IP accepts cash. Restrictions when paying in cash for individual entrepreneurs and LLCs: how much is allowed and how much is not allowed. Restrictions on cash payments

Individual entrepreneurs are required to observe cash discipline and keep records of cash transactions on a general basis. Many questions arise: how to take cash from yourself, how to document such transactions, what to do if the cash balance limit is exceeded? We will answer these and other questions in our material.

Can an entrepreneur using the simplified tax system take money from circulation for personal needs?

Individual entrepreneurs have the right to withdraw funds from the cash register at any time for personal expenses. Despite the fact that the Bank of Russia, by Directive No. 184-U dated June 20, 2007, limited the cases in which cash payments can be used, the entrepreneur’s funds, including sales proceeds, are his property, which the owner has the right to dispose of at his own discretion.

The Civil Code of the Russian Federation contains a rule according to which cash payments not related to business activities are made in cash without limiting the amount.

Why was a cash limit established for entrepreneurs?

The cash balance limit, according to the Regulation of the Central Bank of Russia dated October 12, 2011 No. 373-P, is established not only for entrepreneurs, but for all economic entities engaged in entrepreneurial activities. It is installed in order to control the circulation of cash in Russia. Individual entrepreneurs carrying out economic activity Since 2012, they are required to comply with the cash balance limit on a general basis.

If at the end of the day there are funds remaining in the entrepreneur’s cash register that exceed the established limit

In the same way as an organization, an entrepreneur issues a cash receipt for an amount exceeding the established limit for the issuance of cash.

You can give money to an employee on account; if the individual entrepreneur does not have employees, then the warrant should be issued to yourself.

In the expenditure order, you can indicate the following wording: “Issue for general business expenses” - if the money is supposed to be spent for business purposes, if the entrepreneur takes the money for personal expenses, then the order should write “Issuance of funds for the personal needs of the entrepreneur.”

Although in reality it turns out that the individual entrepreneur transferred money from one pocket to another, nevertheless, formally all the rules were followed, no violations were made, and the established procedure was followed. It does not matter which taxation system the individual entrepreneur uses - simplified tax system 6%, simplified tax system 15% or OSNO. The procedure is the same for everyone.

An individual entrepreneur took money from the cash register for personal needs, how to reflect this in the Book of Income and Expenses

Such transactions are not reflected in the Income and Expense Book, because the issuance of funds on account is not an expense, either for the organization or for the entrepreneur.

In the same way, an operation is not an expense when individual entrepreneur takes money for personal needs. The Accounting Book reflects only expenses taken into account for tax purposes, listed in clause 1 of Article 346.16 of the Tax Code of the Russian Federation.

If an individual entrepreneur’s main income goes through a current account, does he need to set a limit?

Regardless of the amount of cash, it is necessary to set a cash balance limit. The fact is that if a limit is not set, the cash balance at the end of the working day should be zero. With a zero limit, even a balance of one ruble at the end of the day will be a violation of cash discipline. For violation, an individual entrepreneur will be subject to penalties in the amount of 4,000 to 5,000 rubles.

The cash balance limit is calculated depending on whether cash is received from customers at the entrepreneur’s cash desk, or whether there are no cash payments, there is no cash register, and the entrepreneur withdraws funds for various expenses from the current account.

Formula for determining the cash balance limit

1. An individual entrepreneur receives cash from customers using cash registers

In this case, the cash limit is determined by the following formula:

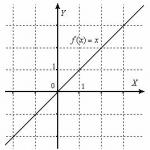

L = V/P x Nc Where,

L – cash balance limit;

V – volume of cash proceeds;

P – billing period;

Nc – the period of time between the days of depositing funds into the current account. This period, with certain exceptions, should not exceed seven working days. For example, if revenue is delivered to the bank once every five days, this figure will be equal to five.

Please note that P is the billing period that individual entrepreneurs, as well as legal entities, determine independently, and it should not be more than 92 working days.

If an entrepreneur has just registered and has no revenue, then in indicator V - the volume of revenue, he must indicate the volume of expected, planned income from customers.

2. An individual entrepreneur does not make cash payments; funds for expenses are withdrawn from the current account

In this case, when determining the limit, the individual entrepreneur must take into account the amount of funds issued for cash payments. When determining the volume, funds withdrawn from the current account for payment are not taken into account wages, scholarships and other payments in favor of employees.

The limit should be determined using the formula:

L = R/PxNn Where,

L – cash balance limit;

R – the amount of funds issued (planned for issue if no activity was carried out) to pay expenses in cash;

P – billing period;

Nn – period between receipt of cash from the current account. This indicator should not exceed seven working days.

In what cases is it permissible to exceed the established limit?

Clause 1.4 of Regulation 373-P establishes that funds in excess of the established limit can be kept in the cash register:

- on salary payment days, taking into account the day of receipt of funds from the bank;

- weekends and non-working days, if at this time the individual entrepreneur has a receipt of funds at the cash desk.

In all other cases, storing funds in excess of the established limit at the cash desk is not allowed.

If an individual entrepreneur purchases materials for cash, should he first hand over all the proceeds to the bank, and then withdraw money for expenses from the current account?

For settlements with suppliers in cash, money is given from the cash register to the employee on account, or, if the individual entrepreneur does not have employees, to himself. At the same time, an expense cash order is issued on the basis of which an entry is made in the cash book.

Please note that in order to issue money on account, you must receive an application from the employee indicating the amount. The individual entrepreneur signs this application and the cashier, or the entrepreneur, if he personally keeps records of cash transactions, issues the required amount for a certain period.

Within a certain period accountable person or the entrepreneur himself, submits an advance report with attached documents confirming the expenditure of funds.

At the same time, the expenditure of money itself is confirmed by a cash receipt and a receipt attached to it with a cash receipt order or with a sales receipt.

Invoices and acts confirm only receipt material assets or services provided, but do not constitute confirmation of payment.

If there is an unspent amount remaining, then the balance must be accepted at the cash desk by issuing a cash receipt order for the remaining amount.

If, after issuing money to the account, or returning the balance of accountable funds, the cash limit is exceeded, then the balance should be handed over to the bank, having first issued a cash order. If the amount of funds for the rest of the day is within the limit, then you do not need to deposit anything to the bank.

If the balance of money was returned from the report at the end of the day and the individual entrepreneur does not have time to deposit the money exceeding the limit to the bank, you can re-issue it for the report, or withdraw it for your own needs, adhering to the established limit, having previously written out an expense cash order.

How to properly pay by card

- If you accept payments by plastic cards, you will need to purchase a cash register (KKM). When making a purchase, the client receives a check for the amount withdrawn from the card.

- When you don’t need to purchase a cash register:

- In the case when payment by plastic card is made via the Internet, i.e. the money is credited to checking account IP.

- If clients pay by card remotely (for example, via the Internet).

How to make payments using electronic money

It is necessary to conclude an agreement with the operator electronic money (for example, WebMoney, Yandex.Money, RBK Money, Rapida). The client transfers money to the operator, and the operator credits these funds to the entrepreneur’s current account. This may be an account opened with an operator (depending on the operator), or a bank account, information about which the individual entrepreneur transfers to the operator.

Entrepreneurs and legal entities Persons are prohibited from making electronic payments among themselves. Calculations can only be made when one of the parties is an individual. person (client, buyer).

Receiving payment in cash from an individual

In most cases, you cannot accept cash payment from the buyer and do not issue any documents to the client.

Which document to issue depends on various conditions:

- On the simplified tax system, When accepting cash as payment for goods sold, work performed, services performed, you are obliged to use the cash register and always issue the client (individual) a cash register receipt.

- On UTII It is permitted not to use a cash register (cash register), but at the request of clients to issue them a receipt for payment. That is, not to all buyers, but only to those who request it. Exception: provision of services to the public (individuals). When providing services to the public (individuals), regardless of the regime (STS or UTII), it is necessary to either use cash register and issue a cash receipt to customers in the usual manner, or issue a BSO (to all customers, and not just upon request).

- On the simplified tax system or UTII when carrying out special types of activities: trade at markets and fairs, peddling small retail food and non-food products, sale of ice cream, newspapers and magazines ( the full list is in paragraph 3 of Art. 2 of Law No. 54-FZ) it is allowed not to use the cash register and not issue anything to the client at all.

How to accept cash payment in cash from an individual entrepreneur or LLC client.

When accepting cash payments from clients of an individual entrepreneur or LLC:

- On the simplified tax system The cash register must be used and the cash receipt of the cash register must be punched, and a cash receipt order (PKO) is also drawn up.

- On UTII , at the client’s request, a payment document is issued in free form (can be printed on a computer), containing the details:

- Title of the document,

- serial number and date of issue,

- FULL NAME. entrepreneur,

- entrepreneur's TIN,

- name and quantity of paid goods (works, services),

- payment amount,

- position and surname and initials of the person who issued the document, as well as his personal signature.

It could be sales receipt, receipt or other document convenient for you, the main thing is that all the listed details are there.

Important point! Issuing BSO to clients of individual entrepreneurs and LLCs is unacceptable. BSO can only be issued to individual clients.

Receiving payment to an individual's personal account

Many entrepreneurs do not want to open an individual entrepreneur’s current account, that is, they want to use the personal account of an individual in their activities, which was opened before the registration of the individual entrepreneur.

The legislation does not prohibit individual entrepreneurs from using a personal current account in their activities. That is, there are no direct penalties for accepting and writing off amounts related to activities that are carried out through such a current account.

However, indirect troubles are possible:

- The personal account service agreement, as a rule, states that you do not have the right to use the account for business purposes. That is claims may arise from the bank.

- Personal and current accounts are different. Clients (legal entities or individual entrepreneurs) may refuse to transfer money to a personal account. In this case, there is a risk: since they transfer the payment to the citizen’s account, inspectors may consider this amount to be payment for the citizen’s services, which means that the LLC/IP must, as a tax agent, withhold personal income tax from the remuneration and transfer the tax to the budget.

- Inspectors may recognize receipts to a personal account as income of an individual(and not income from the activities of an individual entrepreneur) and demand payment of 13% personal income tax.

The logic is as follows: since the money does not go to a business account, but to the account of an individual, it means that they are not related to the activities of an individual entrepreneur, but relate to transactions performed by an individual. Citizens of Russia must pay personal income tax at a rate of 13%. Additionally, fines and penalties will be assessed for the fact that you did not pay personal income tax immediately after receiving this income.

Important point! If you still want to use not the current account of an individual entrepreneur, but the current account of an individual, then It’s safer to open a separate account and use it to carry out only transactions related to the activity. That is, clearly separate: even despite the fact that the account is opened for an individual. person, receipts and write-offs on it are carried out exclusively related to the business; It is better not to conduct personal transactions from this account.

*The material was prepared within the framework of the Russian Chamber of Commerce and Industry project “Navigator of Success”

Last modified Wednesday, May 24, 2017The individual entrepreneur received proceeds from entrepreneurial activity. Is this his personal money? Undoubtedly. Legally, the property of an entrepreneur is not divided into his property as an individual entrepreneur and his property as an ordinary citizen. clause 4 of the motivational part of the Constitutional Court Resolution No. 20-P dated December 17, 1996. But in fact, the money earned from a business is still not as personal as, say, a salary received by an employee. How can an entrepreneur take this money for himself and preferably in cash? Much depends on how they were received.

The individual entrepreneur received the proceeds in cash

This is amazing. In this case, you can simply withdraw the money from the cash register via cash register pp. 4.1, 4.4 Regulations of the Central Bank October 12, 2011 No. 373-P. What basis for payment should it include? The specific wording is not that important. The main thing is that the meaning of the operation is clear - the entrepreneur takes his honestly earned money. For example, this option would be suitable: “For the personal needs of Ivanov A.A.”, despite the fact that Ivanov A.A. - this is our IP.

Although it must be said that many entrepreneurs, and especially their accountants, are wary of this method of receiving cash. They can be understood. Yes, the new Procedure for conducting cash transactions does not establish what exactly cash proceeds can be spent on. It regulates only the rules for processing the issuance of money from the cash register. But along with this Procedure, the Directive of the Central Bank continues to apply, which still states that an individual entrepreneur can spend cash proceeds on payments to employees, travel expenses and payment for goods, work and services. Moreover, this wording means that spending cash for any other purposes is prohibited. clause 2 of the Central Bank Directive No. 1843-U dated June 20, 2007; clause 5 of the appendix to the Letter of the Central Bank dated December 4, 2007 No. 190-T. If an entrepreneur violates this requirement, theoretically he faces a fine of 4,000 to 5,000 rubles. for violation of the cash handling procedure Art. 2.4, part 1 art. 15.1 Code of Administrative Offenses of the Russian Federation.

However, arbitration practice does not know of a single case where the tax office tried to fine an entrepreneur precisely because he took cash proceeds for himself. Although it is obvious that inspectors simply cannot help but encounter such situations. This means that they do not see anything illegal in this. And this is understandable, because no calculations, no spending of cash takes place here - the money remains the property of the same person. In addition, tax officials do not forget that they do not have the right to control what an individual entrepreneur spends the money remaining at his disposal after paying taxes. Letter from the Federal Tax Service for Moscow dated October 17, 2005 No. 18-12/3/74603. So there is no need to fear any claims from them.

The individual entrepreneur received the proceeds to his bank account

In this case, there are three main ways to obtain cash as your personal property. Decision of the Supreme Court dated June 13, 2012 No. AKPI12-491.

METHOD 1. Simply withdraw cash from your current account. New order conducting cash transactions does not limit the purposes for which cash can be withdrawn. Therefore, no far-fetched reasons are required to receive cash. In the check clause 5.2 of the Regulations, approved. Central Bank 04/24/2008 No. 318-P You can indicate that the money is intended for personal expenses. Then there will be no need to either receive money at the cash register or formalize its release from the cash register to the entrepreneur.

METHOD 2. Transfer money from a current account to a current (non-entrepreneurial) account clause 2.2 of the Central Bank Instruction No. 28-I dated September 14, 2006, and then withdraw cash from this account or from a bank card opened to it. The basis of payment in the payment order is “transfer of money to a personal card.”

METHOD 3. Transfer money from the entrepreneur's current account to his bank deposit.

Which option is better? It depends on the bank's tariffs. Almost all banks charge a commission for withdrawing money from a current account, and a significant one - up to 1%. Banks, as a rule, also limit the amount of cash that can be withdrawn over a certain period of time - a day or a month. To achieve this, increased, and essentially prohibitive, fees are established for cash withdrawals in excess of the limit - up to 10%.

The fee for transferring money to a current account or deposit varies from an insignificant fixed amount for one payment (10-20 rubles) to serious commissions of several percent of the payment. For withdrawing money from a current account or from a bank card, some banks do not take money at all, others do, and a lot. Restrictions on withdrawing money from such accounts are also common, especially through bank cards. As a rule, there is no commission for withdrawing money from a deposit; at the same time, a demand deposit is essentially no different from a current account.

Bank fees for transferring money between accounts, depositing and withdrawing cash can “take away” a significant part of an entrepreneur’s profit, perhaps even more than taxes. Therefore, it is better to immediately take cash proceeds that are not required for the business. And non-cash money can be spent on personal needs directly from your current account. True, both this account itself and the cards opened to it are intended for settlements related to business clause 2.3 of the Central Bank Instruction No. 28-I dated September 14, 2006; clause 2.5 of the Regulations, approved. Central Bank December 24, 2004 No. 266-P. But the bank only knows the purpose of the payments; it does not have the opportunity to determine for what purposes the entrepreneur needed certain goods or services. Therefore, the bank should not have any objections to using a current account to pay personal expenses.

There are a lot of ways, but what matters is who pays, for what, and what tax regime the entrepreneur uses. We will tell you about each payment method and how our service can help with this.

Clients - legal entities or individual entrepreneurs

You can accept payment from them to the entrepreneur’s bank account or in cash.

Cash payments between organizations and entrepreneurs are limited to an amount of 100 thousand rubles within one agreement. In this case, you need to run a cash receipt for the amount of cash received and issue a cash receipt order. If the contract amount is more than 100 thousand, you can pay in cash within the established limit, and the rest must be transferred to a bank account.

Electronic money payments between individual entrepreneurs and legal entities are prohibited; electronic money can only be accepted from individuals. Also, legal entity clients cannot be issued BSO, but individual entrepreneurs can.

If an entrepreneur or organization transfers money to another entrepreneur or organization from current account to current account, a cash register is not needed. But if for payment it is applied electronic means payment, for example, a plastic card, then you need to use a cash register (clause 9 of Article 2 of Law 54-FZ of May 22, 2003).

Can an individual entrepreneur accept payment to an individual’s account?

There is no legal prohibition on this, but claims may arise from the bank, because the agreement usually states that the account should not be used for business. Also, due to payments to an individual’s account, the tax office may have questions for your counterparties.

To avoid problems with the tax office and counterparties, it is better to accept transfers to the current account of an individual entrepreneur.

In the service, you can issue invoices in a matter of seconds; your details and the details of your counterparties will be entered automatically. Moreover, you can send the client an invoice with a payment button - this will speed up the settlement process. The service also provides the possibility of mass invoicing.

If your bank is integrated with the service, you can track bill payments online.

How can an entrepreneur accept payments from individuals?

Individuals can pay you for goods and services:

1. Cash. But for this you may need an online cash register. Who exactly should use an online cash register, who can do without it for now, and who is exempt from this obligation on an ongoing basis - read below.

Restrictions on the amount of cash payments with individuals No.

2. By bank card(acquiring or Internet acquiring).

In order for customers to pay for goods or services with a card, they need to enter into an agreement with the acquiring bank and purchase a terminal.

The bank will charge a commission for each payment. Each bank has its own commission percentage.

Acquiring does not affect the obligation to use an online cash register in any way. The slip issued by the terminal does not replace a cash receipt. Those who are obliged to apply cash register, it is also used in acquiring.

To accept payments to your account by card through the website, you need to submit an application to the bank and conclude an agreement. The site must comply technical requirements bank, so it is possible that improvements will need to be made to the site.

3. Bank transaction. The client transfers money according to a receipt or payment order to the individual entrepreneur’s account at a bank branch.

There is no need to use online cash registers for this type of payment yet, but this relief is temporary. As of July 1, 2019, entrepreneurs will be required to use a cash register if an individual transfers payment to their account based on a receipt or payment order from a bank (unless the entrepreneur is exempt from using online cash registers). Confirmation of the deferment is in Part 4 of Article 4 of Federal Law No. 192-FZ of July 3, 2018.

4. By postal order, including cash on delivery. In this case, the cash receipt should be issued by the post office, not the seller, because It is she who accepts the money and then transfers it to the entrepreneur’s account.

5. Electronic money. There are two options here: connect directly to payment systems and use the services of a payment aggregator. In the first case, you need to enter into an agreement separately with each payment system and make settings on the website. In the second case, the agreement is concluded only with a payment aggregator, which makes it possible to accept payments in any way convenient for the client. In this case, the commission is higher, but there is less hassle.

Cash machine when accepting payment by electronic money is required.

The “My Business” service provides the ability to integrate with payment aggregators so that payments received into the account are automatically displayed in the system.

Who should use online cash registers when accepting payments?

All entrepreneurs for whom the law does not provide for a deferment or complete exemption from the use of online cash register systems.

Entrepreneurs who are engaged in the types of activities listed in Article 2 of Law No. 54-FZ of May 22, 2003 are completely exempt from the obligation to use the cash register. Among them:

Sale of newspapers and magazines;

Trade at markets and fairs (subject to restrictions);

Retail trade outside a stationary retail network;

Trade in kvass, milk, oil from tank trucks;

Seasonal sale of vegetables in bulk, etc.

Leasing (hiring) of residential premises owned by this individual entrepreneur by an individual entrepreneur

But not all entrepreneurs on PSN are lucky. For those who are engaged in the types of activities specified in subparagraphs 3, 6, 9 - 11, 18, 28, 32, 33, 37, 38, 40, 45 - 48, 53, 56, 63, paragraph 2 of Article 346.43 of the Tax Code of the Russian Federation, exemption is not granted works.

The full exemption also applies to entrepreneurs from remote areas, if this area is named in a special list of the authority state power subject of the Russian Federation.

And now about those entrepreneurs who are temporarily exempt from using cash registers, until July 1, 2019:

1. Individual entrepreneur on UTII, except for those who are engaged in retail trade and catering services, and at the same time have employees- for them the deferment ended on July 1, 2018.

2. Individual entrepreneurs on PSN, engaged in those types of activities that are not fully exempt. The exception is retail trade and catering services. For these types of activities, the deferment applies only if the individual entrepreneur does not have hired employees. If so, then as of July 1, 2018, such entrepreneurs are on the list of those obliged to use CCP.

3. Individual entrepreneurs in any tax system with or without employees, who provide services to the population and issue BSO to clients (clause 8 of Article 7 of the Federal Law of July 3, 2016 N 290-FZ).

But if we're talking about about the provision of services Catering, then in this case, only entrepreneurs without employees can do without online cash register until July 1, 2019.

If an entrepreneur does not fall under any of these points, he is obliged to use a cash register when accepting cash or electronic money.

Accept payment correctly and

It is not always convenient to pay by bank transfer, especially if you self employed or the founder of a small LLC. Cash payment is a delicate matter. Let us recall that in the middle of last year the legislator established a number of new restrictions on such calculations. Let's figure out what's what and how to act so as not to inadvertently break the law.

Normative base

Order cash payments in Russia it is regulated by the Central Bank. In 2013, this organization published the Directive “On Cash Payments,” which came into force on July 1, 2014. This act consists of seven points.

It should be immediately noted that the provisions of the Directive apply only to legal entities and individual entrepreneurs. For any cash monetary transactions they do not apply to ordinary citizens. In addition, these rules do not apply in three more cases:

- for any settlements with the participation of the Central Bank;

- when conducting banking operations;

- when making customs payments.

The Central Bank's instruction contains two categories of restrictions when paying in cash for individual entrepreneurs and LLCs: by purpose and by amount.

Goal restrictions

Organizations and individual entrepreneurs can spend money from the cash register only for the following purposes:

- payment of wages and social contributions (provided for in the Labor Code);

- issuing money to employees on account (for example, for one-time payment for workers’ services);

- payment of insurance compensation to citizens who have entered into an appropriate agreement and paid insurance premiums in cash;

- expenses for any personal needs of the entrepreneur not directly related to his commercial activities;

- payment for goods, services, work carried out by contractors (except for the purchase valuable papers, which cannot be paid in cash “from the cash register”);

- moneyback – return of funds for goods of inadequate quality, work not performed and services not provided (or provided with poor quality);

- issuance of money during transactions by a bank paying agent (in accordance with Federal law“On the national payment system”).

Please note: restrictions do not apply to credit (including microfinance) organizations. They have the right to spend cash from the cash register for any purpose.

In the Directive the legislator introduced another important rule. Now individual entrepreneur and legal entity. Persons for some “cash” payments can use only the money that was deposited into the cash register after withdrawal from the bank account. Such calculations include:

- payments for the issuance or repayment of loans (or interest on loans);

- on intra-organizational activities;

- for conducting gambling.

What does this mean in practice? Let's say you needed to issue a loan to one of your employees. You can’t just take money out of the cash register and give it to the employee – you’ll have to take a roundabout route. The cash proceeds will need to be deposited at the bank, and then the loan amount will be received in cash (by check) from the same bank. Only after this the amount received can be given to the employee. Naturally, some percentage will “go” to the bank as a commission. Long, inconvenient and unprofitable - that is, quite in the style of the Central Bank.

Limit amount of settlements

The maximum cash payment amount has not changed. Now, as before 2014, it is limited to 100 thousand rubles under one contract. However, the new Directive of the Central Bank contains an important clarification: this limit on the amount is now relevant not only during the validity period of the agreement, but also after the expiration of this agreement.

Let’s imagine that the contract clearly defines its validity period. This period has successfully expired, but the buyer still has outstanding accounts payable. If previously it was possible to pay it in full immediately (regardless of the amount), now this can only be done if the amount does not exceed 100 thousand rubles. Otherwise, you will have to “split” payments under several contracts.

It is necessary to mention a few more important particular points.

There is one more nuance that is worth highlighting separately. The amount limit applies only to contracts where both parties are legal entities or individual entrepreneurs. If one party is an entrepreneur or LLC, and the other is an ordinary citizen (individual), then the restriction will not apply.

Let's return to the lease agreement example. If you rented premises for your office from an organization, you can pay in cash only if the total rental amount does not exceed 100 thousand rubles. If the lessor is an individual, then the amount can be any. The law allows you to pay him in cash at least a hundred, at least two hundred thousand. By the way, calculation is possible not only in Russian, but also in foreign currency.

"Cash" and individual entrepreneur

Most often, it is entrepreneurs who have to pay in cash. We found out what restrictions there are when paying in cash for individual entrepreneurs and LLCs, and now let’s summarize the results and create a complete picture.

- Entrepreneurs can make cash payments with citizens, legal entities, and other individual entrepreneurs. At the same time, in settlements with companies and individual entrepreneurs, entrepreneurs should not exceed the mark of 100 thousand rubles per agreement.

- If you are an individual entrepreneur, then the law gives you the right to pay customs duties without restrictions, issue wages or money to your employees on account. Cash payments from the public, of course, can also be accepted without taking into account any limits.

- Since an individual entrepreneur is an individual. person, all his proceeds (including cash) automatically become personal funds. The individual entrepreneur can dispose of these funds at his own discretion. The purpose of their use does not necessarily have to be related to commercial activities and business needs.

There is no need to hand over the proceeds to the bank in advance. By the way, if an individual entrepreneur makes payments within 100 thousand per contract, you don’t have to open a bank account at all.

Penalty for non-compliance with restrictions

Exceeding the maximum of 100 thousand rubles in cash under one contract is punishable administratively. For violation of cash handling procedures in cash a fine is provided in accordance with the Code of Administrative Offences. This fine is imposed both on the entire company as a whole and on a specific executive(responsible employee) in particular.

- the amount of the fine imposed on the organization is 40–50 thousand rubles;

- An amount of 4–5 thousand rubles is collected from the responsible employee.

In this case, the individual entrepreneur is classified as a responsible employee.

An organization can be held accountable only within two months from the date of violation. By the way, in some cases, not only the company (or individual entrepreneur) making the illegal cash payment bears responsibility, but also the legal entity. the person who accepts the money. The law does not clearly regulate the procedure for distributing responsibility, so the decision depends solely on the court.

What's the result?

So, when paying in cash, an entrepreneur or head of a company must:

- ensure that the total amount under the contract (and additional agreements, if any) does not exceed 100 thousand rubles;

- remember that when making payments to individuals, restrictions on the amount do not apply;

- know in which specific cases cash payments are generally allowed.

Also take into account those not entirely obvious nuances that are given in the lists above. Agree, it will be a shame to receive a fine for a trivial violation when making cash payments.