of the State Statistics Committee of Russia dated April 6, 2001 No. 26 (as part of unified forms of primary accounting documentation). In 2004, this form underwent some changes.

For an employer, a staffing table is a very convenient “tool” that performs several functions at once. In particular, it:

- allows you to clearly trace the organizational structure of the company (its structural divisions);

- fixes the staffing levels of structural units and the number of staff units for each position (profession);

- allows you to monitor the system of remuneration for employees of structural divisions;

- establishes and fixes the sizes of allowances;

- facilitates tracking of vacancies and selection of personnel for these vacancies.

Is it necessary to have a staffing table?

On this moment There are two points of view regarding the employer’s obligation to maintain staffing.

According to the first, the presence of this local regulatory act is mandatory, since it directly affects the labor function of the employee and his remuneration. Thus, in the Labor Code of the Russian Federation, the staffing table is mentioned in Art. 15 containing the definition labor relations, and in Art. 57, according to which essential condition of an employment contract is a labor function, namely: work in a position in accordance with with staffing, profession, specialty indicating qualifications, the specific type of work assigned to the employee.

According to another point of view, the employer independently decides on the need to maintain a staffing table. The following arguments support this position. Firstly, Resolution No. 1 approved recommended for use unified staffing form (No. T-3). The staffing table is also mentioned in the Instructions for filling out work books, approved by Resolution of the Ministry of Labor of Russia dated October 10, 2003 No. 69 (hereinafter referred to as Instruction No. 69). In particular, clause 3.1 of the Instruction notes that entries on the name of a position (job), specialty, profession indicating qualifications are made, as a rule, in accordance with the organization’s staffing table.

As we can see, none of the listed regulations enshrines duty employer on registration of the staffing table. At the same time, we recommend not to neglect maintaining this personnel document, since the inspection authorities adhere to the first point of view.

Yes, the Foundation social insurance The Russian Federation draws the attention of policyholders (employers) to the need to draw up a staffing table as a document used to confirm the correctness. Pension Fund The Russian Federation, when collecting information about the length of service of insured workers, also repeatedly drew attention to the need.

Often, tax authorities, when conducting on-site audits, request the organization’s staffing table. For example, in the decision Arbitration Court Moscow dated April 28, 2007, in case No. A40-4332/07-117-33, it is noted that “The Tax Code of the Russian Federation imposes on the taxpayer the obligation to submit, at the request of the tax authority, documents and information necessary for tax control. The fact that employment contracts, staffing schedules, personal and individual cards are not documents tax accounting, in itself does not refute the organization’s obligation to have such documents and submit them for on-site tax audit, since the information they contain may have significant tax implications.”

Often, the lack of staffing is assessed by inspection bodies as a violation of labor and labor protection legislation, for which executive may be fined in the amount of 500 to 5,000 rubles, and the organization - in the amount of 30,000 to 50,000 rubles. (Article 5.27 of the Code of Administrative Offenses of the Russian Federation). But due to the fact that there is no clear obligation for the employer to maintain this document in the legislation, these sanctions can be tried to be challenged in court.

Who should develop and approve the staffing schedule?

After deciding on the need to draw up a staffing table (if, of course, the organization does not already have one), the next question arises - who should develop this personnel records document?

The legislation does not define the circle of responsible persons, so we assume that this issue should be dealt with by the head of the enterprise. A separate order may be drawn up, assigning the responsibility for drawing up the staffing table to a specific employee, or this responsibility may be enshrined in the employment contract or the employee’s job description.

As a rule, in small organizations employees are involved in drawing up staffing schedules. personnel service and (or) accounting, less often - employees legal service. IN large companies- economic planning department or labor organization department and wages. If we're talking about about an individual entrepreneur, this can be done by a personnel officer, an accountant (if there are any on staff) or the entrepreneur himself.

The staffing table is approved by an order (instruction) signed by the head of the organization or a person authorized by him (see Example 1). The details of this document are indicated in the field “Approved by order of the organization dated “____” _____________ 200__ No. __” of the unified form No. T-3.

Please note that the dates of preparation, approval and entry into force of the staffing table may not coincide. Thus, the staffing table may be approved after its preparation, and the date of its introduction (entry into legal force) may be later than the dates of approval and preparation.

Taking into account the fact that wages are paid to employees monthly, it is logical to put the staffing table into effect from the first day of the month.

The unified form No. T-3 also indicates the period for which the staffing table is approved. In this regard, the following question arises:

How often should the staffing schedule be drawn up?

There is no clear answer in the legislation. However, given that the staffing table is a planning document, it is advisable to draw it up for one year. At the same time, the staffing table can be approved once and remain in effect for several years.

How to correctly fill out the unified form No. T-3?

So, let's proceed directly to drawing up the staffing table. The most common way to complete it is to fill out the unified form No. T-3. In this case, you should be guided by the Instructions for the use and completion of forms of primary accounting documentation, approved by Resolution No. 1.

We design the “hat”. First of all, in the “Name of Organization” field, you must indicate the name of the organization in accordance with the registration certificate. If the certificate contains both a full and a short name, then either of them can be indicated in the staffing table.

Then the code according to OKPO (All-Russian Classifier of Enterprises and Organizations), the document number and the date of its preparation are indicated. For ease of registration, the staffing number may contain a letter index (for example, ШР).

The unified form No. T-Z includes the following wording: “ Staffing table for the period ______ from “___” ______ 20__.” It would seem that designating the period of validity of a document implies indicating the date of not only the beginning, but also the end of this period. Is it necessary to indicate the expiration of the staffing table or is it enough to indicate that the staffing table comes into force on a certain date? Obviously, the unified form presupposes the second option. This is explained by the fact that in the process of carrying out activities in an organization, there may be a need to change the staffing table, therefore it is very difficult to accurately predict the expiration date of its validity.

IN column 1 (“name”) the name of the corresponding structural unit is indicated. These can be branches, representative offices, departments, workshops, areas, etc. (clause 16 of the resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 No. 2 “On the application by courts Russian Federation Labor Code Russian Federation").

For the convenience of working with staffing, it is better to arrange structural units in groups according to their hierarchy from administration to service units. For example, first of all, the divisions that carry out general management will be indicated (directorate, accounting, personnel department, etc.), then - production divisions or divisions performing the main functions of the organization, and at the end - auxiliary and service divisions (administrative and economic service, supply department, warehouse, etc.).

IN column 2 (“code”) the codes of the structural units assigned to them by the employer are entered. As a rule, codes are indicated by numbers, the number of which varies depending on the complexity of the organization's structure. This allows you to determine the place of each department (division, group, etc.) in the overall organizational structure. For example, the financial department is assigned code 02. Accordingly, the financial planning department and accounting department included in the department will have codes 02.01 and 02.02.

If the organization uses centralized system document flow, the code of the structural unit may not be specified.

In column 3 the position (specialty, profession), rank, class (category) of the employee’s qualifications are indicated. It is better if this data is presented in accordance with:

- All-Russian classifier professions of workers, positions of employees and tariff categories OK 016-94 (introduced by Decree of the State Standard of Russia dated December 26, 1994 No. 367);

- Qualification reference book for positions of managers, specialists and other employees (approved by Decree of the Ministry of Labor of the Russian Federation dated August 21, 1998 No. 37).

Of course, these directories are becoming outdated and many positions that have appeared in recent years are missing from them (for example, the position of office manager). Therefore, differences in the names of positions, professions, and specialties in qualification directories and in personnel documents of the organization are acceptable. However, if with the performance of work in certain positions, professions, specialties related to the provision of compensation and benefits or the presence of restrictions, then the names of these positions, professions or specialties and qualification requirements they must comply with the names and requirements specified in the qualification directories approved in the manner established by the Government of the Russian Federation (Article 57 of the Labor Code of the Russian Federation, clause 3.1 of Instruction No. 69). Otherwise, the employee will not have the right to benefits.

Example 2

Collapse Show

In the work book of a music worker who directed a children's choral studio at a boarding school for 17 years, his position was indicated as “club organizer.” Since this position is not in the All-Russian Classifier of Worker Occupations, Employee Positions and Tariff Grades, nor in the List of Works, Professions, Positions, Specialties and Institutions, taking into account which an old-age labor pension is assigned early in accordance with Article 28 Federal Law“On labor pensions in the Russian Federation”, approved by Decree of the Government of the Russian Federation dated October 29, 2002 No. 781, this seniority was not included in the insurance for the early assignment of a pension to the employee.

According to Art. 57 of the Labor Code of the Russian Federation, the position of the employee being hired must correspond to that indicated in the staffing table. There are cases when the job title used in the employment contract does not correspond to the staffing table or such a position is not provided for by the staffing table at all. In this case, the contradiction that exists between employment contract and staffing schedule, should be decided in favor of the employment contract (Article 8 of the Labor Code of the Russian Federation). The employee will perform the labor function provided for by the employment contract (that is, work in the position, specialty or profession established in the contract), and the personnel officer will have to make appropriate changes to the staffing table. We'll look at how to do this a little later. For now, let's continue filling out the form.

When filling columns 4 (“Number of staffing units”) indicates the number of staffing units for the relevant positions (professions). In the case where it is planned to maintain an incomplete staff unit, taking into account the characteristics of part-time work, the number of staff units is indicated in the appropriate proportions, for example, 0.25; 0.5; 2.75, etc.

Considering that new employees can only be hired for vacant positions, the staffing table can indicate not only existing staffing units, but also vacant ones. In other words, if an organization employs 10 people and the staffing table also indicates 10 staffing units, then when the staff expands, changes will have to be made to the staffing table. Or you can immediately lay down a larger number of staff units (for example, 12). Thus, in the staffing table it is possible to maintain a staffing reserve for the future.

One of the issues that causes difficulties in practice is related to the registration of part-time workers. For example, several people may work part-time or part-time in one position. In this case, the staffing table indicates the total number of staff units for the corresponding position.

Let's say that in a freight forwarder position, two people work full time and one person works part time. In this case, column 4 should indicate 2.5 staff units.

IN box 5 (“Tariff rate (salary), etc.”), depending on the remuneration system adopted in the organization, the monthly salary is indicated according to the tariff rate (salary), tariff schedule, percentage of revenue, share or percentage of profit, coefficient labor participation(KTU), distribution coefficient, etc. In this case, wages are determined in ruble equivalent.

Let us remind you that in accordance with Art. 133 TC RF size official salary (tariff rate) cannot be lower than the legally established minimum wage (in currently- 4,330 rub.). In this case, the wage system must be installed by the local normative act(for example, the Regulations on remuneration).

Example 3

Collapse Show

The staffing table provides for one staff position for the position “secretary” with a salary of 15,000 rubles. However, taking into account the interests of the company, the secretary was hired on the terms external part-time job by 0.5 bets. In accordance with Art. 285 of the Labor Code of the Russian Federation, remuneration for part-time workers is made in proportion to the time worked, depending on output or on other conditions determined by the employment contract. In this regard, the employment contract must indicate an amount proportional to the time worked by the part-time worker (in this case - 7,500 rubles).

As can be seen from the above example, the staffing table determines the salary for the corresponding position, but not the remuneration for a specific employee

IN columns 6-8 (“Bonuses”) indicate incentives and compensation payments employees (bonuses, allowances, additional payments, incentive payments) established current legislation RF (for example, northern allowances, allowances for academic degree etc.) or introduced at the discretion of the organization (for example, related to the regime or working conditions).

- a fixed amount (if the salary changes, the size of the bonus can be left the same or also changed);

- in the form of a percentage bonus (in this case, the size of the bonus changes along with the salary).

Please note: if the remuneration system provides for the possibility of establishing individual bonuses for each position, then in column 3 each position must be highlighted in a separate line, and in column 4 a unit must be entered opposite each position.

Another common question that worries HR managers, too: is it possible for employees occupying the same positions to set different salaries, for example, by providing for a salary range in the staffing table? Both in the legal literature and in practice, there are two opposing approaches to solving this issue. So, some experts believe that this is quite acceptable. This point of view is supported by Art. 132 of the Labor Code of the Russian Federation, according to which the salary of each employee depends on his qualifications, the complexity of the work performed, the quantity and quality of labor expended and maximum size not limited. Taking this into account, wages should be set differentially and depend, first of all, on the qualifications of the employee, on the basis of which employees occupying the same position, but having different qualification categories, different salaries may be set.

According to other experts, each position has one salary. In the event that it is necessary to establish different wages for employees occupying the same positions, it is advisable to regulate the amount of wages using various bonuses (for example, for work intensity).

Example 4

Collapse Show

The organization employs two specialists as accountants. At the same time, the staffing table provides for a salary of 10,000 rubles for the accountant, as well as allowances for irregular working hours in the amount of 10% of the salary (1,000 rubles) and for work intensity - 20% (2,000 rubles). Taking into account the qualifications and work experience of one of the employees holding this position, all allowances were established and, accordingly, his salary amounted to 13,000 rubles. (RUB 10,000 + RUB 1,000 + RUB 2,000). The second accountant was given only one bonus for irregular working hours, after which his salary amounted to 11,000 rubles. (10,000 rub. + 1,000 rub.).

IN box 9 the total amount formed by adding columns 5-8 is noted, that is, the sum of salaries for all staff units of a particular position, taking into account the established allowances. If columns 5-9 cannot be filled in in ruble equivalent (for example, due to the use of non-tariff, mixed and other remuneration systems), these columns are filled in in the appropriate units of measurement (percentages, coefficients, etc.). In this case, calculating the total amount (total) in columns 5-9 is possible if tariff rates and surcharges are set in the same units for the same period of time.

Box 10 , as its name suggests, is intended for various notes. If they are absent, it remains blank.

After entering the data in all fields, you must fill out line "Total" located at the bottom of the table. To do this, the number of staff positions, the amounts of salaries, allowances and the amount of the monthly wage fund are calculated in vertical columns.

The completed staffing table is signed by the head of the personnel service or the person entrusted with the responsibility for maintaining personnel records, as well as Chief Accountant organizations.

The unified staffing form does not provide for stamping. In this regard, a stamp can be placed, but is not required.

A sample of filling out the staffing table is presented in Example 5.

How to make changes to the staffing table?

Sooner or later, any personnel officer is faced with changes in the information contained in the staffing table. For example, there may be a need to introduce a new staff unit or an entire department, or to reduce an existing one, to change salaries, tariff rates, rename a department or position, etc.

There are two ways to make changes to the approved staffing table:

Option 1. Change the staffing table itself, that is, approve a new staffing table with a new (next in order) registration number

Option 2. Make changes to the current staffing table.

In this case, the staffing table remains the same, only a number of its positions change (the content of the column). Changes are made by order, after which the staffing table is adjusted. The following can be used as the headings of the corresponding order: “On changing the staffing table”, “On partial changes in the staffing table”, “On making changes to the staffing table”, etc. The order should indicate the basis for making changes to the staffing table (for example, reorganization of the company , optimization managerial work, improving the structure of the organization, etc.).

If the organization has a complex structure, we recommend that when making changes to the current staffing table, indicate in the order not only the corresponding position, but also the structural unit whose staffing is affected by the changes being made. This is due to the fact that different departments may have positions with the same titles.

There are no regulations on how often the staffing table needs to be updated. Therefore, this can be done as needed.

Do not forget that changes and additions made in the prescribed manner to the organization’s staffing table are brought to the attention of employees, after which they work books on the basis of an order (instruction) or other decision of the employer, appropriate changes and additions are made. This is stated in paragraph 3.1 of Instruction No. 69.

Please note that permanent or temporary change labor function employee and (or) the structural unit in which the employee works (if the structural unit was indicated in the employment contract) is nothing more than a transfer to another job (Part 1 of Article 72.1 of the Labor Code of the Russian Federation). A change in the job title determined by the parties and enshrined in the employment contract is also regarded as a change in the employee’s labor function, regardless of the reasons for such a change (for example, in connection with a change in the staffing table).

When to make changes when reducing staff?

A reduction in the number or staff of employees is one of the grounds for making changes to the staffing table. A reduction in the size of an organization involves the exclusion of individual staff units from the staffing table, while a reduction in staff involves the exclusion of individual positions. Employees who are laid off for one reason or another are subject to dismissal under clause 2 of Art. 81 Labor Code of the Russian Federation.

Considering that, in accordance with Article 180 of the Labor Code of the Russian Federation, employees must be notified of an upcoming dismissal due to a reduction in numbers or staff no less than two months before dismissal, a new staffing table can be put into effect no earlier than two months after its preparation. The presence of a staffing table can confirm that the dismissal of workers was justified (that is, the employer will have the opportunity to clearly demonstrate the lack of jobs).

If the circumstances that led to a change in the staffing table towards a reduction in staffing units are eliminated, the employer can restore the reduced positions by making changes to the staffing table or by approving a new one.

Is it possible to change the unified form?

The Resolution of the Goskomstat of Russia dated March 24, 1999 No. 20 “On approval of the procedure for using unified forms of primary accounting documentation” notes that, if necessary, an organization can enter additional details. At the same time, it is not allowed to delete those details that are already present in this form (including code, form number, document name).

All changes made to unified form, must be formalized by the administrative documents of the organization. In addition, the formats of the forms themselves indicated in the albums of unified forms of primary accounting documentation are recommended and are subject to change. Thus, when producing forms based on unified forms, it is allowed to make changes in terms of expanding and narrowing columns and lines, adding loose leaves - for the convenience of placing and processing the necessary information.

What is staffing?

Many organizations practice maintaining a “working” form of staffing - staffing, otherwise known as position filling or staff list. The main difference between this document and the staffing table is its dynamism, in the fact that it can quickly change depending on ongoing (numerical and qualitative) changes in the personnel of the enterprise and does not require the issuance of an order for its approval and change.

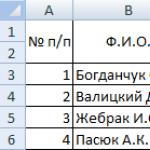

Since the staffing table, showing the total number of staffing units (positions) at the enterprise, does not make it possible to determine whether a position is vacant or occupied and which of the employees occupies it, the staffing table, as a rule, indicates exactly this information - the names and initials of the enterprise employees occupying positions provided for in the staffing table, and the status of the position - closed or vacant.

This document may also include other data, such as the employee’s personnel number, his length of service in the company, a special category (minor, disabled person, pensioner with children under three years old, etc.). You can take the organization’s approved staffing table as a basis for the staffing list and add the necessary columns in accordance with the needs of a particular organization. Neither the obligation to maintain staffing nor its unified form is currently established by regulations. The only thing that is regulated is the storage period for expired documents. In accordance with the List of standard management documents generated in the activities of organizations, indicating storage periods, approved by the Federal Archive on October 6, 2000, staffing arrangements are subject to storage for 75 years, after drawing up new ones. In this case, staffing tables must be stored for 3 years, starting from the year following the one in which it became invalid.

Footnotes

Collapse Show

Staffing as personnel document, causes many a large number of questions. For example, how often it needs to be drawn up, how to fill out the unified form correctly and whether this normative act is mandatory. To clarify the situation, it is worth going into more detail on some issues.

Why do you need staffing at all?

Staffing table is a document necessary for the formation staffing structure and the size of the organization in full accordance with the Charter of the enterprise. This document contains a list of structural divisions of the organization, a list of positions, names of specialties and professions indicating qualifications, as well as data on the required number of certain staff units. To compile it, the unified form T-3 is used, which is approved by the Resolution of the State Statistics Committee of Russia.

From the employer’s point of view, the staffing table performs a number of important functions and allows for maximum optimization and streamlining of the institution’s work. Using a staffing table allows you to clearly see the entire structure of the organization with its divisions, record the number of staff units, control the number and quality of employees, monitor the wage system and the amount of allowances. And when vacancies arise, it greatly simplifies the selection of personnel.

Is the staffing table a mandatory document?

Interestingly, there is no clear answer to this question. On the one hand, the Labor Code addresses the issue of staffing, since this document concerns the labor function of an employee of an organization and the remuneration of personnel. And the employment contract states that the employee performs duties in accordance with the staffing schedule. There is a unified form of the staffing table, and this document is also mentioned in the Instructions for maintaining work books (entries in the work book are made taking into account the name of the position in accordance with the staffing table). This means that the organization must have a staffing table. But, on the other hand, not a single regulatory act directly states the employer’s obligation to introduce a staffing table. And yet, it is better to draw up this personnel document, since most inspection bodies consider it mandatory for any organization.

For example, tax authorities and the Social Security Fund always request staffing when conducting on-site audits. Using it, they verify the correctness of calculation of insurance premiums, collect information about the insurance experience of employees, and monitor the correctness of taxation. The fact that the staffing table is not a tax accounting document does not relieve the employer of the need to provide it during inspections at the request of third-party organizations. And its absence may be regarded as a violation labor legislation, for which a fine for the organization is imposed in the amount of 50,000 rubles. Of course, it can be challenged in court (especially since there is no direct indication in the law of the employer’s obligation to draw up a staffing table), but first you will have to pay it.

Frequency of drawing up staffing schedules

How often do you need to create a new staffing table? There is also no clear answer to this question. But in this situation, you should be guided by logic: since the staffing table is a planning document, then it is advisable to draw it up for one calendar year or six months. This will allow, if necessary, to regulate the number of personnel of the organization and its qualitative composition. But, at the same time, it is possible to approve the staffing table for several years (if the organization does not need to introduce new positions).

Who develops and approves the staffing schedule?

If the company does not have a staffing table, but management decided to develop one, a reasonable question arises: who should do it? The legislation again does not give an unambiguous answer to this. Therefore, the manager can do this himself, determining the circle of responsible persons who will help him. It would be logical if these were HR employees, chief accountant, employees of the legal or economic planning department. And if the enterprise has a department for organizing labor and wages, you can entrust this work to them. Responsibilities for developing and drawing up the staffing table for 2014 may be reflected in the employee’s employment contract or his functional responsibilities.

Approval of the staffing table relates to the powers of the head of the organization or the person to whom these powers are transferred by order of the head. To approve the staffing table, the manager must sign a special order or instruction. The details of this document must be indicated in the field of the unified form T-3 “Approved by order of the organization dated “__”_______20__No__”. In this case, the approval date and the effective date of the staffing table may not coincide (the effective date is usually later).

How long is the staffing table kept?

Rosarkhiv establishes certain storage periods for standard management documents, according to which the institution’s staffing table must be stored for three years, starting from the year following the one in which the document became invalid. As for staffing arrangements, which will be discussed in the next section, they are stored for seventy-five years after new ones are compiled.

Staffing is a help in the work of the HR department

In some organizations, the HR department maintains a staffing table - a mobile version of the staffing table, which reflects all vacant positions, as well as all information on filling positions (full names of current employees, position status, etc.). The staffing arrangement provides the necessary information about changes in personnel, contains personnel numbers of employees, information about the length of service and categories (minors, disabled people, pensioners, having children under three years old, etc.) of employees.

When drawing up the staffing structure, the current staffing table is taken as a basis, to which the necessary columns are added. This document is not mandatory and the organization does not have to maintain it. But the staffing arrangement is a fairly convenient document, especially for large organizations, which allows you to optimize the work of personnel officers and clearly control the filling of vacant positions. Therefore, it is often used as an internal document.

Staffing table: rules for drawing up

Let's consider drawing up a staffing table based on the unified T-3 form. For getting finished document you just need to fill out the form, following the Instructions for filling out forms of primary accounting documentation.

"A cap". When filling out the “header”, you need to indicate the name of the organization in the “Name” field (this is done in accordance with the registration certificate), OKPO code, document number and date of preparation. In the field “Staffing table for the period...” you need to indicate only the date of entry into force of this document.

- Column 1 “Name”. We indicate the name of the structural unit, workshop, representative office, branch, arranging the structural units according to the existing hierarchy.

- Column 2 “Code”. We indicate the code of the structural unit assigned to it by the head of the organization.

- Column 3. We indicate the position (specialty, profession), rank, class (category) of the employee’s qualifications in accordance with the All-Russian Classifier of Professions and the Qualification Directory of Managers and Specialists. Here it should be taken into account that the position for which the employee is hired must sound the same both in the staffing table and in the employment contract, as well as in the work book.

- Column 4 “Number of staff units.” We indicate the number of staff positions for the relevant positions. If there are incomplete units, they should be indicated in fractions, for example, 2.75. And if there are vacant positions, they are also indicated.

- Column 5 “Tariff rate”. We indicate the salary, tariff schedule, percentage of revenue, share of profit - it all depends on what kind of remuneration system operates in a particular organization. The main thing is to indicate the amount in ruble equivalent and remember that the salary (tariff rate) cannot be lower than the minimum wage.

- Columns 6, 7, 8 “Allowances”. We indicate the provided incentive and compensation payments. These can be bonuses, additional payments, incentive payments, allowances, which can be established both by the legislation of the Russian Federation and by the employer. Such payments may be fixed amounts or percentage increases.

- Column 9. Indicate the total amount in columns 5-8. That is, we sum up the salaries and all the required allowances and display the total value in rubles. If the data is given as a percentage, we display the percentage.

- Column 10 is for notes. If there are none, it is left blank.

After all the fields are filled in, you need to fill in the “Total” line. It summarizes all the indicators in vertical columns: it indicates how many staffing units are provided for in the schedule, the amount of salaries (tariff rates), allowances and the amount of the monthly wage fund.

The staffing table is signed by the head of the human resources department or an authorized person, as well as the chief accountant of the organization. You can put a stamp on the document, but it is not necessary.

Change of staffing

Even established staffing schedules have to be changed from time to time. The reason for such changes may be the need to introduce a new unit or division into the staff or, conversely, to reduce the existing staff. In addition, there may be a need to change salaries, tariff rates, as well as the need to rename positions or departments.

There are two options for making changes to the staffing table:

- develop and approve a new staffing table;

- make changes to the current staffing table.

In the first case, the staffing table is developed on the basis of the current one, but taking into account the necessary changes, and is put into effect from the beginning or middle of the calendar year. If there is an urgent need, then from the beginning of the new month.

As for making changes to the current document without canceling it, they are made in accordance with the order of the head “On changing the staffing table”. The order itself must indicate the basis for making changes to the staffing table (this could be reorganization, staff reduction, improving the structure of the organization, etc.), as well as indicate exactly what changes should be made.

In a large organization with a branched structure, it is better to indicate not only the positions that are affected by the change, but also the structural units where these positions are located. In this case, all changes in the staffing table must be brought to the attention of the enterprise’s employees, and also entered into the work books with reference to the basis (order or instruction).

Staff reduction: when to make changes?

A reduction in staff or number of employees is one of the grounds for making changes to the staffing table, since a reduction in the size of an organization involves the exclusion of individual staff units from the schedule, and a reduction in staff - positions. In this case, laid-off employees are subject to dismissal (unless they are expected to be transferred to another job).

Since when dismissal due to a reduction in the number or staff of employees, it is necessary to notify about the changes no later than two months in advance, the new staffing table can be put into effect only after this period. Although it can be drawn up in advance, the very presence of a new or changed staffing table, which has already been approved, will confirm the eligibility of dismissing employees. If the circumstances that led to the decision to make a reduction are eliminated, the employer has the right to change the staffing table again in the direction of increasing the number of employees.

Change of the unified form T-3

Resolution of the State Statistics Committee No. 20 of March 24, 1999 allows organizations to make changes to the unified forms of primary accounting documentation (this permission does not apply to the accounting of cash transactions). Therefore, if there is an urgent need, the organization can make its own changes to the finished form, but deleting existing details is not allowed. Changes may concern the expansion or narrowing of columns, the addition of lines or loose leaves. Necessary corrections can be made when producing forms based on a unified form.

M.A. Kokurina, lawyer

Staffing: we create it ourselves

A company cannot be fined for lack of staffing: this is not a violation of labor or tax laws. After all, the obligation to have such a document is not directly stated in the Labor Code. Although the phrase “in accordance with the staffing schedule” is still contained there Art. 57 Labor Code of the Russian Federation. In addition, this document is not the primary document required to recognize expenses in tax accounting. Why are online forums full of discussions about how to fill it out? And readers turn to our editors with similar questions quite often.

Why do you need staffing?

EXPERIENCE EXCHANGE

FIREPLACE Alexander

Chief accountant, Moscow

“How tenacious is our Soviet heritage, where the staffing table, along with the seal and estimates, was considered the basis of the financial independence of the institution: “...salaries according to the staffing table and taking into account the ratio of the number of managers, specialists and employees...”

Maybe in budgetary sphere control is weak, so you can’t do without a staffing table. But in those working for profit commercial companies the most important thing is to save and control. If the company is small, then the manager knows by name who works, how and for what. In a medium-sized and, especially, a large company, HR reports are such that the standard staffing table, as they say, is not even close.

So think for yourself: should you have a staffing table or not. I answer like this: “In our organization there is no such document! »» .

In fact, a complete, correctly drawn up staffing table summarizes information about the number and structure of the organization’s personnel and salary costs. That is, from it you can see how many staff units are capable of ensuring the normal activities of the company and how much money is needed for salaries.

Unified forms primary documents V in electronic format can be found: section “Reference Information” of the ConsultantPlus systemInspectors want to see approximately the same thing from your staffing table. Tax or labor inspectorates, the Pension Fund of the Russian Federation and the Social Insurance Fund are instructed to request staffing during inspections, and they do so. Compare information from it with information on salaries from employment contracts, employment orders, pay slips, and employee testimony. In particular, to identify gray payments, check the correctness of calculation of insurance premiums or the application of tax benefits. clause 91 of the Methodological Instructions, approved. Resolution of the FSS dated 04/07/2008 No. 81; Appendix 1 to the Methodological Recommendations, approved. Resolution of the Board of the Pension Fund of January 30, 2002 No. 11p.

By the way, there are courts that support labor inspectorates and fine companies for violating labor laws when the salary specified in the employment contract does not correspond to the amount specified in the staffing table and Decision of the Leningrad Regional Court of 08/04/2011 No. 7-478/2011.

There is also such a position of judges: the staffing table fully confirms the amount of the employee’s salary on a par with the employment contract and the order for employment with Appeal ruling of the Supreme Court of the Republic of Buryatia dated 07.11.2012 No. 33-3034. But not all courts consider the staffing table a necessary document for the company, in particular proving the level of salaries in the organization and Resolution of the Federal Antimonopoly Service of the North-West District dated November 8, 2011 No. A26-3875/2010.

In addition, the staffing table may be useful in the event of a dispute with an employee dismissed with the wording “due to a reduction in the number of employees.” To prove the legality of dismissal Art. 179, paragraph 2 of Art. 81 Labor Code of the Russian Federation, you can submit to the court exactly staffing tables and/or orders amending them issued before and after refusal:

- <или> from any positions, if there was a staff reduction (suppose the position of senior cashier was eliminated);

- <или> from any staff units, when the reduction in numbers took place (for example, instead of three units of cashiers, there was only one).

WE TELL THE MANAGER

The staffing table with changes made to it will serve as additional evidence in the event of a legal dispute with an employee dismissed due to reduction in numbers or staff.

And if you have no changes in the staffing table on the date of issuing the order to dismiss the employee due to redundancy, the court may reinstate him at work and oblige you to pay him for the days of forced absence. Cassation ruling of the Supreme Court of the Udmurt Republic dated September 27, 2010 No. 33-3088.

So the decision to have or not to have staffing is really yours. And our further recommendations for those who answered yes to this question.

What to write down in the staffing table

When drawing up this document, you can use form No. T-3 approved Resolution of the State Statistics Committee dated January 5, 2004 No. 1. It is no longer mandatory, but in order not to reinvent the wheel, take it as a basis and, if necessary, modify it “for yourself.” Let's say there are no allowances in your company - then remove the unnecessary column.

FROM AUTHENTIC SOURCES

Deputy Head Federal service on labor and employment

“ It is recommended that the procedure for preparing primary accounting documents, including labor accounting and payment, be enshrined in a local regulatory act on the organization’s accounting policy.

Unified forms of primary accounting documentation for recording labor and its payment, approved by Resolution of the State Statistics Committee No. 1, contain the necessary details, comply with legal requirements, and are familiar in work. Therefore, it is recommended that you continue to use these forms, including Form No. T-3.”

We provide a sample of filling out the staffing table using the unified form No. T-3.

|

LLC "Yasnye Zori" You can write the full or abbreviated name of the organization as it is written in constituent documents name of company |

Code | Approved Resolution of the State Statistics Committee Russia dated 01/05/2004 No. 1 |

|||

| OKUD form | 0301017 | ||||

| according to OKPO |

| STAFF SCHEDULE | Document Number | Date of preparation | APPROVED | ||

| 3Use continuous numbering for all your staffing tables - it’s more convenient | 20.03.2013 | ||||

| for a period of ________ The period of validity of the staffing table may not be indicated, because the law does not establish the validity period of this document or mandatory periods for changing it. It can be approved once and be valid indefinitely if there are no changes to it. And if large-scale changes in the staffing table are needed, you better approve it anyway new edition, even when the validity period you set has not yet expired With " 1 » April 20 13 Separately indicate the date from which the staffing schedule comes into force. This way you can immediately see when it will become effective, and there is no need to look into the order for its approval. |

By order of the organization dated "25" March 2013 No. 3-5 |

||||

| Staff of 24 units |

| Structural subdivision |

Position (specialty, profession), rank, class (category), qualification Work in some positions, specialties or professions is associated with the provision of benefits (for example, early retirement in old age) or the presence of some restrictions (for example, shortened working hours). In such cases, the names of these positions, specialties, professions, as well as the structural units in which they are registered, must exactly correspond to the names indicated in the qualification directories. And all these names must be the same in the staffing table, employment contract, work book. Therefore, if you have, for example, hazardous production, heavy hazardous work, do not forget to check the List of productions, workshops, professions and positions approved Resolution of the State Committee for Labor of the USSR and the Presidium of the All-Union Central Council of Trade Unions dated October 25, 1974 No. 298/P-22 |

Number of staff units Here you indicate how many employees are provided for each position in your organization. You also write down incomplete staff units, for example, when working part-time work time- 0.25; 0.5; 0.75 bet. It is better to make the staffing table as complete as possible, that is, to include in it those positions and the number of them that are needed for the operation of the company. Then you won’t have to make changes to it every time new employees come to work. |

Tariff rate, salary, etc., rub. The salary must be written down: in a fixed amount(without specifying a fork, for example 23,000-30,000 rubles); only in rubles(in USD or foreign currency- a violation for which the labor inspectorate may fine Art. 5.27 Code of Administrative Offenses of the Russian Federation); in an amount not less than 5205 rubles.- the current minimum wage for full pay and Art. 133 Labor Code of the Russian Federation; Art. 1 of the Law of December 3, 2012 No. 232-FZ |

Allowances, rub. Indicate the allowances provided for by law (for example, regional coefficients for working in areas with special climatic conditions, additional payments for hazardous working conditions). Allowances, unlike salaries, can be written down: <или>in the form of a fixed amount in rubles; <или>as a percentage of salary; <или>in the form of a coefficient. There is no need to list bonuses, bonuses and personal allowances here. |

Total per month, rub. (gr. 5 + gr. 6 + gr. 7 + gr. 8) x gr. 4 You can put a dash in this column if the premiums are indicated as percentages or coefficients. But for a complete calculation of the payroll, it is better to recalculate the percentage bonuses into fixed amounts and include them in the total amount of wages |

Note In the note you can note important features of the work schedule or payment for the position. In particular, in this column you can: <или>make a reference to a local regulatory act establishing additional payments “for harmfulness” in a higher amount compared to those provided for by law; <или>indicate that for some profession the payment is piecework |

|||

| Name You can name your structural units and positions as you wish. For example, “accounting” or “department accounting and economics”, “chief accountant” or “head of the accounting and economics department” | code You assign codes to departments yourself so that you can determine the structure of the company and the subordination of departments to each other | ||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Administration | 01 | CEO | 1 | 46 000 | - | - | - | 46 000 | |

| Secretary | 1 | 15 000 | - | - | - | 15 000 | |||

| Accounting | 02 | Chief Accountant | 1 | 34 000 | - | - | - | 34 000 | |

| Senior accountant | 1 | 28 000 | - | - | - | 28 000 | |||

| Economist | 0,5 | 28 000 | - | - | - | 14 000 | |||

| Purchasing department | 03 | Head of Purchasing Department | 1 | 28 000 | - | - | - | 28 000 | |

| Commodity expert | 2,5 | 22 000 | - | - | - | 55 000 | |||

| Purchasing Manager | 2 | 16 000 | - | - | - | 32 000 | |||

| Retail department | 04 | Administrator of the trading floor | 1 | 18 000 | - | - | - | 18 000 | |

| Salesman | 3 | 15 000 | - | - | - | 45 000 | |||

| Salesman-cashier | 4 | 15 000 | - | - | - | 60 000 | |||

| Technical department | 05 | Delivery driver | 2 | 15 000 | - | - | - | 30 000 | |

| Loader | 4 | 12 000 | - | - | - | 48 000 | |||

| Total: | 24 | - | - | - | 453 000 | ||||

Staffing table- this is a document of the organization, used to formalize the structure, staffing and staffing levels of the organization (section 1 of the instructions approved by the resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1). The staffing table is an impersonal document. It does not indicate specific employees, but the number of positions in the organization and salaries for them. Employees are appointed to positions by orders of the manager after the approval of the schedule.

According to section 1 of the instructions approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1, the schedule is signed by the chief accountant and the head of the personnel service (or the employee responsible for personnel records). If the staff is large and the schedule takes up several sheets, then the chief accountant, at his discretion, can sign both once (at the end of the document) and on each sheet. After this, the staffing table must be approved by the head of the organization by order.

Technically, the staffing table can be compiled by any service to which the manager is assigned this responsibility. As a rule, this is done by the personnel department. If the organization is small, then a personnel officer or chief accountant.

Validity

No validity period has been established for the staffing table. Once the staffing table is approved, changes are made to it as necessary. The organization is not obliged to approve (revise) the staffing table every year, but has the right to do so at its own discretion.

Errors when drawing up staffing schedules

- There is no need to indicate the Ural coefficient and other allowances in the staffing table

To fill out the staffing table correctly, you must separately indicate the amount of salary and separately the amount (percentage) of allowances. The salary is reflected in column 5 of the T-3 form, and various allowances (including the Ural coefficient) are reflected in columns 6–8. If it is impossible to determine the exact amount in rubles, it is permissible to enter a percentage or coefficient in the indicated columns (Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1). - Every year a new staffing table must be approved

The law does not oblige the employer to update the staffing table annually. This document, in principle, has no validity period or frequency of approval. - All positions in the staffing table must comply with the approved occupational classification

If the positions in the staffing table do not correspond to the positions given in the Classifier, in most cases this is not a violation. - The staffing table must indicate the full names of employees

There is no need to indicate the full names of employees in the staffing table. Otherwise, you will have to change the document every time you leave. In addition, in the unified staffing form there is no column for entering personal data. - You can indicate “floating” salaries in the staffing table

Sometimes an employer sets different salaries for equivalent positions or directly in the staffing table in column 5 indicates the so-called “fork” of salaries (for example, 20,000–30,000 rubles).

This approach is contrary to labor laws. Any discrimination against workers when establishing wage conditions is prohibited (Article 132 of the Labor Code of the Russian Federation). The employer is obliged to provide employees with equal pay for work of equal value (Article 22 of the Labor Code of the Russian Federation, letter of Rostrud dated April 27, 2011 No. 1111-6-1).

Labor Relations- this is a relationship based on an agreement between the employee and the employer on the personal performance by the employee for payment of a labor function ( work according to the position staffing table, profession, specialty indicating qualifications; specific type of work entrusted to the employee), the employee’s subordination to internal labor regulations while the employer provides working conditions provided for by labor legislation and other regulatory legal acts containing standards labor law, collective agreement, agreements, local regulations, employment contracts.

The employment contract specifies:

...............................

Mandatory for inclusion in the employment contract are the following conditions:

............................

labor function(job position in accordance with staffing table, profession, specialty indicating qualifications; specific type of work assigned to the employee).

.............................

We see that there are only two articles about staffing. At first glance, the legislator does not seem to oblige to have a staffing table, but it was developed and approved for a reason unified form T-3 “Staffing table”.

So, below we will consider why the staffing table is needed, how it is filled out, and how it is put into effect.

to menu

WE CREATE A Staff Schedule, Arrangement, SAMPLE download

Staffing arrangement

Staffing arrangement (staff list, staff replacement) reflects which units in the staffing table are occupied, indicating the full names of specific employees, their personnel numbers and terms of remuneration. If necessary, this document also includes other data, for example, information about length of service or other characteristics of employees: disabled person, pensioner, minor, part-time worker, etc.

Regular replacement is not a document required to be maintained by the organization's personnel service, but it is widely used in practice. This document allows you to quickly navigate and restore the specific working conditions of employees in the organization.

There is no unified form of staffing in the legislation, so it is drawn up in any form. The staffing schedule according to the unified form No. T-3 is usually taken as a basis and supplemented with the necessary columns and columns.

What is meant by “staff” and “staffing”?

Staff is the composition of an organization’s employees, determined by management for a certain period.

Various sources give different definitions to the concept of “staffing table”, but, in principle, their essence boils down to the following: the staffing table is an organizational and administrative document that reflects the structure of the organization, contains a list of positions indicating their number and salary levels. The staffing table also reflects the amount of allowances and additional payments that exist in a given organization in relation to specific positions.

To protect yourself from claims from inspectors, do not establish different salaries in the staffing table for positions with job functions of the same complexity.

The same job title implies the same job responsibilities. In this case, it is necessary to observe the principle of equal pay for work of equal value (Article 22 and Part 2 of Article 132 of the Labor Code of the Russian Federation). In employment contracts and job descriptions employees can be assigned different levels of work, different rights and responsibilities, and different levels of responsibility. However, it is better to name the positions differently, using the words “senior”, “junior”, “leading”, etc.

to menu

WHO should draw up the Staffing Schedule and make changes to it?

There is still no clarity on this issue. IN different organizations functions for drawing up staffing schedules are performed by different structural units. When assigning responsibility for the formation of staffing to employees of any structural unit, management is often based on the size of the organization. Today in Russia there are both large organizations with a staff of over 500 people, and small enterprises with no more than 50 employees. There are also entrepreneurs without education legal entity who work for them wage-earners. Since most small businesses and individual entrepreneurs There are no personnel departments, no departments of organization and remuneration, then the staffing table is drawn up by accounting staff, managers or the entrepreneurs themselves. In medium-sized enterprises (from 100 people), as a rule, there is a personnel department or personnel service and, accordingly, the functions of drawing up and making changes to the staffing table are transferred to them (but there are often cases when accounting staff are again involved in drawing up and changing the staffing table).

In large companies that include both human resources departments or personnel services, as well as labor organization and remuneration departments, the above-mentioned divisions are responsible for developing the staffing table.

It should be noted that the formation of a staffing table is a rather complex process, consisting of several stages and requiring the involvement of not only HR specialists, but also economists.

to menu

WHAT does the preparation of the Staffing Schedule begin with?

Before you start compiling staffing table, it is necessary to decide on the organizational structure of the enterprise. An organizational structure is a schematic representation of structural divisions. This document reflects all divisions of the organization and schematically outlines the order of their subordination. The organizational structure can also reflect both vertical and horizontal connections between departments.

It is problematic to clearly indicate where the boundaries of responsibility for drawing up the staffing table lie, but we will try to delimit some stages of drawing up the HR, and at the same time fill out the unified form No. T-3.

Filling unified form T-3 “Staffing list” you should start with the name of the organization - it must be indicated in strict accordance with the name that appears in the constituent documents. In the case where an organization has both a full and an abbreviated name, the use of any name is allowed. To avoid any questions and controversial situations, it is advisable to consolidate the rules for filling out details in the local regulatory act on documentation and document flow (regulations, instructions).

Next is the document number. For organizations where the staffing table is often subject to changes, it is advisable to introduce a separate numbering for the staffing table with a letter designation (for example, “shr”).

The date of the document is entered in a specially designated column in the form “dd.mm.yyyy.” The date of the staffing table does not always coincide with the start time of its validity, therefore, the unified form contains the column “Staffing table for “____”_______ 20, i.e. on a certain date from which the staffing table comes into effect.

Resolution of the State Statistics Committee of Russia, which introduced unified form No. T-3, the approval of the staffing table is provided for by order of the head of the organization. To do this, the date and number of the order, the number of staff units and the monthly payroll are entered in a separate column.

to menu

What is the name of the structural unit?

The first column of the unified form is called “Name of structural unit”. If we are talking about a commercial organization, then, as a rule, there are no restrictions in the names of structural divisions, except for the requirements for terminology and generally accepted concepts and definitions (it is undesirable to name structural divisions with poorly understood foreign words). However, there are organizations in which a number of benefits provided to employees upon retirement depend on the name of the structural unit indicated in the staffing table (for example, medical and educational institutions, enterprises that include production with harmful conditions labor). Therefore, the task of correctly reflecting the names of structural units in the staffing table falls on the HR department or the organization and remuneration department.

To facilitate work in this direction, there are industry classifiers of hazardous industries or nomenclature of names of structural divisions, as well as tariff and qualification reference books, all-Russian classifiers, List No. 1 of industries, works, professions, positions and indicators in underground work, in work with particularly hazardous and especially hazardous difficult working conditions, employment in which gives the right to an old-age pension (old age) on preferential terms and List No. 2 of industries, jobs, professions, positions and indicators with harmful and difficult working conditions, employment in which gives the right to an old-age pension ( old age) on preferential terms.

The names of departments are indicated by groups:

- management or administrative part (such divisions include the directorate, accounting, personnel department, etc.);

- production units;

- auxiliary or service units.

As a rule, the location of the names of structural units in most organizations corresponds to this order. The exception is for enterprises whose main business is trade. In such companies there are no production departments, but there are sales departments or commercial departments, which are closely related to logistics departments (the latter in this case are service departments).

Supporting departments usually include the supply department, repair services, etc.

to menu

What is a “structural unit code”?

The structural unit code usually indicates the location of the structural unit in hierarchical structure organizations. It is also assigned for the convenience of document management (especially for large enterprises). By means of coding, the place of smaller units in the structure of large ones is indicated. For example, within departments there are directorates, within departments there are departments, within departments there are groups. If a department is designated by the digital code 01, then the department within the department will, accordingly, be numbered 01.01. Departments and groups are designated in the same way.

How to fill out the “Profession (position)” column?

This column is filled out in strict accordance with tariff and qualification reference books and the All-Russian Classifier of Employee Positions and Worker Professions. The sequence of filling out this column for each structural unit is individual, taking into account the specifics of a particular organization. As a rule, first are the positions of the head of a structural unit, his deputies, then leading and chief specialists, then the positions of performers. If a structural unit includes both engineering and technical personnel and workers, it is necessary to allocate engineers first, then workers.

to menu

What is a “staffing unit”?

A staffing unit is an official or working unit provided for by the staffing table of an enterprise. As a rule, the number of staff units of organizations financed from the federal or regional budget is determined by higher-level organizations. Number of staff units commercial enterprise determined by his needs for certain types of work, the degree of urgency of their implementation and economic feasibility.

How to set the salary (tariff rate)?

Under salary (tariff rate) in accordance with understood fixed size remuneration of an employee for fulfilling labor standards ( labor responsibilities) of a certain complexity (qualification) per unit of time.

Tariff rates are a tool for tariffication of employee remuneration in organizations financed from federal budget in accordance with the Unified tariff schedule. Commercial organizations set salaries based on their financial capabilities.

It should be noted here that the salary or tariff rate in accordance with the Labor Code of the Russian Federation cannot be lower than the legally established minimum wage. It should also be taken into account that the minimum wage does not include additional payments and allowances, bonuses and other incentive payments, payments for work in conditions deviating from normal ones, for work in special climatic conditions and in territories exposed to radioactive contamination, other compensation and social payments.

When establishing official salaries or tariff rates, it is necessary to remember that the staffing table can only reflect the size of the salary or tariff rate, therefore it is completely impossible to take into account the wage fund. This is due to the fact that in enterprises with shift schedule work, the wages of employees receiving an official salary increase by the amount of additional payments for night work, and the work of employees whose wages are calculated based on the tariff rate is paid depending on the number of hours worked in a particular month and varies. In most organizations, the size of the monthly wage fund for reflection in the staffing table is calculated from the average number of working hours and is assumed to be conditionally equal to 166 hours per month.

For workers whose work is paid according to the piece-rate system, the ShR, as a rule, sets a tariff rate or salary, which, depending on the specifics of the organization, is calculated using certain methods.

When setting the salary, one should be guided by the requirements contained in acts of labor legislation, as well as local regulations - Regulations on remuneration in the organization, Regulations on bonuses and others.

to menu

What are “allowances and surcharges”?

In a unified form No. T-3 There are several columns united by the common name “Additional allowance”. The current Labor Code of the Russian Federation does not contain clear definitions of the concepts "additions" and "surcharges".

Guided by generally accepted guidelines, we can define additional payments as payments accrued to employees in addition to salaries (tariff rates) for special working conditions or working hours. Additional payments are made to employees engaged in heavy work, work with harmful and (or) dangerous and other special working conditions. The specific amount of the additional payment is established by the employer taking into account the opinion of the representative body of employees or by a collective agreement or is stipulated in the employment contract. Currently in many budgetary organizations industry regulations apply legal documents, which regulate the size of wage increases for industry workers.

Salary supplements- these are incentive payments in excess of the established official salary, which stimulate employees to achieve higher production indicators, increase professional excellence and labor productivity. As a rule, bonuses are established based on the results of employee certification by decision of a qualification or certification commission.

Until definitions for the concepts of “allowance” and “additional payment” are introduced at the legislative level, it is difficult to distinguish or systematize this type of payment. The main thing that needs to be taken into account when creating a staffing table is the two main forms of payment of allowances and additional payments.

The first form - percentage - is set as a percentage of the official salary, and if the size of the salary (rate) is revised, the size of the bonus (surcharge) automatically changes.

The second form of payment is an allowance or surcharge, set as a fixed amount. Such payment may remain constant even if the salary (rate) changes, unless otherwise provided by a collective agreement, employment contract or local regulation. When additional payments or allowances are established in the staffing table, a note is made in the corresponding column about the amount and for what this allowance (addition) is established.

One of the most frequently asked questions is how to ensure that employees occupying the same positions receive a salary that corresponds to their level of qualifications, and at the same time comply with the principles of equality laid down in the Labor Code of the Russian Federation? The solutions to this problem may be different - it all depends on the professionalism of the management team. When looking for your own solution, you need to evaluate existing system wages at the enterprise. But, basically, this problem is solved by establishing a “standard” salary for all employees working in a given position or profession, and remuneration for more qualified workers is made by establishing personal allowances for a certain period. When the employee confirms his qualifications by order of the head of the enterprise, the bonus is established for the next period.

What is “monthly payroll”?

Monthly payroll- these are the total cash, which are provided for by the staffing table and payment system in force at the enterprise for payment to employees.

to menu

When are changes made to the Staffing Schedule?

Changes in staffing table are introduced when the number or staff of employees is reduced. When reducing numbers, individual units are excluded, and when reducing staff, individual units are excluded. At the same time, employees filling reduced positions or working in reduced professions are subject to dismissal under the relevant articles of the Labor Code of the Russian Federation.

Is it possible to make changes to the unified form No. T-3?

Changes to the staffing table are also made by order (instruction) of the head “On making changes to the staffing table”. Changes may be as follows:

- renaming a position, specialty, profession;

- renaming a structural unit;

- change in tariff rate (salary);

- change in the number of staff units (increase, decrease).

to menu

There are two ways to make changes to the staffing table:

1. Change the staffing table itself. The new staffing table with the following registration number is approved by order of the manager.

2. If the changes made to the staffing table are not significant, they can be formalized by order (instruction) “On making changes to the staffing table.” The following reasons may be specified as the basis for the order:

- reorganization of the organization;

- expansion or contraction production basis organizations;

- carrying out activities aimed at improving the performance of individual structural units;

- changes in legislation;

- an increase in the number of workers and the workload on administrative and management personnel, and so on.

As stated in the resolution of the Goskomstat of Russia dated March 24, 1999 “On approval of the procedure for using unified forms of primary accounting documentation”, in the unified forms of primary accounting documentation (except for forms for recording cash transactions), approved by the Goskomstat of Russia, organization, if necessary may provide additional details. In this case, all details of the approved forms remain unchanged (including code, form number, document name); Removing individual details from unified forms is not allowed.

Changes made must be documented in the relevant organizational and administrative document of the company.

The formats of the forms indicated in the albums of unified forms of primary accounting documentation are recommended and subject to change.

When producing blank products based on unified forms of primary accounting documentation, it is allowed to make changes in terms of expanding and narrowing columns and lines, taking into account the significance of indicators, including additional lines (including free ones) and loose sheets for the convenience of placing and processing the necessary information.

Qualification directory for positions of managers, specialists and other employees

(approved by Resolution of the Ministry of Labor of the Russian Federation dated August 21, 1998 N 37)

to menu

ORDER to ENTER into force the Staffing Schedule

LLC "Gasprom"

INN 4301123456, KPP 430101001, OKPO 98756423

full name of the organization

ORDER No. 90

on approval of the staffing table

Moscow 10/8/2015

In accordance with section 1 of the instructions approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1,

I ORDER:

Approve the staffing table dated October 8, 2015 No. 15 with a staff of 18 staff units with a monthly wage fund of 317,000 rubles.

Appendix: staffing table on two sheets.

Director ____________ A.V. Ivanov

Agreed:

Chief accountant _________ A.S. Petrova

Head of HR Department _________ E.E. Gromova

The following have been familiarized with the order:

Assistant Accountant ___________ V.N. Zaitseva

8.10.2015

Secretary ____________ E.V. Ivanova

8.10.2015

Etc. all employees are familiarized with the order against signature.....

The manager may authorize any other person to sign orders according to the staffing table.

Chief accountant and personnel worker Only the staffing table itself must be signed. The order does not require their visas. They become familiar with the order in the same way as other employees.

to menu

QUESTIONS AND ANSWERS

As part of the counter-inspection, she requested the staffing table of the educational institution.

- Is it legal to require this document when checking a counterparty?

- Is there any liability if it is not directed?

Inspectors have the right to request the staffing table of the educational organization itself.

They may need it, for example, to establish the existence of relations of interdependence or control of the organization with other taxpayers (possibly with counterparties of the educational organization itself).