Milk accounting on dairy farms. "report on the movement of livestock and poultry on the farm." Who fills out the milk flow record sheet?

Accurate recording of milk yield on a farm is an important part of technological operations in dairy farming.

It is necessary to determine the breeding value of a cow, calculate economic and physiological indicators, and promptly monitor the economic situation.

For a livestock breeder, data concerning the increase in a cow’s daily milk yield, the achievement of peak lactation (highest daily milk yield) and its decline are important. The technologist adjusts the level of feeding, the economist adjusts the sales cost of the product, based on the gross volume of production. Likewise, it is important to take into account the amount of milk from various technological groups when assessing the professionalism of the operator.

Multifunctional milk milk recording units

The best option for determining the quantity and temperature of milk, its filtration, and sampling for laboratory analysis are high-precision milk production metering units on the farm. They can be used both for inter-shop operations and for estimating the volume of milk at a specific MTF site.

Their advantage is the purification of milk by filters from mechanical mixtures, automatic washing with directed jets of liquid and the transfer of information directly to a PC, which significantly simplifies the work of the technologist and breeder in accounting for milk yield on the farm. VUFM installations operate with a capacity ranging from 400 to 71,000 liters per hour, which allows you to quickly analyze milk yield (without the need for time-consuming and labor-intensive control milkings) on a farm with two or three milkings and a livestock of 30 - 40 heads.

Local milk metering devices

A milk meter is used to record milk yield on a farm, coming both from a milk pipeline or other reservoir into a tank, and during the process of pumping it into a milk tanker. A flow milk meter with a counter is used directly to sum up the amount of milk that is transferred from a tank or other reservoir to the milk tank of a milk tanker. If the milk does not undergo pre-filtration, a filter should be installed in front of this device to avoid clogging. The flow meter is mobile, it can be installed in different positions, and the location of the display can be changed if necessary.

To estimate the total amount of milk of small volumes, you can use electronic scales VSE-600M, which work with a mass of milk from 4 to 600 kg. They can be used both at MTF and in dairy shops of small lines by installing a tank on them. The flow meter is a measuring and computing module; it is used to measure the volume and mass of flowing milk and fermented milk liquids, both one-time and in total.

The accuracy of the instruments does not exceed 0.5% error, which makes it possible to determine with high reliability the amount of milk in different areas of the farm and on the farm as a whole.

GOST R 51451-99

Group H19

STATE STANDARD OF THE RUSSIAN FEDERATION

METHOD FOR ACCOUNTING COW'S MILK YIELD

Procedure for milk recording for cows

OKS 67.100.10

OKSTU 9209

Date of introduction 2001-01-01

Preface

1 DEVELOPED by the State Institution All-Russian Scientific Research Institute of the Dairy Industry (GU VNIMI)

INTRODUCED by the Technical Committee for Standardization TC 186 "Milk and Dairy Products"

2 ADOPTED AND ENTERED INTO EFFECT by Resolution of the State Standard of Russia of December 22, 1999 N 606-st

3 This standard is harmonized with the international standard ISO 1546-81 "Methods for recording cow's milk yield"

4 INTRODUCED FOR THE FIRST TIME

5 REPUBLICATION. September 2008

1 area of use

1 area of use

The standard establishes a methodology for accounting for milk yield of cows of dairy breeds or breeds with a prevailing ability to produce milk located in the raw material areas of milk processing enterprises.

Accounting for milk production is carried out for each cow by periodically measuring the mass of milk, mass fractions of fat and protein and calculating the mass of milk, fat and protein for the accounting period, followed by calculation of the average values of mass fractions of fat and protein for one lactation period, or one operational year, or during 305 consecutive days of lactation.

2 Normative references

This standard uses references to the following standards:

GOST 23327-98 Milk and dairy products. Method for measuring the mass fraction of total nitrogen according to Kjeldahl and determining the mass fraction of protein

GOST R 51457-99 Cheese and processed cheese. Gravimetric method for determining the mass fraction of fat

3 Definitions

In this standard, the following terms with corresponding definitions apply:

3.1 accounting of milk yield: A procedure for determining the mass of milk produced by a cow over a certain period, as well as fat, protein and mass fractions of fat and protein, guaranteeing the reliability of information about the productivity of each cow in the herd.

3.2 herd: Any group of cattle, which is kept for the same purpose, belongs to one owner and is housed in a separate or several premises, united by the breed characteristics of the animals and conditions of detention.

4 Methods for recording milk production

4.1 Method A

Milk production is recorded only by official representatives of the government service. Accounting data is entered into table 1.

Table 1

Recording duration, h | Recording period, days | Accounting method |

4.2 Method B

The accounting of milk production is carried out by the owner of the cows or an official government representative together with the owner. Accounting data is entered into table 1.

5 Methods for measuring milk mass, fat and protein mass fractions

5.1 Milk weight measurement

The mass of milk is determined on a scale with the smallest division not exceeding 200 g. The results are recorded in kilograms.

5.2 Measurement of mass fractions of fat and protein

5.2.1 Sample preparation

Milk samples for analysis are prepared by mixing milk from each individual cow so that they represent milk from all milkings performed within 24 hours. Equal masses (volumes) of milk should be taken from each milking.

5.2.2 Determination of the mass fraction of fat - according to GOST R 51457.

5.2.3 Determination of the mass fraction of protein - according to GOST 23327.

5.2.4 The mass of fat in the milk produced by a cow on the day of registration is determined by multiplying the mass of milk produced on the day of registration by the mass fraction of fat and dividing the result by 100.

5.2.5 The mass of protein in the milk produced by a cow on the day of registration is determined by multiplying the mass of milk produced on the day of registration by the mass fraction of protein and dividing the result by 100.

6 Length of milk production recording period

Calculation of milk yield can be carried out:

a) taking into account the lactation period (lactation period method);

b) taking into account 365 consecutive days (operating year method).

In both of these cases, the results of recording milk yield for a period of 305 days following calving are especially noted. These results are called "standard" or "control lactations."

The lactation period is considered completed when the cow stops milking her twice a day. However, lactation can be considered to continue as long as the cow produces more than 3 kg of milk per day and is milked at least once a day for a period exceeding one week.

When counting once a month, the end of the lactation period is considered to be the 14th day after the last count, during which milking was carried out twice a day. This day is included in the calculations. For longer periods of time between records (more than once a month), the date of cessation of lactation is considered to be the date corresponding to the middle of this interval.

7 Calculation methods

The total mass of milk, as well as the mass fractions of fat and/or protein, are calculated in accordance with one of the methods below.

7.1 Method 1

7.1.1 The mass of milk produced is calculated for the period between two consecutive counts. The calculation is made by multiplying the weighing results obtained during one accounting day by the number of days in the calculation period. By adding up the individual results obtained in individual periods, the mass of milk produced by the cow during the entire lactation period is obtained.

7.1.2 Calculate the mass of fat produced during the period between two consecutive counts. The calculation is made by multiplying the results of calculating fat mass on the day of recording by the number of days in the calculation period.

7.1.3 Calculate the mass of protein produced during the period between two consecutive counts. The calculation is made by multiplying the results of calculating the protein mass on the day of recording by the number of days in the calculation period.

7.1.4 The mass fraction of fat and protein in milk is calculated by multiplying the total mass of fat and protein (kg) by 100 and dividing the resulting values by the total mass of milk (kg).

7.2 Method 2

7.2.1 The mass of milk produced is calculated for the period between two consecutive counts. The calculation is made by adding the weighing results over the next two days of recording and then dividing the amount by two. The quotient is then multiplied by the number of days in the billing period. The total milk yield is obtained by summing the milk yield calculated for all periods.

The mass of fat and protein contained in milk is calculated similarly to 7.1.2, 7.1.3.

7.2.2 Mass fractions of fat and protein in milk are calculated according to 7.1.4.

Note - Accounting is carried out using billing periods () of approximately equal duration, but the check is carried out on the working day closest to (±2).

The results obtained using this method can replace the missing number of days if, for an unavoidable reason, such as paid holidays, registration is delayed for a period not exceeding 68 days (cows in estrus do not qualify for such reasons).

The results obtained using the calculation methods outlined above are recorded without changes or amendments.

Examples of calculations are given in Appendix A.

8 Registration of accounting results

8.1 Data recording

The accounting data must contain the results obtained without amendments or changes. Attached to them:

a) method of accounting for milk yield (method A or B);

b) duration of recording (lactation period, within 305 days or operational year);

c) information establishing the identity of the animal (code, nickname);

d) factors that may affect milk yield, especially:

- date of birth of the cow (year and month);

- the number of daily milkings, when their number exceeds twice a day (III means three times a day; III, II means three daily milkings at the beginning of lactation and two milkings later; instead of III and II, the numbers 3 and 2 can be used);

- exact dates of all calvings;

- the duration of all previous lactations or the number of days of milking per year;

- total mass (kg) of milk, fat and protein produced for each lactation or operational year and 305 days of accounting lactation; if the cow actually produced milk for less than 305 days, indicate the actual lactation period;

- start date of the operational year;

- dry season (if available);

- milking method (manual or mechanical);

- type of food; health status (any accidents or illnesses that occurred during or before the lactation period, foot and mouth disease, etc.);

- special environmental conditions: keeping in a barn, grazing on lowlands or mountain pastures, the height of mountain pastures above sea level, the duration of grazing on mountain pastures.

8.2 Publication of results

Information regarding the results of milk production accounting can only be published by organizations involved in milk production accounting and dairy cattle breeding associations recognized by government organizations for this type of activity.

APPENDIX A (for reference). Calculation examples

APPENDIX A

(informative)

Recording duration, h | Accounting period (), days | Accounting method |

Note: A - double milking; |

||

Accounting date | Milk weight, kg | Mass fraction of fat, % | Fat mass, g |

Beginning of lactation March 26, 1976 |

|||

Table 3 - Method 1

Accounting date | Milk weight, kg | Number of days in the period | Mass fraction of fat, % | Total for the accounting period: |

|

Milk, kg | |||||

Total per lactation | |||||

Total milk weight: 4591 kg |

|||||

Table 4 - Method 2

Accounting days | Number of days in the period | Daily Products | Total for the accounting period: |

||

Milk, kg | Milk, kg | ||||

Total per lactation: | |||||

Total milk weight: 4591 kg Average fat mass fraction: %* |

|||||

_______________

* The formula corresponds to the original. - Database manufacturer's note.

Electronic document text

prepared by Kodeks JSC and verified against:

official publication

Milk, dairy products and canned milk.

Specifications: Sat. GOST. -

M.: Standartinform, 2008

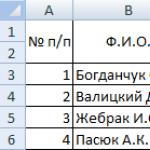

The receipt of milk yield is reflected in the Milk Production Logbook (Form No. SP-21). It is led by the farm manager, foreman, machine milking foreman or senior milkmaid. In the journal for each milkmaid, group (team) of milkmaids, the number of cows they serve and data on the amount of milk received (in kilograms) for each milking separately are recorded daily.

Based on the control milkings carried out, entries are made in the journal with the note “Control milking”. The farm manager, foreman or senior milkmaid (operator) daily determines the percentage of fat content in milk for each group of cows assigned to them and converts the received milk to one percent. The journal is kept in one copy. To record the daily receipt and consumption of milk during the month, each farm maintains a Milk Flow Record Sheet (Form No. SP-23). At the end of the reporting period, one copy of the statement, along with milk production logs, limit cards, invoices and other expense documents, is submitted to the accounting department. The second copy of the statement serves as the basis for recording and writing off milk as consumption in the warehouse accounting book of the farm manager, foreman or milk receiver.

The main one, intended for registering the release (shipment) of milk to buyers and customers, is the Consignment Note (raw materials) (form No. SP-33). This document is issued by the farm manager or foreman for each shipment of milk and dairy products (morning, evening and afternoon). To formalize transactions for the transfer of milk for sale in cash from stationary retail outlets, organizations use the Certificate of Acceptance of Products for Sale (Sale) (Form No. SP-36). It lists the types of products transferred for sale to the retail outlet. It is compiled in two copies, one remains at the point of sale, and the second, together with the accompanying documents, is transferred to the accounting department. The Report on the sale of agricultural products (Form No. SP-38) is intended for registration and reflection of transactions during a one-time sale of milk. Data on the sale of milk, revenue received and its use are entered into the Product Sales Report (form No. SP-37). And to summarize information about the movement of milk in the refrigerated warehouse - in the Report on the refrigerated warehouse (form No. SP-30).

Milk processing

When dispensing milk for public catering, an Invoice for On-farm Purpose (Form No. 264-APK) and a Limit Collection List (Form No. 269-APK) are used.

For daily accounting of the processing of milk and dairy products at a separator point, butter shop or other processing facilities, the Statement of Processing of Milk and Dairy Products (form No. SP-27) is used. The first section provides data on the receipt of milk for processing: unit of measurement, quantity, fat content, total fat units, price, amount, corresponding account; in the second section - data on receipts from processing separately for each of the received types of products.

At the end of the reporting period, the first copy of the statement with attached receipt and expense documents is submitted to the accounting department. The second copy remains at the point or workshop. The reverse side of the sheet is used to record working hours and calculate the earnings of specialists involved in the processing of milk and dairy products. The consumption of products derived from milk is also reflected here.

Important to remember

Accounting for milk received and milk transferred for processing is documented with special documents.

Specific forms of documents for milk accounting are recommended in the Methodological Recommendations for Accounting Costs and Product Output in Dairy and Beef Cattle Breeding (approved by the Ministry of Agriculture of Russia).

Accounting for milk produced from the main herd of cattle on farms is kept in the Milk Production Record Card (APPENDIX 1). The card is maintained by the farm manager or another person whose responsibilities include performing accounting functions. It is opened for each milkmaid every month. Every day, after each milking, data on the amount of milk produced in the morning, at noon, and in the evening is recorded, and the percentage of fat contained in it is also indicated. At the end of the working day, the milkmaid confirms the amount of milk produced with a signature on the card. The card is compiled in one copy and stored on the farm for a month. When carrying out control milkings, a corresponding entry is made in the card. It allows you to calculate milk yield results for a day, a decade or another period of time. As necessary, these results can be entered into cumulative and consolidated accounting registers. At the end of the month, within the time limits established by the document flow schedule, the milk yield record card with the milk flow sheet is submitted to the farm accounting department.

Along with the document described above, instead of milk yield cards, the Oshmyansky Rassvet agricultural production company uses the Milk Milk Record Book (APPENDIX 2) to record milk. This document is filled out for a group of milkmaids and is designed for half a month. The log reflects the milk yield for the morning, noon and evening separately. The amount of milk produced by each milkmaid is recorded by a laboratory assistant. At the end of the working day, the milkmaids sign a journal for the total amount of milk they produced for the day, then the farm manager signs. The log also reflects the results of control milking, which allows it to be used to improve zootechnical work on the farm. The results calculated in it (vertically - the amount of milk produced per day and for the entire farm, and horizontally - the amount of milk produced by each milkmaid during the reporting period) allows, at the end of 15 days, to obtain the necessary generalized data for posting milk and calculating wages for livestock workers . The completed journal with supporting expense documents is submitted to the farm accounting department.

Primary accounting on a commercial dairy farm is completed by filling out the Milk Movement Record Sheet (APPENDIX 3), which is intended for daily accounting of the receipt and consumption of milk. This document is drawn up in one copy. Every day, in addition to milk yield, it indicates the consumption of milk in various directions: use, spent on feeding calves, piglets, sales to the state, on the market, public catering, procurement organizations, and so on. The statement also indicates the remaining milk at the end of the day and the percentage of fat. At the end of the month, within the time limits established by the document flow schedule, the milk flow sheet, along with other primary documents on consumption and receipt, is submitted to the farm’s accounting department.

One of the channels for milk supply is its donation by the population.

Milk from the population is accepted in specially designated premises outside the territory of dairy farms. Accounting for milk received from the population is usually kept in the Record Book for Acceptance (Purchase) of Milk from Citizens (APPENDIX 4). Each record of milk donation is confirmed by the signature of the donor. The fat content in milk is determined for each sample, other quality indicators are analyzed in case of doubt about the freshness and naturalness of the milk supplied. Based on the results of the analysis, the book indicates the fat content and the amount of milk in terms of basic fat content. By multiplying the amount of milk (in terms of basic fat content) by the purchase price in effect at the place of receipt, the amount due to the deliverer is determined (without compensation for vehicles).

Related information:

- Section III: Current state and efficiency of milk production at OJSC “Semyanskoye”, Vorotynsky district, Nizhny Novgorod region

and beef cattle breeding

21. In the primary accounting of dairy and beef cattle products, the following groups of documents can be distinguished: on recording production output; for recording live weight gain; for recording the yield of offspring. The need to use these documents is due to the fact that the production process in dairy and beef cattle breeding ends with the output (receipt) of finished products, the increase in live weight of animals, as well as offspring and by-products.

22. The main primary document for recording milk receipts in agricultural organizations is the Milk Production Log (form N SP-21), which is maintained by the farm manager, foreman, machine milking foreman or senior milkmaid. In it, for each milkmaid, group (team) of milkmaids, the number of cows they serve and data on the amount of milk received (in kilograms) for each milking separately are recorded daily.

A milk production log is kept daily for a group (team) of milkmaids (operators) or for a group of cows assigned to a milkmaid (operator). For control milkings carried out, entries in the journal are made with the note “Control milking”. The farm manager, foreman or senior milkmaid (operator) daily determines the percentage of fat content in milk for each group of cows assigned to milkmaids or to a group (team) of milkmaids (operators), and converts the received milk to one percent.

The milk production log is kept in one copy and is stored on the farm (in the team) for 15 days.

Every day, milkmaids (operators) confirm with their signature the indicators of the amount of milk produced and the percentage of fat in the milk. In addition, the log is signed daily by the farm manager or foreman.

23. To record the daily receipt and consumption of milk during the month, each farm maintains a Milk Flow Record Sheet (form N SP-23). At the end of the reporting period, one copy of the milk flow accounting sheet, together with the milk yield accounting logs by receipt, limit cards, delivery notes and other documents on consumption, is submitted to the accounting department.

The second copy of the milk flow record sheet serves as the basis for recording and writing off milk as consumption in the warehouse accounting book of the farm manager, foreman or milk receiver.

24. To register the acceptance (purchase) of milk received from citizens in the execution of concluded agreements for acceptance for subsequent sale or for direct purchases, the Logbook for the acceptance (purchase) of milk from citizens (form N SP-22) is used. In the log, the receiver records the incoming milk in the order of fulfillment of concluded agreements with each citizen: quantity, fat content, etc., provided for by the concluded agreement, including details for the procedure for settlements with milk distributors.

25. To register the offspring of animals (calves) obtained on the farm, the Act on the posting of the offspring of animals (form N SP-39) is used.

The act is drawn up in two copies by the farm manager, livestock specialist or foreman directly on the day the offspring is received. The act is drawn up separately for each type of animal offspring. The act records the surname, first name, patronymic of the employee to whom the animals are assigned, the nickname or number of the uterus, the number of heads and weight of the resulting offspring, the inventory numbers assigned to them, notes are made about the distinctive features of the offspring (color, nickname, etc.), and signatures of persons confirming the receipt of offspring, and stillborn animals are recorded separately.

The executed acts are used for zootechnical accounting and entries on the farm in the Animal and Poultry Movement Record Book (form N 304-APK). One copy of the act is transferred directly to the accounting department the next day after its preparation. A copy of the act, according to which entries were made in the Book of Animal and Poultry Movements, at the end of the month also goes to the accounting department along with the Report on the movement of livestock and poultry on the farm (form N SP-51).

In addition to its main purpose - to record the number of animals - these acts are also used in accounting to calculate wages for farm workers.

26. The results of weighing animals for growing and animals for fattening, determining their actual live weight are reflected in the Animal Weighing Sheet (form N SP-43).

The statement is compiled by a livestock specialist or farm manager, a foreman during periodic and selective weighing of animals to determine the increase in their live weight, as well as in cases of receipt and departure of animals from the organization by species and accounting groups of animals.

In the statement of livestock being weighed, the weight is indicated on the date of weighing, on the date of the previous weighing, and the difference will be the increase in live weight or plumb weight. The statement is signed by the livestock specialist, the foreman and the worker to whom the livestock is assigned.

The general results of the weight statement for the corresponding groups of animals are recorded in the Animal and Poultry Movement Record Book (form N 304-APK), and are also used to draw up the Calculation of Live Weight Gain (form N SP-44).

The increase in live weight of animals is determined by age groups. For this purpose, they prepare a Calculation for determining the increase in live weight of animals (form N SP-44). The calculation is made by type and accounting and production groups according to materially responsible persons to whom the animals are assigned.

The form is the logical conclusion of the Animal Weighing Sheet (form N SP-43). The increase in live weight in the form of N SP-43 can be determined only by the livestock available at the beginning and end of the periods for which the animals were weighed, i.e. on the date of this weighing and the date of the previous weighing. Accordingly, between these two dates, changes occurred in the animal population: the entry of animals into a given accounting group and the departure of animals from this group. Therefore, in order to determine the overall increase in live weight for the corresponding accounting group, it is necessary, in addition to the data from form N SP-43, to take into account the changes that have occurred in the composition of the livestock (its arrival and departure). The calculation of determining the increase in live weight, taking into account the movement of livestock, is compiled according to form N SP-44. To do this, add the weight of retired livestock (including dead) to the weight of animals at the end of the reporting period and subtract the weight of livestock at the beginning of the reporting period and those received during the reporting period. The result of this calculation is the gross increase in live weight of livestock by age group being reared or fattened and fattened during the reporting period, i.e. without deducting the mass of dead animals.

In cases where weighing animals is impossible (for example, heifers at a certain stage of pregnancy, etc.), their live weight is taken according to the last weighing. Subsequently, weight gain (increase in live weight) is determined by weighing these animals after calving.

When sent to meat processing plants and other sales points, livestock must be weighed. The weighing results are recorded in the consignment note. This live weight is taken into account to determine the weight gain for a given group of animals.

In specialized farms (bases) engaged in the procurement and fattening of livestock, the calculation is accompanied by an Act on the removal of livestock from fattening, fattening, growing (form N SP-45).

The calculation is made by the livestock specialist, farm manager, and foreman on a monthly basis for the farm as a whole and animal accounting groups based on data from the Animal Weighing Sheets (form N SP-43) and the relevant documents for the receipt and disposal of animals. The calculation for determining the increase in live weight, together with a report on the movement of livestock and poultry on the farm, is transferred to the accounting department and serves as the basis for capitalizing the resulting increase and calculating wages to livestock workers.

Weighing animals and determining the increase in live weight is also carried out in the following cases: transfer to the next age group, transfer to the main herd, culling from the main herd, mortality, slaughter, sale and other types of disposal.

27. Agricultural organizations can purchase livestock from the population (according to the agreement) with its placement for growing and fattening to obtain an increase in the live weight of this livestock, as well as acceptance for subsequent delivery to procurement points in order to assist the population in selling their livestock.

Acceptance of livestock from the population (according to the contract) for the purpose of placing it for growing and fattening is carried out by a commission consisting of the head of the unit, the manager of the farm, a livestock specialist, a veterinarian and the person to whom the animals are assigned.

Based on the zootechnical and veterinary examination, determination of fatness and weighing of each head of livestock in the presence of the person handing over the animals, an Act for the transfer (sale) and purchase of livestock and poultry under contracts is drawn up (form N SP-46).

This act is applied to operations of receipt (purchase) and disposal (transfer, sale) of animals under contracts with citizens. The document is universal and applies to all animal movement operations related to concluded contracts with citizens for purchase, fattening, rearing, etc. operations with citizens.

The act records the receipt (transfer) of animals under each agreement concluded with a citizen, live weight, fatness and all other details provided for by the concluded agreement, including details for the payment procedure for accepted (transferred) livestock.

Upon fulfillment of the concluded contract (completion of fattening, etc.), documents are drawn up either for posting or for the sale of the animal (when delivered to a meat processing plant or procurement point).

The act is signed by all members of the commission, the person who handed over the animals, and approved by the head of the agricultural organization. One copy is given to the person who surrendered the animals. When placed for raising and fattening, animals are assigned an inventory number. The chief accountant checks the correctness of the calculation of the cost of purchased livestock from the population, issues a cash receipt order (or receives an application from the donor to transfer money to his bank account).

To register the reception and accounting of animals accepted from the population, the Reception and Payroll Sheet for animals accepted from the population (f. SP-40) is used. The statement is compiled by the animal receiver. The statement indicates the last name, first name, patronymic of the donor, the number of animals accepted from him, their fatness, live weight, price, amount to be paid. The statement is used both for the receipt of animals and for settlements with the deliverer (in the case of accepting animals for further rearing in the organization). In cases of transit operations (delivery of accepted animals to a procurement point), it is also used for settlements with the procurement point for animals handed over to it. In the first case, the statement is filled out in two copies, in the second case - in three copies.

Animals accepted from the population and left on the farm for growing and fattening are accounted for in a separate subaccount to account 11 “Animals for growing and fattening” on the corresponding analytical accounts by species and accounting groups of animals.

Animals purchased from outside suppliers (from other organizations, breeding associations, etc.), as well as those received as a free transfer, are accounted for on the basis of waybills and invoices, acceptance certificates, veterinary, breeding certificates and other documents.

28. The increase in live weight of animals must be taken into account in all cases of their movement (transfer to other groups, sale, transfer for fattening under contracts, etc.).

Hence the need arises to use documents in cattle breeding to record the movement of animals to reflect not only their livestock, but also the increase in live weight and live weight of livestock.

In all cases of transfer of animals from one accounting age group to another (including the transfer of animals to the main herd), an Act on the transfer of animals from group to group is drawn up (form N SP-47).

The act is applied in all cases of registration of transfer of animals from one sex and age group to another, including the transfer of animals to the main herd. The document is universal, i.e. used for all species and accounting groups of animals.

The act is drawn up by a livestock specialist, farm manager or foreman directly on the day of transfer of animals from one group to another.

The document indicates from which group the animals are transferred to which, their inventory numbers, gender, class, color and other features, time of birth, number of heads (if a group of animals is transferred), book value, to whom the accepted animals are assigned and signatures of workers, their accepted.

The executed acts, approved by the head of the organization or division and signed by the manager of the farm, livestock specialist and employees who accepted the animals for further service, are used for entries in the Animal and Poultry Movement Record Book (form N 304-APK). At the end of the month, the acts, together with the Report on the movement of livestock and poultry on the farm (form N SP-51), are submitted to the accounting department and are used to reflect the movement of animals in the accounting registers and to calculate wages for the employees to whose group they were transferred.

29. For each case of slaughter, forced slaughter, death, death from natural disasters, loss of animals, a Certificate of Disposal of Animals and Poultry (slaughter, slaughter, death) is drawn up (Form N SP-54).

The act is used to record animals in cases of their death, forced slaughter, as well as the slaughter of animals of all accounting groups (young animals, fattening animals, animals of the main herd). Culling animals from the main herd for fattening and sale, i.e. without slaughter in the organization, is formalized by the act of disposal of animals from the main herd.

The act of disposal of animals is drawn up by a commission, which includes: the manager of the farm, livestock specialist, veterinarian (veterinarian) and the employee responsible for the maintenance of this animal.

The act is drawn up on the day of disposal (slaughter, death, trimming, loss) and is immediately submitted to the administration of the organization for consideration. The act must detail the reasons and circumstances for the disposal of animals, as well as the possible use of the products (for food, for livestock feed, to be destroyed, etc.). When animals are disposed of due to mortality or forced slaughter, the report indicates the reason and diagnosis. In case of death or death of animals due to the fault of individual employees, the cost of these animals is recorded in the account of the guilty employee with an additional valuation to the market price and is recovered from him in the prescribed manner.

Products from the slaughter (death) of animals (meat, skins) are delivered to the organization's warehouse using an invoice, which, with the signature of the storekeeper who accepted the products, is attached to the act of disposal of animals.

If the skin of a dead animal has commercial value and can be sold, the act states: “The skin was removed and delivered to the warehouse, invoice N ___.” If, for one reason or another, the skin is not used, then the record “The corpse was disposed of along with the skin” is made in the acts.

The use of products is permitted only strictly for the purposes specified in the act.

After approval by the head of the organization, the act is used to record the livestock in the Animal and Poultry Movement Record Book (form N 304-APK) and, together with the Report on the movement of livestock and poultry on the farm (form N SP-51), is submitted to the accounting department for account entries .

30. In specialized livestock organizations (bases and complexes for rearing and fattening of animals), in order to document the results of fattening operations and transfer of removed fattening, fattening, rearing of animals from the cattleman, the head of the base (complex), a Certificate of Removal of Livestock from Fattening, Fattening, Weaning (f . N SP-45) .

The first section of the document reflects data on fattening, fattening and rearing of livestock, and displays live weight gain broken down by animal fatness. In the second section, the cost of fattened, fattened, and rearing livestock is calculated (also by fatness groups). In the third section, the cost per unit of gain and the total increase in live weight are calculated.

For each type of livestock, a separate act is drawn up in two copies, one of which is transferred to the accounting department, and the second is stored at the base or complex.

31. Based on the primary accounting documents for the receipt, transfer and disposal of animals, daily entries are made in the Animal and Poultry Movement Record Book (form N 304-APK), and at the end of the month a Report on the movement of livestock and poultry on the farm is drawn up. At the end of the reporting month The first copy of the report, together with primary documents on the movement of animals, is submitted to the accounting department for verification and entry into the accounting registers for recording the movement of animals. The second copy remains on the farm. A consignment note is issued by the farm manager, foreman or livestock specialist with the participation of a veterinarian for each batch of livestock sent to procurement points or sold to other organizations. The document is issued when animals are delivered, regardless of the type of transport: by road, by rail, in droves, etc. A veterinary certificate is filled out along with the waybill for sending animals.

To formalize transactions for the transfer of manufactured products (milk) for sale in cash from the organization’s stationary retail outlets (shops, stalls, tents, etc.), the Act on Acceptance of Products for Sale (sale) (form N SP-36) is used. The act lists the specific types of products transferred for sale to the retail outlet. The act is drawn up in two copies, one of which remains at the point of sale, and the second, together with the accompanying documents, is transferred to the accounting department, where it serves as the basis for writing off the products from the relevant financially responsible persons and recording it as a report to the head of the corresponding point of sale.

To register and reflect transactions for one-time sales of milk at the market and other places of trade (sale of milk from car tanks, from flasks and small tanks), the Report on the sale of agricultural products (form N SP-38) is used.

34. To register and reflect operations for the receipt and movement of by-products (manure, shedding wool, etc.) of dairy and beef cattle breeding, accounting calculations, accounting certificates (form N 88-APK), invoices for on-farm purposes (form. N 264-APK), acts on write-off of organic fertilizers.