Journal-order. Filling out order journals. Account order journals. Journal order forms of accounting Who issues the journal order 1

Each enterprise has the opportunity to independently choose the system and form of tax and accounting accounting. The prevailing principles for the formation of accounting data are: reliability, transparency, accessibility, the ability to obtain a report on any asset or type of settlement, the exclusion of data leakage and distortion.

Applicable forms and accounting systems

The set of documents, registers, accounting reports, the sequence and order of their completion, and appearance are decisive for the form of accounting. It is customary to distinguish several types of them:

- Memorial-warrant accounting system.

- Journal-order accounting system.

- Simplified system.

The most widely used accounting system at an enterprise is considered to be the journal-order form. In modern conditions of process automation, many software options have been created that are focused on obtaining maximum results. When using accounting programs, there are no clear boundaries between forms and accounting systems, since generating a report of any type takes a minimum amount of time and effort.

General characteristics of the journal-order accounting system

This system is based on the principle of systematization and accumulation of data reflected in primary documents. Recording of information in registers occurs simultaneously, taking into account the chronological sequence. The main documents of the system are: journal order, accumulative (auxiliary) statement, general ledger and balance sheet. For more detailed disclosure of information on analytical accounting, a card and accounts can be used. Their data is transferred to the appropriate journal-order and statement. To account for fixed production and non-production assets, intangible assets, inventory cards for each object are maintained, and production costs are recorded using costing sheets. Various types of calculation tables and transcripts are maintained as necessary separately for each type of asset and calculation.

Procedure for filling out registers

Filling out order journals occurs according to the credit characteristics of the operation, i.e., the data reflected in the primary documents is summarized by the credit of a specific account and recorded in the appropriate register. At the same time, the register corresponding to debit is reflected in it, which allows you to apply the method in one document. Each order journal is a statement built on a chessboard principle, formed on the basis of the credit of one or several similar (close in content) accounts.

The sum value is placed at the intersection of the row and column of the register. For example, you can take journal order 2, designed to reflect information on the credit of account No. 51 “Current Account”, to the debit of accounts 50, 55, 52, 57, 58, 18, 60, 62, 68, 66, 76, 71, 70, 73, 75, etc.

Magazine order No. 2

Entry no. | Total for the Loan |

|||||||||

| 2,0 | ||||||||||

| 57,0 | ||||||||||

| 15,0 | ||||||||||

| 35,0 | ||||||||||

| 13,0 | ||||||||||

The following operations are reflected here:

Each business transaction is confirmed on the basis of which a journal order is filled out. When withdrawing cash from the cash desk of an enterprise, a cash receipt order (account 50) is used, and a payment order is used to transfer monetary assets from the company's current account to various counterparties or budgets of various levels.

Statement

The journal order is filled out from primary documents, but some accounts have a fairly large amount of analytical information, which is processed in the auxiliary statement, and its total for the day is included in the corresponding register cell. For example, when making payments to suppliers and contractors in one day, it is possible to make several dozen transfers to repay (reduce) the amount of debt or pay advance payments. To conduct analytics, an auxiliary statement is compiled according to In the specified example, on May 12, 2010, 57.0 units of funds were transferred from the company's current account, which are sent to various counterparties under the relevant contracts or delivery documents. To decipher this amount, a special document can be drawn up.

Explanation of count 60

The result of this statement is reflected in journal order No. 2; documents confirming the operation (payment orders with a bank mark) are attached to the analytical transcript.

Register numbers

Each order journal is subject to numbering. The form is a large format sheet that displays many columns for recording account numbers corresponding to the credit of the selected account (or group). Records of transactions are kept daily or as primary accounting documents and auxiliary statements are generated. A journal order is opened for a specific synthetic account (a group of accounts similar in content) on a monthly basis, each is assigned a permanent number.

- Form No. Ж-1 is maintained for credit 50 of the account.

- Form No. Ж-2 is maintained for the credit of account 51.

- Form No. Ж-3 - credit to accounts 56, 57, 55.

- Form No. Ж-4 - credit to accounts 92, 95, 93, 94, 90.

- Form No. Ж-6 - credit 60 accounts.

- Form No. Ж-7 - loan

- Form No. Ж-8 - credit to accounts 06, 97, 09, 61, 67, 64, 63, 76, 75, 58, 73.

- Form No. Ж-10 - credit of accounts 70, 02, 10, 84, 20, 69, 23, 65, 29, 28, 26, 31, 44, 05.

- Form No. Ж-11 - credit to accounts 43, 41, 40, 46, 45, 62.

- Form No. Ж-12 - credit to accounts 82, 89, 96, 86, 87, 88, 85.

- Form No. Ж-13 - credit to accounts 01, 48, 03, 04, 47.

- Form No. Ж-14 - account credit 14.

- Form No. Ж-15 - credit to accounts 83, 81, 80.

- Form No. Ж-16 credit accounts 11, 07, 08.

Closing registers

Account journals are filled out throughout the month, and when each register is closed, the credit to debit turnovers of the specified accounts are summed up. Synthetic accounting data is checked for compliance with the values of the auxiliary statement, which reflects the analytical transcripts. The resulting values, after reconciliation, are transferred to the General Ledger. It opens for each calendar year, contains balances at the beginning of the period, is filled monthly with account turnover and serves to compile an interim balance (quarterly, monthly, semi-annual).

When closing the year (reporting period), a balance sheet is formed based on the data entered in the General Ledger. To do this, the turnover of all order journals for the period is summed up, the opening balance is taken into account, and depending on the type of account (passive or active), the balance at the end of the year is calculated. The journal-order accounting system is designed for manual data processing. Its main negative characteristic is the cumbersomeness of journals and registers, so the best option for its use is accounting automation.

The second part journals-orders of the first group are auxiliary statements compiled for the purpose of monitoring cash flows. For example, for journal order No. 1, which is maintained on the credit of account 50 “Cash,” an auxiliary statement No. 1 is opened on the debit of the “Cash” account.

Inventories in these registers are made according to the checkerboard principle, that is, the amount of debit and credit of corresponding accounts is entered once, which reduces the time for registering transactions.

Journal – General Ledger

|

Memorial order number |

Memorial order amount | |||||||||

|

Balance as of 01.12 | ||||||||||

|

Total for December | ||||||||||

|

Balance as of 01.01 |

Statement No. 1 on the debit of account 50 "Cash" for January 200_g. balance as of 01.01 according to the General Ledger – 1600 rubles.

|

Date of discharge |

To the debit of accounts 51 90 71, etc. |

Total by debit |

Order journals of the second group are used to record transactions on settlement accounts with suppliers and contractors, accountable persons, etc. These registers are built on the principle of combining synthetic and analytical accounting, so there is no need to keep books and analytical accounting cards to them and make reconciliations between them.

Entries in order journals of this group are made in a linear manner, that is, debit and credit turnovers are placed on the same line. For example, in journal order No. 6 for the credit of account 60 “Settlements with suppliers and contractors,” analytical accounting is maintained for each supplier and payment request. One line reflects the enterprise's debt to a specific supplier, and a record is made of its repayment as payment is made on the same line. The overall result of debit and credit turnover is synthetic accounting data.

Journals-orders and statements of the third group designed to account for production costs. Entries to these registers are made in a checkerboard pattern. In this case, debited accounts are reflected in the subject (horizontally), and credited accounts in the predicate vertically) of the register. For example, journal order No. 10 is maintained on the debit and credit of several interrelated accounts. It records only the total amounts for the month, which is necessary to summarize production costs by economic elements and costing items. For journal-order No. 10, auxiliary accumulative statements No. 12 are kept (to account for expenses in account 25 “General production expenses”) and No. 15 in accounts 26 “General business expenses”, No. 31 “Future expenses”, No. 89 “Reserves for future expenses and payments". These statements provide a grouping of costs by analytical accounting items, which is important from the point of view of monitoring compliance with the estimates of these costs.

Journal-order No. 6 on the credit of account 60 "Settlements with suppliers and contractors" for May 200 G.

Journal order No. 10 and other orders contain special grouping analytical data necessary for reporting. The structure of the third group order journals is shown below.

Journal-orders and auxiliary statements are the main forms of accounting registers used in the journal-order form of accounting. The main forms of order journals are maintained in combination with auxiliary statements that group entries on the debit of the account in correspondence with the credit of the corresponding accounts. How to create these forms in "1C: Accounting 8" with detailing according to various analytical indicators, the methodologists of the company "1C" tell.

Before the advent of computer technology, the main form of accounting in the USSR was journal-order, based on the use of journal-orders and auxiliary statements as accounting registers*. Currently, accounting and tax accounting in most organizations is carried out automatically using special programs, but for many accountants the forms of journal orders and account statements have remained familiar.

Note:

* Read about the journal-order form of accounting in issue 6 (June) of "BUKH.1S" for 2004, page 42.

Traditionally, order journals are built on the principle of recording in them credit turnover for each balance sheet account in correspondence with debited accounts. The main forms of order journals are maintained in combination with auxiliary statements that group entries on the debit of the account in correspondence with the credit of the corresponding accounts.

"1C: Accounting 8" allows you to generate a journal order and statement for any accounting account using the "Account Turnover" report (menu "Reports" -> "Account Turnover"). The "Account Turnovers" report displays the initial and final balance and turnover of the selected account for a specified period, and details of these turnovers in the context of corresponding accounts. The data is displayed with an additional breakdown by time periods (by days, by weeks, by months, etc.).

To initially generate the “Account Turnover” report, it is enough to indicate the organization, period and select the accounting account in the report form. Then click the “Generate” button on the command panel of the report form. For example, let's generate a report "Account turnover" for account 60 "Settlements with suppliers and contractors" for the organization Belaya Akatsiya LLC for the first quarter of 2006 (see Fig. 1).

Rice. 1

By default, the report in the program is generated with detail by subaccount of the selected account and shows both debit and credit turnover of the account, in correspondence with other accounts. In the example given, the data in the report is detailed by subaccount 60: counterparties, contracts, documents of settlements with the counterparty.

In order to generate a journal order or account statement in the program, you need to make the appropriate settings for the "Account Turnover" report using the "Settings..." button on the command panel of the report form.

Generating an order journal using the "Account Turnover" report

In the settings window, on the “General” tab, select Period - By day, and uncheck the “Debit” checkbox for “Account turnover”. On the "Account Detail" tab, use the button to remove the subcontos "Counterparties", "Agreements" and "Documents of settlements with the counterparty" from the list (the list of subcontos on the tab should be empty). After completing all the settings, click on the “OK” button in the lower right part of the settings window (see Fig. 2).

Rice. 2

The generated report contains all the data characteristic of the order journal (credit turnover of account 60 “Settlements with suppliers and contractors” in correspondence with debited accounts), while the name of the report remains the same “Account turnover 60”. The report is detailed by day of business transactions (see Fig. 3).

Rice. 3

Generating an account statement using the "Account turnover" report

In the settings window, on the “General” tab, select Period - By day, check the “Debit” checkbox and uncheck the “Credit” checkbox for “Turnover with accounts”; to the right, check the “By subaccounts of correspondent accounts” checkbox to detail the report on subaccounts of corresponding accounts. On the “Account Detail” tab, leave the list of subcontos empty. After completing all the settings, click on the “OK” button in the lower right part of the settings window.

The generated report contains all the data typical for the auxiliary statement to the order journal (debit turnover of account 60 “Settlements with suppliers and contractors” in correspondence with credited accounts), while the title of the report remains the same “Account turnover 60”. The report is detailed by days of business transactions and by subaccounts of corresponding accounts.

If we draw an analogy with the program “1C: Accounting 7.7”, then the “Account Turnover” report allows you, by setting its parameters, to obtain both the “Journal order (statement) for the account” and the “Journal order for subconto”. To get an analogue of the first report, you need to select “Period” - “By days” in the settings parameters on the “General” tab, and on the “Detailing” tab, remove all subconto values from the list, and then click the “OK” button in the settings form. To obtain separate “Order Journal” and “Account Statement”, you need to perform additional settings described in this article. To obtain an analogue of the “Journal-order for subconto”, it is enough to indicate in the “Account Turnover” report form the accounting account and the period for which you want to obtain data, and click the “Generate” button in the command panel of the report form.

Accounting registers are special accounting journals that allow you to systematize and group data about the facts of the economic activities of an enterprise. For each accounting system, different forms of accounting registers are provided. We will tell you in our article which journals are used in the journal-order accounting system.

Key points

The journal-order system of maintaining accounting provides for confirmation of all business transactions with the appropriate document - a primary documentation form. The primary document, in turn, must be registered in a special journal. Moreover, entries are made in chronological order.

All transactions are grouped into accounting accounts. That is, when reflecting correspondence with one accounting account, a separate journal order (JO) is used; when creating an entry for another account, the entry is reflected in another accounting journal. Note that the same entry can and should be reflected in two journals at once: in one for the debited account, and in the other for the credited account. This method reflects the double entry method in accounting.

The final data of the housing organization at the end of the reporting period are transferred to the key register - the general ledger. Let us remind you that a balance sheet is formed based on the general ledger data at the end of the financial year. Consequently, the reliability of the accounting financial statements depends on the completeness and correctness of recording information in the Order Journal.

Now let’s look at each JO in more detail, and provide sample forms and samples to fill out.

The forms below are examples! In accordance with the provisions of the Law “On Accounting” No. 402-FZ, each economic entity has the right to independently develop and approve its own forms of primary and accounting documentation. Also, the company is not obliged to maintain all the records if there are no operations to fill them out. Justify the company's position on this issue in its accounting policies. approve your own forms by a separate order or annex to the company’s accounting policies.

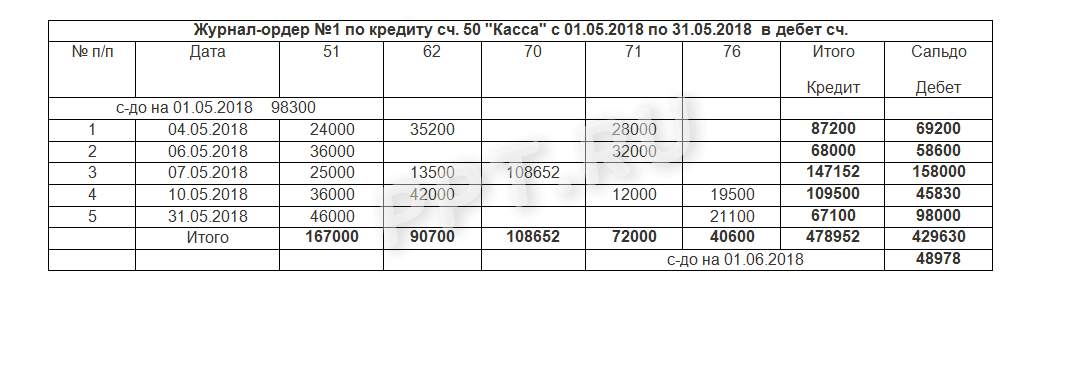

Journal order No. 1 “Cashier”

To generate the organization’s cash turnover, a special journal order 1 is used (you can download the form in Word and a sample to fill out below). In other words, all operations in which account 50 “Cash” is involved should be reflected in JO No. 1.

The basis for making entries is the cashier's report. The document, in turn, is generated on the basis of issued PKO and RKO for the day (or several days). Note that credit turnover on the account. 50 in ZhO are disclosed in more detail than debit (receipts to the cash desk). To detail cash receipts, order journal 1 and statement 1 are used. That is, statement 1 is a breakdown of profitable transactions with the company’s cash.

ZhO form No. 1

Example of filling out ZhO No. 1

Journal order No. 2 “Current account”

To conduct business operations on company current accounts opened in credit and banking institutions, use journal order 2 (you can download the form and an example of filling it out below). Entries should be made only on the basis of bank statements. They are the confirmation of the fact of movement of the company’s monetary assets. The ZhO details write-offs from r/accounts. A special statement is kept to disclose information about receipts.

Journal warrant 2, form

Filling example

Journal order No. 3 “Special accounts”

If the company's funds are stored in special accounts opened with banks or other credit institutions, then transactions on such accounts are reflected in JO No. 3. Records are generated according to the account. 54, 55, 56 accounting. In other words, if an enterprise uses letters of credit, check books or stores money in other accounts in its activities, then record the movement through these storage locations in ZO No. 3.

Example of filling out ZhO No. 3

Journal order No. 4 “Borrowed capital” and JO No. 5 “Mutual offsets”

If a company receives loans or borrowed funds to conduct business, then payments for the received loans are carried out in a special journal-order 4. The turnover in the account is entered into the register. 66 and 67, that is, for short-term and long-term loans and debt obligations.

Journal warrant 4, form

Filling example

Settlements by means of mutual offset of services rendered, works or goods supplied between economic entities are recorded in journal order 5 “Mutual Offsets”. It is worth noting that offset transactions between Russian companies are currently carried out quite rarely. However, set-off of counterclaims is not prohibited.

Journal order, form

Journal order No. 6 “Settlements with suppliers”

To register documents reflecting settlement transactions with current contractors, suppliers and other business partners, use order journal 6. Make entries based on received invoices, delivery notes and signed certificates for work and services performed. Enter expense transactions based on bank statements confirmed by completed payment orders. It is unacceptable to combine records even for one contractor (supplier). Each document must be reflected separately.

ZhO form No. 6

Journal order No. 7 “Settlements with accountables”

Reflect the money given to the employees of the reporting company in JO No. 7. Let us remind you that it is unacceptable to combine transactions even in cases where the money is given to one reporting person. Detail the records for each fact of issuing money.

Journal warrant 7, download form

Journal order No. 8 “Advances on settlements”

In settlements between suppliers and contractors, use advance payments, then to register advances paid, use the order journal 8. Make entries based on bank statements. Also, the JO should reflect settlements with budgets for tax payments and individual intra-economic transactions.

ZhO form No. 8

JO No. 10 “Main production”

All expenses that are aimed at ensuring the main activity are reflected in ZhO No. 10. Group business operations according to accounting accounts: fixed assets, depreciation, wages of key personnel, tax deductions, inventories and other expenses.

Journal warrant 10, download form

Journal order 10, sample filling

ZhO No. 11 “Finished products, sales”

Reflect the manufactured products in JO No. 11. If the company provides services or work, then also record the results of its activities in journal order 11. Information can be grouped by nomenclatures, types of goods or categories of services. The company has the right to independently develop a form, taking into account the specifics and type of activity.

Journal warrant 11, form

Sample filling

JO No. 13 “Property and capital”

Reflect the movement of fixed assets and intangible assets in the company in special JO No. 13. Enter information based on primary documents. For example, OS cards, invoices for internal movement, intangible asset registration cards and other primary documentation. Also, in the JO, reflect transactions for calculating depreciation on the company’s property assets. The register also records information about changes in the authorized capital.

Form ZhO No. 13

Journal order 13, sample filling

JO No. 16 “Capital Investments”

Information about the company's existing capital investments must be registered in a separate LC. Such business operations include: investments in non-current assets, equipment ready for installation. Record movement based on primary documents (commissioning, installation certificate).

Accounting for cash transactions for a month, and in case of a small volume of business transactions - for a quarter, is carried out in journal-order No. 1 and statement No. 1. Let us remind you that in the order journals, entries are kept only for the credit of a certain account, indicating the corresponding debit accounts. Thus, in journal order No. 1, operations on the credit of account 50 “Cash” are taken into account, and the amounts of business transactions are entered in the debit of the corresponding accounts.

Order journal No. 1 is combined with statement No. 1. It is located on the back of the order journal. The statement is maintained according to the debit of account 50 “Cash”, i.e. it reflects the debit turnover on this account in correspondence with the credit of other accounts. The data in journal order No. 1 and statement No. 1 is entered from the cash book (using incoming and outgoing cash orders).

Now let’s fill out journal order No. 1 and statement No. 1, using the cash reports we compiled earlier. First, fill out journal order No. 1. In the top line we write down for which month the records are being kept. Then, from all the transactions that took place during this month, those transactions are selected in which account 50 “Cashier” is carried out on credit. That is, transactions reflecting the expenditure of money from the cash register.

Let's consider the first such operation. It happened on August 10, 2011. We put the date in the first line (you can only put the number, since the month and year are indicated above).

Then we look at the debit of which account the transaction occurred. In our case, the debit of account is 71. In the top horizontal line we look for account 71. At the intersection of line 1 and column “71” we put the transaction amount - 600 rubles.

Let's consider the following operation. Date – 08/10/2011 - put it in the second line. This operation went through the debit of account 62. This means that in the top line we look for column “62” and at the intersection of it with line “2” we put the transaction amount - 19 rubles.

The remaining transactions that took place on the credit of account 50 are entered in the same way.

If the account you need is not in the top line, then you enter this account yourself in the empty column. If several debit transactions of the same account occurred on the same day, then the total amount of these transactions is recorded in one line.

After you have entered the amounts of all expenses from the cash register into the JO, it is very important to correctly summarize the results. First, HORIZONTAL TOTAL (line totals) are summed up, i.e. totals of the amount spent from the cash register for each day. In our example, the total for 08/10/2011 is 600 rubles, for 08/10/2011 – 19 rubles. etc. These totals are recorded in the rightmost column. Then the VERTICAL RESULTS (the results of each column) are summed up, i.e. totals of the debit amounts of each account. In our example, the total for the account is 71 - 600 rubles, the total for the account 62 - 19 rubles, the total for the account 70 - 18,000 rubles, the total for the account 51 - 3,000 rubles. They are written in the very bottom line.

Finally, the TOTAL SUM in the total row and in the total column are reconciled. These amounts must be equal to each other. At the intersection of the total line and the total column, the total total is placed. This amount shows how much money was issued from the cash register during the month.

Journal order No. 1 will look like this:

| JOURNAL-ORDER No. 1. | ||||||||||||

| № | on the credit of account 50 “Cash” - to the debit of accounts for August 2011. | № 08 | № 51 | № 70 | №71 | № 76 | № 62 | № _ | № _ | № _ | № _ | Date or for what dates |

| 3 000 | 18 000 | 21 000 | ||||||||||

| Date or for what dates | 3 000 | 18 000 | 21 619 |

TOTAL

Now let's fill out the form.

First of all, fill in the very top line in the upper right corner: “balance at the beginning of the month.” We set the opening balance (from the cash book) - 44 rubles. Then we enter into the statement the amounts of transactions in which account 50 is debited. Let's consider the first such operation. It happened on August 10, 2011. We put this date in the first line. We look for account 90/1 in the top line (the account that corresponds with the “cash desk” for the loan) and put at the intersection of line “1” and column “90/1” the amount of the business transaction is 1,100 rubles. In the same way we enter the amount of the remaining transactions. Then the horizontal and vertical totals are summed up, the total sums are checked and the total total amount is recorded (it shows how much money was received at the cash desk for the month). And finally, the ending balance is calculated. You know that it is calculated as follows:

FINAL BALANCE = BEGINNING BALANCE + DEBIT TURNOVER – CREDIT TURNOVER.

In our case, the debit turnover of the account is the total amount of statement No. 1, the credit turnover is the total amount of statement No. 1. We calculate the final balance: 44 + 22,646 – 21,619 = 1,071

The ending balance is recorded in the last line in the lower right corner. The “performer” and the chief accountant put their signatures.

| Statement No. 1 looks like this: 44 __ | ||||||||||||

| № | on the credit of account 50 “Cash” - to the debit of accounts for August 2011. | № 90/1 | № 51 | № 70 | №71 | № 76 | № 52 | № _ | № _ | № _ | № _ | Date or for what dates |

| 1 100 | 1 100 | |||||||||||

| 21 500 | 21 546 | |||||||||||

| Date or for what dates | 1 100 | 21 500 | 22 646 | |||||||||

| STATEMENT No. 1. 1 071 __ |

From the debit of account 50 “Cash” From the credit of accounts: Balance at the beginning of the month __

Balance at the end of the month __

After filling out the Journal No. 1 and Statement No. 1, it is necessary to check: