Meeting of shareholders, rules and procedure. Who and how draws up the minutes of the annual general meeting of shareholders Materials of the annual meeting of shareholders in the year

The Central Bank of the Russian Federation in corporate relations is a unique “source of law”. On the one side, most of

its documents are advisory in nature, on the other hand, the consequences of violating such “recommendations” can be more than serious. Such a polite and caring dad, at the same time ready at any moment to scold the naughty child not only with a belt, but also with something heavier. Therefore, we invite you to carefully look at what representatives of the Central Bank of the Russian Federation recommend that we do by the next general meeting

shareholders (hereinafter referred to as the GSM), and together think about how best to prepare documents confirming that you follow these recommendations. Letter from the Central Bank of the Russian Federation regulates cases of holding general meetings of shareholders in the form of joint participation.

Let us remind you that this is only one of the possible forms of conducting the General Meeting of General Meetings provided for by the Law on JSC. It represents the joint presence of shareholders to discuss issues on the agenda, incl. the opportunity to speak and make decisions on them (Article 47, paragraph 11 of Article 49 of the Law on JSC).

1. The letter specifies certain requirements of the Corporate Governance Code (another “recommendatory” act of the Central Bank of the Russian Federation) in terms of creating the most favorable conditions for shareholders to participate in the general meeting, as well as providing them with the opportunity to express their opinion on the issues under consideration. In particular, the Central Bank of the Russian Federation specifically stipulates that the procedure for conducting a general meeting of shareholders (regulations) must provide for equal rights for participants in terms of the opportunity to speak at the meeting or ask questions to the speakers. For this purpose, in preparation for the general meeting

recommended: Analyze the turnout of shareholders at general meetings of shareholders over the previous 3 years. This is done with the aim of selecting a suitable premises for holding the General Meeting, taking into account the expected maximum turnout of shareholders.

3. Analyze the activity of shareholders at the General Meeting over the previous 3 years and determine the duration of the General Meeting, incl. based on the expected maximum quantity shareholders who may wish to participate in speeches and discussions on issues on the meeting agenda.

4. If the General Meeting provides for the possibility participation of shareholders in discussing agenda items via video conferencing - notify about this shareholders in preparation for the General Meeting.

Which joint stock companies are required to invite the registrar to the general meeting of shareholders? How to implement this? What will the registrar do at the meeting? What composition of signatories in this case should be indicated in the documents: minutes and the report of the counting commission, in the minutes of the meeting itself? It turns out that the requirements of the Federal Antimonopoly Service in this matter sometimes go further than the requirements of the law and clarifications of the Bank of Russia. Details are in the article “Participation of the registrar in the general meeting of shareholders” in magazine No. 11′ 2017

Of course, the approach to holding a general meeting of shareholders must be individual.

Enough a large number of corporations created through privatization have hundreds, thousands, or even tens of thousands of small shareholders on their register with one or two shares who have never taken part in their activities. Many of these shareholders have either forgotten about their shares or are ignoring their rights. Some have already left this mortal coil, but their heirs, for various reasons, are in no hurry to formalize the transfer of shares in the shareholder register.

Moreover, decisions in such corporations are made by 2–3 majority shareholders. Why does such a company need a large hall if 4-5 people come to the general meeting of shareholders?

On the other hand, there are modern joint-stock companies, many of whose shareholders strive to keep abreast of what is happening in the company, and large public joint-stock companies, whose general meetings are staged as a show with a free buffet and distribution of memorable gifts. Such companies require large premises to gather everyone who wants to listen to management reports and vote in person. All this is understandable, and the recommendations of the Central Bank of the Russian Federation certainly reflect current practice. At the same time,

However, before we think about how to follow the recommendations of the Central Bank of the Russian Federation, let’s think about whether this is necessary at all? If you want to minimize risks, definitely yes. Of course, if the meeting is held as usual, there will be no need for any confirmation that all the recommendations of the Central Bank of the Russian Federation were taken into account when convening it.

But what if an emergency happens this time? For example, will 2 times more shareholders come than usual? Or will a corporate blackmail attack begin against the organization and complaints will be sent to the Central Bank of the Russian Federation? You will definitely have to confirm with documents that even at the stage of convening the meeting you tried to take into account possible options for the development of events. An analysis of the turnout and activity of shareholders must be carried out at the very first stages of preparation for the GMS. This should be done by the body preparing for the OSA. According to sub. 2 p. 1 art. 65 of the Law on JSC this issue falls within the competence of board of directors

- (supervisory board).

- In companies with the number of shareholders - owners of voting shares - less than 50, this may be another body determined by the charter (Clause 1, Article 64 of the Law on JSC). Therefore, it is natural to conclude that the results of the analysis should be reflected in the documents of this body - for example, in the minutes or minutes of a meeting of the board of directors. These issues can be considered both during the final meeting dedicated to the preparation of the General Assembly, and during one of the intermediate meetings. Arguments in favor of holding a separate meeting and accordingly recording its results in a separate protocol:

- firstly, such recommendations must be taken into account when searching for premises, and this process is not very fast, and accordingly, they must be proposed to the executive body as early as possible;

secondly, even if the location of the meeting is known in advance (the building of the JSC itself, for example) and the recommendations are obviously of a formal nature, during the meeting dedicated directly to the appointment of the General Assembly, a large number of issues are resolved. There is no need to burden it with additional discussion of formal recommendations;

Let us remind you that the law requires holding a general meeting of shareholders at least once a year. A mandatory meeting is called annual, and any other meeting – extraordinary. The annual meeting of shareholders is held within the time limits established by the company's charter. However, paragraph 1 of Art. 47 of the JSC Law defines the boundaries of this period: no earlier than 2 months and no later than 6 months after the end of the financial year.

The JSC must approve the annual financial statements by the general meeting of shareholders, if the company's charter does not fall within the competence of the board of directors/supervisory board (subclause 11, clause 1, article 48 of the JSC Law). However, in accordance with Part 2 of Art. 18 of the Accounting Law, reporting must be submitted no later than 3 months from the end of the reporting period (calendar year). And it would be logical to submit to the tax authority financial statements that have passed all corporate approval procedures. Then The period for holding the annual general meeting of shareholders is narrowed to 1 month - March!

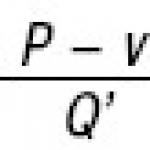

Scheme 1

Collapse Show

And the board of directors must resolve issues regarding the organization of the annual general meeting of shareholders much earlier, so that no later than 20 days before the meeting they have time to send out notifications to its participants about the place, time and other aspects of its holding (Clause 1, Article 52 of the Law on JSC).

Example 1 shows the minutes of the meeting of the board of directors, which reflects the implementation of the recommendations of the letter of the Central Bank of the Russian Federation dated December 19, 2017 No. IN-06-28/60. It is a short version of logging:

- only who was heard about what (without recording the progress of the discussion) and

- decisions made with voting results (without demonstrating who voted how, and any special opinions).

If there is no conflict of opinions of the participants, then there is no point in reflecting the position of individual members of the collegial body in the minutes. In any case, the level of detail in reflecting the progress of the discussion and decisions taken at the meeting it is determined by its chairman, and the secretary only executes it.

In the standard format of a protocol, it is customary to first provide a numbered list of issues on the agenda, and then put the corresponding number and for each issue indicate at a minimum: who was heard about what, what was decided and how they voted for it.

But in our situation, there will be only 1 question on the agenda “On determining the place and duration of the annual general meeting of shareholders” (marked with number 1 in Example 1), and we will place the analysis that the Central Bank requires from us in the “LISTENED” section (see . number 2 in the same place).

INFORMATION MAIL

ON PREPARATION AND CONDUCT OF THE GENERAL MEETING OF SHAREHOLDERS

JOINT STOCK COMPANY

In connection with the receipt of requests regarding the procedure for preparing and holding general meetings of shareholders, the Bank of Russia reports the following. Preparation, convening and holding of the general meeting of shareholders are carried out in accordance with the Federal Law of December 26, 1995 N 208-FZ “On Joint-Stock Companies” (hereinafter referred to as the Law), the Regulations on additional requirements

to the procedure for preparing, convening and holding a general meeting of shareholders, approved by order of the Federal Financial Markets Service of Russia dated 02.02.2012 N 12-6/pz-n, the charter of the company, internal documents of the company regulating the activities of the general meeting of shareholders.

One of the forms of holding a general meeting of shareholders provided for by the Law is the joint presence of shareholders to discuss issues on the agenda and make decisions on issues put to vote (general meeting held in the form of a meeting), which also includes the possibility of speaking at the meeting of persons taking part in it. It should be noted that the Code corporate governance

Taking into account the above, the procedure adopted in a joint-stock company for conducting a general meeting of shareholders (regulations) must provide for persons taking part in the meeting equal rights in terms of the opportunity to speak at the meeting and discuss issues on the agenda of the meeting.

In order to ensure that shareholders exercise their rights to participate, speak and vote at a general meeting of shareholders in the form of joint presence during the preparation and holding of such a meeting, the Bank of Russia recommends that joint stock companies:

1. Analyze the turnout of shareholders at general meetings of shareholders over the previous 3 years and select the premises for holding a general meeting of shareholders, taking into account the expected maximum turnout of shareholders entitled to participate in the general meeting of shareholders.

2. When preparing for a general meeting of shareholders, determine the place where it will be held and the procedure for its organization in such a way as to prevent the possibility of restricting or impeding the access (passage) of shareholders to the place of registration for the meeting and directly to the premises intended for its holding.

Article 52. Information on holding a general meeting of shareholders

- checked today

- law of 01/01/2020

- entered into force on 01/01/1996

There are no new articles that have not entered into force.

Compare with the edition of the article dated 01/01/2017 07/01/2016 07/01/2015 01/01/2014 09/01/2013 06/09/2009 02/19/2007 01/01/2002 01/01/1996

A notification about holding a general meeting of shareholders must be made no later than 21 days, and a notification about holding a general meeting of shareholders, the agenda of which contains the issue of reorganization of the company, no later than 30 days before the date of its holding.

In the cases provided for in paragraphs 2 and 8 of Article 53 of this Federal Law, notification of a general meeting of shareholders must be made no later than 50 days before the date of its holding.

Within the time limits specified in paragraph 1 of this article, the notice of holding a general meeting of shareholders is brought to the attention of persons entitled to participate in the general meeting of shareholders and registered in the register of shareholders of the company by sending registered letters or by delivery against signature, if other methods of sending (publishing) such a message are not provided for by the company’s charter.

The company's charter may provide for one or more of the following ways of bringing a notice of a general meeting of shareholders to the attention of persons entitled to participate in the general meeting of shareholders and registered in the register of shareholders of the company:

- 1) sending an email to the address Email the corresponding person indicated in the register of shareholders of the company;

- 2) sending a text message containing the procedure for familiarizing yourself with the message about holding a general meeting of shareholders to the contact telephone number or email address indicated in the register of shareholders of the company;

- 3) publication in a printed publication specified by the company’s charter and posting on the company’s website on the Internet information and telecommunications network specified by the company’s charter, or posting on the company’s website on the Internet information and telecommunications network specified by the company’s charter.

The company must keep information about the sending of messages provided for in this article for five years from the date of the general meeting of shareholders.

The notice of holding a general meeting of shareholders must indicate:

Information (materials) to be provided to persons entitled to participate in the general meeting of shareholders in preparation for the general meeting of shareholders of the company includes the company’s annual report, annual accounting (financial) statements, an auditor’s report on it, the conclusion of an internal audit carried out in public company in accordance with Article 87.1 of this Federal Law, information about the candidate (candidates) for the executive bodies of the company, the board of directors (supervisory board) of the company, the counting commission of the company, draft amendments and additions to the charter of the company, or the draft charter of the company in new edition, draft internal documents of the company subject to approval by the general meeting of shareholders, draft decisions of the general meeting of shareholders, information provided for in Article 32.1 of this Federal Law on shareholder agreements concluded within a year before the date of the general meeting of shareholders, conclusions of the board of directors (supervisory board) of the company on a large transaction, a report on transactions concluded by a public company in the reporting year in which there is an interest, as well as information (materials) provided for by the company’s charter. If, in accordance with the company's charter, the presence audit commission is mandatory, the specified information (materials) also includes information about candidates for the audit commission of the company, and in the cases provided for in paragraph one of paragraph 3 of Article 88 of this Federal Law - the conclusion of the audit commission of the company based on the results of the audit of the annual report, annual accounting (financial) company reporting.

Scroll additional information(materials) required to be provided to persons entitled to participate in the general meeting of shareholders in preparation for the general meeting of shareholders may be established by the Bank of Russia.

The information (materials) provided for by this article, within 20 days, and in the case of a general meeting of shareholders, the agenda of which contains the issue of reorganization of the company, within 30 days before the general meeting of shareholders must be available to persons entitled to participate in general meeting of shareholders, for review on the premises executive body company and other places, the addresses of which are indicated in the notice of the general meeting of shareholders, and if this is provided for by the charter of the company or internal document of the company, regulating the procedure for preparing and holding the general meeting of shareholders, also on the company’s website on the Internet information and telecommunications network. Specified information(materials) must be available to persons participating in the general meeting of shareholders during the meeting.

The company is obliged, at the request of a person entitled to participate in the general meeting of shareholders, to provide him with copies of these documents. The fee charged by the company for providing these copies cannot exceed the costs of their production.

If the person registered in the register of shareholders of the company is a nominal holder of shares, the notice of the general meeting of shareholders and information (materials) to be provided to persons entitled to participate in the general meeting of shareholders in preparation for the general meeting of shareholders of the company are provided in in accordance with the rules of law Russian Federation on securities to provide information and materials to persons exercising rights under securities.

New rules for preparing, convening and holding a general meeting of shareholders. New ways of informing about the meeting. New ways to vote at a meeting. Planned changes in regulation.

16.00 - 16.15 Coffee break 11.45 - 13.15 ROUND TABLE: CURRENT ISSUES AND NON-STANDARD SITUATIONS AT THE SHAREHOLDERS MEETINGCurrent and controversial issues arising when applying new standards, including:

- voting and counting of votes on the issue of consent to an interested party transaction;

- the procedure for considering, voting and counting votes on the issue of consent to a major transaction, which is also an interested party transaction;

- options for holding an in-person general meeting using information and communication technologies, allowing for the possibility of remote participation without being present at the meeting location;

- procedure for voting and counting votes in case of disproportionate voting on the basis of a shareholder agreement, etc.

Annual report; report on transactions in which there is an interest; annual financial statements; auditor's report; audit commission report. Content and disclosure requirements.

15.45 - 16.00 Coffee break 16.00 - 17.30 VIOLATIONS DURING THE CONVENING AND HOLDING OF THE GENERAL MEETING OF SHAREHOLDERSViolations committed during the preparation and holding of the general meeting of shareholders. New rules for challenging decisions of the general meeting of shareholders. Judicial practice in cases of invalidation of decisions. Administrative responsibility for violations committed during the preparation and holding of general meetings of shareholders: identification procedure, practice of attraction.

17.30 - 18.00 Answers on questionsWhen should I start preparing for the annual shareholders meeting? Which preparatory stages do you need to go through before it takes place? What legislative changes need to be taken into account this year? The answers to these questions are in the material “EZh”.

In connection with the approaching AGM 2017 season, many joint stock companies traditionally have questions related to the preparation, convening and holding of the annual general meeting of shareholders. In addition, 2016 was rich in changes to legislation that affected the procedure for convening and holding general meetings of shareholders:

firstly, on July 1, 2016, a number of provisions of Federal Law dated June 29, 2015 No. 210-FZ related to the reform of corporate actions came into force. This law significantly changed; in particular, the procedure for preparing a list of persons entitled to participate in the meeting introduced additional features on informing shareholders about the holding of the General Meeting, new ways of participation of shareholders in the General Meeting have been added, etc.;

secondly, on January 1, 2017, Federal Law No. 343-FZ dated July 3, 2016 came into force, which introduced changes to the regulation of issues related to major transactions and interested party transactions, in connection with which issuers there was an obligation to prepare additional materials to the shareholders meeting.

So, let’s consider step by step the procedure for convening the annual general meeting of shareholders in 2017.

Step 1. Shareholders submitting agenda items for the AGM and nominating candidates to management bodies and other bodies of the company

Everything here is traditional: these proposals must come from shareholders - owners of at least 2% of voting shares no later than 30 days after the end of the reporting year (Part 1, Article 53 of the Federal Law of December 26, 1995 No. 208-FZ “On Joint-Stock Companies” , hereinafter referred to as the Law on JSC). The company's charter may provide for a later date.

At the same time, shareholders who are clients of nominee holders now have additional “procedural” options.

Firstly, these shareholders can send proposals and a list of candidates in the traditional ways provided for by the Regulations on additional requirements for the procedure for preparing, convening and holding a general meeting of shareholders (approved by order of the Federal Financial Markets Service of Russia dated 02.02.2012 No. 12-6/pz-n), that is:

by sending postal service or through courier service at the address of the company;

delivery against signature to a competent person of the company;

referrals in another way, if provided for by the charter or other internal document of the company.

Such a proposal must be accompanied by a statement of the securities account of the shareholder - client of the nominee holder (clause 2.7).

Secondly, these shareholders can send proposals to the agenda of the meeting by giving instructions (instructions) to the nominee holder, whose clients they are.

Obviously, the second method is more economical. The nominee holder who has received the instructions sends the shareholder's proposal through the chain of nominee holders to the company's registrar in the form of an electronic message. Finally, the registrar delivers the message to the issuer.

A proposal for the agenda of the AGM sent in this way is considered received by the company on the day it is received by the registrar of the company. The Law (Clause 6, Article 8.7-1 of the Federal Law of April 22, 1996 No. 39-FZ “On the Securities Market”, hereinafter referred to as Law No. 39-FZ) obliges the nominee holder to provide the registrar with the specified proposals no later than the date established by federal laws, before which they must be received, that is, no later than 30 days after the end of the reporting year, unless the charter of the company provides for a later date.

Step 2. Consideration by the board of directors of the company (or sole executive body in the absence of a board of directors) of proposals received for the agenda of the AGM

The board of directors of the company must consider the proposals received within five days after the expiration of the period specified in the law (or in the charter), make a decision on them and, within three days from the date of the decision, send it to shareholders (Parts 5, 6 of Article 53 of the Law about JSC).

The decision of the board of directors to include issues and a list of candidates on the agenda or to refuse inclusion to shareholders who are clients of the nominee holder is also sent by the company using the “cascade” method, that is, through the registrar to the nominee holder, whose client is the shareholder.

It is necessary to note that one of the most common grounds for deciding to refuse to include issues on the AGM agenda is the failure of shareholders to comply with the deadlines provided for making these proposals. In particular, in judicial practice One may come across the opinion that if the last day of the period established for nominating candidates/introducing issues to the agenda is a non-working day, then the rules of Art. 193 of the Civil Code of the Russian Federation on transferring it to a working day do not apply (see, for example, the resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated October 10, 2007 in case No. A82-1491/2007-4).

In addition to the issues proposed for inclusion on the agenda of the general meeting of shareholders by the shareholders themselves, as well as in the absence of such proposals, the absence or insufficient number of candidates proposed by shareholders for the formation of the relevant body, the board of directors of the company has the right to include issues on the agenda of the general meeting of shareholders and propose list of candidates at its discretion (Part 7, Article 53 of the Law on JSC).

Step 3. Consideration by the board of directors of issues related to the preparation of the AGM

In connection with the entry into force of the provisions of Federal Law No. 210-FZ dated June 29, 2015, the list of issues that the board of directors considers when convening the AGM has changed.

Some of these questions remained unchanged:

form of holding the AGM (meeting);

date, place, time of the AGM;

start time of registration of persons participating in the AGM;

postal address to which completed ballots can be sent (if voting is carried out by ballots);

AGM agenda;

the procedure for notifying shareholders about the AGM;

list of information (materials) provided to shareholders in preparation for the AGM, and the procedure for its provision;

New issues for consideration by the board of directors in preparation for the AGM in 2017 will be the following:

the email address to which completed ballots can be sent, and (or) the address of the website on the Internet on which the electronic form of ballots can be filled out, if such a possibility is provided for by the company’s charter;

date of determination (recording) of persons entitled to participate in the AGM;

wording of decisions on issues on the agenda of the AGM, which should be sent to electronic form(in the shape of electronic documents) nominal holders of shares registered in the register of shareholders of the company;

type(s) of preferred shares, the owners of which have the right to vote on issues on the agenda of the AGM;

if the agenda of the AGM includes the issue of obtaining consent to carry out or subsequent approval of a major transaction, the board of directors also approves the conclusion on the major transaction;

if the JSC is public, the board of directors must also approve a report on interested party transactions concluded by the company in the reporting year.

In parallel with the “technical” issues of preparing the AGM, the board of directors also considers such issues as:

the issue of preliminary approval of the company’s annual report (approved at least 30 days before the AGM);

the question of recommendations for the distribution of profits and losses of the company based on the results of the financial year, and if the board of directors recommends the payment of dividends - also recommendations on the amount of dividends on the company's shares, the procedure for its payment and a proposal on the date on which persons entitled to receive dividends will be determined .

Consideration of these issues is also possible at a separate meeting of the board of directors.

We will separately dwell on the issue of determining the date of recording of persons entitled to participate in the AGM.

Firstly, the approach to determining the specified date has changed. This date cannot be set earlier than ten days from the date of the decision to hold the AGM and more than 25 days before the date of its holding, and if the agenda of the AGM includes the issue of reorganization of the company - more than 35 days before the date of its holding (Part 1 of Article 51 of the Law on JSC).

Secondly, the procedure for compiling the list of persons entitled to participate in the AGM has changed (Article 8.7-1 of Law No. 39-FZ).

The specified list is compiled by the registrar in accordance with the data of its registration of rights to securities and data received from nominee holders for whom nominal holder personal accounts have been opened in the register of shareholders. In this case, the list may include not only information identifying the shareholder - the nominee holder's client, but also information about how this shareholder votes on the issues on the agenda of the AGM.

The specified information is provided to the registrar by nominee holders no later than the date by which ballots must be received.

Step 4. The company concludes an agreement with the registrar for the services of the counting commission and sends a request to compile a list of persons entitled to participate in the meeting on the specified date

In public joint-stock companies in accordance with clause 3 of Art. 67.1 of the Civil Code of the Russian Federation, certification of decisions of general meetings of shareholders can be carried out only by the registrar, and in non-public ones - both by the registrar performing the functions of the counting commission and by a notary.

Step 5. Sending a message about the AGM and related information

Notification of the AGM to persons entitled to participate in the meeting, according to general rule delivered within the following time frames:

no later than 20 days before the date of the AGM;

if the agenda of the AGM contains the issue of reorganization - no later than 30 days before the date of the AGM.

In accordance with sub. 5 paragraph 3 art. 66.3 of the Civil Code of the Russian Federation, the charter of a non-public joint-stock company may establish other deadlines for notifying shareholders about holding an AGM.

Within the specified time frame, the notice of the AGM is sent to the following shareholders:

registered in the register by sending registered letters or delivery against signature, unless other methods are provided for by the charter of the company;

not registered in the register - by the “cascade” method, that is, the company sends a message in electronic form to the registrar of the company, the registrar - to the nominal holder, and the nominal holder, in turn, to its client.

The company's charter may provide for one or more of the following methods of notifying shareholders registered in the register and entitled to participate in the general meeting of shareholders, namely:

1) sending an electronic message to the email address of the relevant person indicated in the register of shareholders of the company;

2) sending a text message containing the procedure for familiarizing yourself with the message about holding a general meeting of shareholders to the contact telephone number or email address indicated in the register of shareholders of the company;

3) publication in a printed publication specified by the company’s charter and posting on the company’s Internet website specified by the company’s charter or posting on the company’s Internet website specified by the company’s charter.

Note that the first and second methods are new ways of notifying persons entitled to participate in the general meeting of shareholders in preparation for the AGM in 2017.

In addition, new information was also added to the content of the message about the AGM, namely:

the email address to which completed ballots can be sent, and (or) the address of a website on the Internet on which the electronic form of ballots can be filled out (if such methods of sending and (or) filling out ballots are provided for by the company’s charter);

the date on which persons entitled to participate in the AGM are determined (recorded);

It should be noted that the completeness of the materials that the company is obliged to provide for the AGM has also changed.

To the standard list of materials, including the annual report, annual (financial) accounting statements and other materials, the legislator added:

conclusion of the board of directors of the company on a major transaction (if the agenda of the AGM contains the issue of consent to a major transaction);

a report on transactions concluded by a public company in the reporting year in which there is an interest.

Information should be available in the premises of the executive body of the company and other places whose addresses are indicated in the notice of the general meeting of shareholders, and if this is provided for by the charter or internal document of the company regulating the procedure for preparing and holding the general meeting of shareholders, also on the company’s website on the Internet.

If there is a nominee holder in the register of shareholders, then the information is also sent through the company registrar to the nominee holder.

Step 6. Sending voting ballots to the AGM

Provisions of Art. 60 of the Law on JSC, which provide for cases of voting by ballots and preliminary sending of ballots for voting, have also changed significantly.

If previously the law required voting by ballot at the AGM of a company with more than 100 shareholders, and the preliminary sending of ballots (except for cases provided for in the charter) - joint stock companies with the number of shareholders - owners of voting shares - 1000 or more, then now voting by ballots and preliminary sending of ballots to the AGM should be carried out in the following cases:

public companies (regardless of the number of shareholders);

non-public company with the number of shareholders - holders of voting shares - 50 or more;

a non-public company whose charter provides for the mandatory sending or delivery of ballots.

A significant innovation is also that the preliminary distribution of ballots is provided only for shareholders who are registered in the register. Ballots are sent to such shareholders no later than 20 days before the general meeting of shareholders in the following ways:

by registered mail;

in other ways provided for in the company's charter.

It should be noted that as another method of sending a ballot, the law also names sending an electronic message to the email address of the relevant person indicated in the register of shareholders of the company.

The law does not provide for the sending of ballots by the above methods to shareholders who are clients of the nominee holder. As noted above, the company must send to nominee holders the wording of decisions on agenda items in electronic form.

Corresponding to this obligation is the provision that voting by ballots is equivalent to the receipt by the company registrar from the nominal holder of messages about the expression of will of persons who are clients of the nominal holder. These expressions of will must be received at least two days before the AGM.

If shareholders who are clients of the nominal holder still want to vote in the traditional way, that is, with a voting ballot, these persons or their representatives will have to register for the AGM and receive a ballot or apply to the company in advance for a ballot.

It should be noted that this is not the only innovation that concerns the method of shareholder participation in the general meeting. Companies should keep in mind that in addition to the previous methods of shareholder participation in the AGM (register in person and send ballots to the company two days before the AGM), the following will also be considered to have taken part in the AGM:

shareholders who registered on the Internet site specified in the notice of the AGM;

if such a possibility is provided for by the charter, shareholders whose electronic ballots are filled out on the Internet site specified in the notice of the AGM no later than two days before the date of the general meeting of shareholders;

if such a possibility is provided for by the charter, shareholders whose ballots were received in electronic form to the email address specified in the notice of the AGM.

Thus, we reviewed the activities that the society should take to convene the AGM in 2017, while noting the main changes in legislation.

As a summary, we can conclude that the procedure for preparing and holding the AGM has become more technologically advanced, primarily due to the introduction of new methods of notifying shareholders, sending ballots in advance, and the ability to participate in the general meeting of shareholders online. However, it should be noted that some innovative changes require changes to the charters, which deprives societies of the opportunity to use them in the current AGM season.