Check your business partner. How to do it: check your business partner for free. Checking tax information

Verifying business partners is an important step before establishing new business contacts. Without it, it is sometimes impossible to ascertain the reliability of future allies. Every entrepreneur who is looking for new contacts is at risk in the form of concluding a contract with unreliable partners or, even, may become a victim of professional scammers. That is why checking business partners is necessary for those who do not want to risk their finances and reputation.

Checking potential business partners is the key to successful business development.

What risks can checking your business partner help you avoid?

Solvency, integrity and the availability of legal documentation confirming the right to engage in the activity you need - this is what should interest you in the first place. Checking your business partners according to the above criteria will help you predict with an accuracy of a percentage how smoothly the planned transaction will go.

Otherwise, the risks of financial losses and the possibility of getting a bad reputation from other partners with whom you work increase significantly.

Some possible risks:

Checking can protect your business from such shocks and risks as:

|

Concluding an agreement with a fictitious company. |

This may be a company that is registered as a dummy person or registered specifically for this transaction. The constituent documents may indicate non-existent addresses and contacts of the company, or the name of a well-known company may be illegally used through falsification; |

|

Concluding a transaction with a company whose officials or founders are wanted. |

Checking business partners may reveal similar risks; as well as the fact that the organization is a frequent participant in litigation; |

|

Concluding a transaction with an unauthorized person who deliberately exceeds his authority. |

Checking a potential partner for good faith helps to avoid this unpleasant situation even at the stage of consideration and preparation of the contract. For example, you can detect the forgery of letters and guarantees that were supposed to confirm the reliability of the partner, or the identification of a negative credit history and failure to fulfill your obligations or multiple use of collateral; |

|

Use of third party details when completing a transaction |

A slightly more thorough check, carried out professionally, will easily reveal such “details” that your future partner would prefer to keep silent about. |

In addition, the world of Russian business is in constant motion. And, as a result, new schemes for fraudulent financial transactions and ways to deceive bona fide businessmen appear here periodically. Professionally engaged in tracking and identifying threats to economic security for our clients, we are aware of such information and are ready to provide you with all the necessary data and conduct a check of your business partners, as they say, at the highest level.

When should you think about checking your business partner?

Solvency, integrity and the availability of legal documentation confirming the right to engage in the activity you need - this is what should interest you in the first place. Checking your business partners according to the above criteria will help you predict with an accuracy of a percentage how smoothly the planned transaction will go. Otherwise, the risks of financial losses and the possibility of getting a bad reputation from other partners with whom you work increase significantly.

Checking business partners as a goal-setting criterion for their reliability?

Unscrupulousness and unreliability of partners can significantly undermine your business. Checking their reputation and legal validity reduces the possible risks of a business transaction being disrupted due to the partner’s insolvency or deliberate fraudulent intent. The desire of business people to check their partners becomes quite logical and understandable. This is especially true when:

- a financial transaction for a large amount is planned;

- an agreement for the acquisition or alienation of property belonging to a partner is about to be drawn up, or there is an intention on his part to purchase something from you;

- a new person comes to the organization, who, due to his job obligations, will have access to commercial information, and its release may undermine your plans or business;

- you plan to delegate some of your powers to a colleague or partner. The person on whose decisions the success of your business will depend needs a high-quality check for connections with competitors, as well as the integrity of his own ambitions for your business;

- you are ready to make a business proposal related to opening a joint business;

- there is a prospect of marriage: scammers often act this way or try to manipulate the feelings of their future spouse for their own benefit.

Checking business partners is the key to commercial success and stability of your business.

What information can be obtained from INFOCON LLC?

- Obtaining a standard and extended business certificate about a future partner company. This includes confirmation of the authenticity of registration documents of a legal entity, as well as information about the founders, authorized capital and verification of bank details. The result of a request from the tax office about this subject can also be obtained;

- Checking the reputation and solvency of banks, insurance organizations and other financial institutions;

- Searching for information about the financial and property status of the company, trade and other transactions, reputation in the market;

- Collecting information about a person, checking personnel, confirming information about the place of residence and work of an individual, checking address data;

- Conducting marketing research and assessing the work of competitors, assistance in finding partners taking into account specified data, as well as providing information on the results of foreign economic transactions with a certain type of product.

All these services are provided by experienced specialists who carry out search work of this kind with due professionalism.

Whoever has the information controls the situation. And in Russian business realities, so to speak, a professional and unbiased inspection of your business

partners can be a prerequisite for running a successful business.

By concluding new deals, partnership agreements or opening new sales routes, an entrepreneur puts the business at risk, especially in the event of a partner’s dishonesty. Cases of fraud, dishonest business dealings, refusal to pay for goods, espionage, unfortunately, are the realities of the modern financial and economic space.

You can defend your own case only by making sure of the good intentions of the other side. Checking the business image of counterparties, business history, “purity” of competitive strategies, addresses, contacts, accounts and arbitration responses is only a small part of the work that will protect the business from losses.

Benefits of partner verification:

- eliminating the risk of a transaction with a fictitious company/dummy/company using the details of other organizations;

- minimizing the likelihood of doing business with an “unclean” company/tax-evading company/bankrupt;

- identifying the organization’s involvement in litigation;

- calculating the authenticity/authority of a representative of a partner company;

- detection of counterfeit documents, certificates, guarantees, seals.

It is possible to obtain positive audit results only by contacting professional services. Detective agency "InfoProverka" offers competent assistance from a private detective. Possession of the necessary knowledge for work in the field of business intelligence, analysis of the authenticity of documentation, and the subtleties of studying the strategy of partners’ actions will allow you to quickly collect information and make the right conclusion.

Transactions based on trust

Mostly, the victims of fraudsters and unscrupulous partners are companies that have limited time to make decisions or are in an advantageous economic position. Many financially unstable organizations try to stay afloat through their investments, which in the end rarely meets the expectations of the former.

Our job is to fully study partners and prepare reports on the project. Clients receive:

- business certificate (authentication of documents, information about founders, bank details);

- information about reputation, solvency, financial and property situation;

- information on ongoing domestic and foreign economic transactions;

- data on a specific individual;

- marketing assessments (comparison with competitive structures, prospects for cooperation).

In the context of the financial and economic crisis, the number of scammers and unscrupulous companies increases many times over. Many companies do not pay for the delivered goods, citing the crisis, and, despite this, continue to operate successfully.

Naturally, in such a situation the question of choosing a reliable business partner is especially acute, because concluding a deal with unscrupulous business partners can seriously undermine the financial well-being of the company. Checking your counterparties today is not the right, but the responsibility of every company.

Verification of business partners is part of a set of measures to ensure the security of the company, and checking the solvency and checking the business reputation of the company are mandatory steps for those who want to insure themselves against monetary losses associated with fraudsters operating in the business market.

Key risk factors when working with new business partners

- little time is allocated for making a decision, since competition in any field is quite high;

- in times of crisis, many companies are in difficult financial situations and can solve their problems at your expense;

- Your managers will not always be able to discern a defaulter or fraudster in a potential business partner, especially if the counterparty is located in another region or abroad;

- the constituent and other documents provided to you may be inaccurate or outdated, or even falsified;

- the company may not have financial problems, but management’s policy may be such that the company delays fulfilling its obligations, and sometimes for quite a long time.

Who can you trust to check your business partner?

Where can I get reliable information about the solvency of a company? Should you trust the information provided by the partner party, or is it necessary to carefully check the reputation of the company with which you intend to cooperate? Should you check the counterparty yourself or use the services of specialized information firms and agencies? These questions undoubtedly arise before every business leader.

It is often very difficult to independently check a company that is a potential partner, since a fraudulent company, as a rule, surrounds itself with people who give false information. In addition, if your counterparty is located in another city, then verification by the company’s managers is much more expensive than the services of specialists. Travel expenses, hotel payment, daily allowance. At the same time, an employee sent on a business trip with such a task will be able to collect only a minimum of information. Undoubtedly, he will find out whether the company has an office at the address indicated by it, whether the company really does what it declares as its main activity, what its partners, suppliers and clients say about the company. However, it is unlikely that your manager will be able to obtain information about the company’s registration from databases, and without additional costs it will be very difficult to collect information about its credit history.

Checking a business partner at GrandLevel

The most important principles of our company are to provide only verified, reliable information, as well as compliance with confidentiality conditions.

Technologies for obtaining and processing information, as well as extensive connections with reliable sources, allow the GrandLevel company to obtain first-hand information. Naturally, such data is completely reliable. And checking the solvency of your partner, checking his business reputation, carried out by our company, will not be an “event carried out only on paper”, but serious work aimed at ensuring the financial security of your business.

It is no secret that a significant part of the information necessary to verify your business partner, business reputation and solvency of the company can be obtained from open sources. For example, regional divisions of the Federal Tax Service have been publishing lists of debtors for quite some time. Regional branches of the Federal Bailiff Service also “disclose official information”: in the public domain there is information about debts under court decisions, lists of seized property and property that is wanted. But you need to be able to find this information and weigh it carefully. Our specialists use proven algorithms; in addition, they carefully monitor the relevance and reliability of the information.

Checking the business reputation of the company

The history of the creation and development of the company is traced (the duration of the enterprise’s existence is an indirect sign of its stability), the existence of subsidiaries and (or) parent companies. A significant factor is the presence of long-term partners at the enterprise and their feedback on cooperation.

The registration data of the enterprise is studied, as well as changes in the constituent documents, the actual address, and the reasons for their change, if any, are clarified. The composition of founders and managers is studied. If the composition has changed, the reasons are determined. The existence of the company’s debts and the dynamics of their repayment are clarified. Has there been any fraud in the company's history? Has your partner participated or is participating in judicial or administrative proceedings? Were any penalties imposed?

Solvency check

The financial condition of a legal entity is studied, as well as the fulfillment of obligations under loans and debts. Information about property is clarified: movable and immovable property, the presence of liquid assets, which banks service this legal entity.

Business certificate

In order to calmly and carefully make a decision on cooperation, having verified information about your partner’s solvency and business reputation, you can order a business certificate.

Contents of a standard business certificate:

- checking the authenticity and relevance of registration data;

- confirmation of the presence of an office, establishment of the actual address of the company;

- checking data on the presence of actual directors and founders of the company;

- checking the number of full-time employees;

- establishing the location of warehouses and additional offices;

- providing information about the company's current accounts;

- provision of information from the balance sheet for the last reporting period;

- checking whether the company has permanent business partners;

- checking the company’s business reputation in the market;

- providing information about problems in relationships with suppliers and regulatory authorities.

With our help, you get the following advantages in doing business:

- the process of making your decision on cooperation is significantly accelerated;

- the number of your reliable clients increases;

- You save your funds from unjustified losses;

- you receive money for the goods supplied on time;

- Feel free to provide deferred payment to unfamiliar partners in any region;

- you get undeniable advantages over your competitors.

The execution time for a business certificate is 3–4 business days from the moment we receive the request, regardless of the geographic location of your business partner in the Russian Federation or abroad.

The range of issues on which a business certificate is prepared can be further expanded at the request of the customer.

The cost of a business certificate is from 2,500 rubles, depending on the form of service and the number of requests.

This is a problem whose extreme importance need not even be discussed.

However, there is a fairly convenient algorithm for solving it, which I successfully use.

The main thing is that the data is obtained in real time, is official and can be confirmed by relevant documents. After all, the documents that are submitted to confirm the status of a partner before concluding a transaction already have a certain period from the date of issue, and changes could occur. To simplify the perception of the material, I prepared a video (please do not judge it too harshly - this is my first attempt at working with the Kamtasia video studio, it was recorded immediately - from the first take, I could not correct the terrible accent!).

http://www.youtube.com/watch?v=Tj0c7o0O9j8 That’s why I’m also submitting the text version.

1. Checking the status of the partner in the Unified State Register.

We go to the website of the State Enterprise “Information Resource Center” (officially maintained by the Unified State Register), in the “SEARCH IN THE USR” section, agree to the search conditions, select the type of entity that we need to check (individual entrepreneur or legal entity) in the search field request, we enter the registration number of the taxpayer’s registration card (full name of an individual) or the EDRPOU code (name or part of it for a legal entity). I recommend entering digital data - the search for it gives only one result, in contrast to text data, when the search can produce tens and hundreds of answers, enter the security code, “OK”, and get on the screen information about the information that is in the Unified State Register on the moment of our verification (data is updated immediately after the registration action is completed by the state registrar - personally tested). There is not much information, but it is extremely important:

— Manager — find out who has the right to sign documents on behalf of a legal entity (plus location and telephone numbers);

— Data on whether the legal entity is in the process of termination - it is also important to know whether the counterparty is in the process of termination (especially if by court decision);

— The date and name of the last registration action is the most important point of information, because if a record is made about the absence of a legal entity at its location, I recommend that you think ten times before entering into an agreement and be absolutely prepared for a tax audit, which will try very hard to find grounds for recognition the agreement is void and additional tax liabilities are assessed. It is also possible to record the lack of confirmation of information about a legal entity - this is a rather unpleasant fact, which may indicate insufficient qualifications of the management of the legal entity (but not as terrible as the first option).

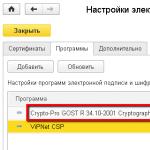

2. Checking tax information.

It is carried out on the website of the State Tax Service of Ukraine in two directions - as a VAT payer and as a taxpayer.

We check the VAT payer on the “VAT Payers Register” service (data is updated every ten days). Everything is simple and very similar to a search in the Unified State Register - we enter the USREOU code, the security code, and we receive information regarding the VAT payer - the Certificate number and the date of its issue. The information may also be in the “Cancelled VAT Payer Certificates” database - then it is necessary to check the basis for cancellation - at the initiative of the payer or the tax office.

We check how a taxpayer is using the “Find out more about your business partner” service. The verification procedure is the same (there is only one difference - if the EDRPOU code starts with 0, they do not need to be included in the request, for example - not “00123456”, but “123456”. We receive information whether the payer is registered with the tax office, and whether there is a tax debt at the beginning of the month.

After writing the material, another rather necessary service was launched on the website of the State Tax Service of Ukraine - “CHECKING THE CERTIFICATE OF A SINGLE TAX PAYER”, where you can check the authenticity of the Certificate (but only by its series and number). Data is updated once a month. The procedure is similar to those described above.

3. Checking court cases.

Conducted on the website of the “Unified State Register of Court Decisions”. In the “Search by Context” field, enter the EDRPOU code (registration number of the taxpayer’s account card - an individual), click “SEARCH”, and see whether our potential business partner is involved in court cases, as which party and on what issues. You can search by name, but the registry can return thousands of answers. It is very important to make sure that there are no cases regarding the nullity of contracts. If there are a lot of such cases, it means that after the conclusion of the agreement, you cannot avoid them. But the decision, of course, is yours.

“Counterparty verification” is a popular service; a Yandex search for these words produces more than 2 million responses. Not everyone knows that you can carry out an express check yourself, and it’s completely free

Any entrepreneur sooner or later encounters an unscrupulous partner. Therefore, before concluding a deal with a new counterparty, it makes sense to check it. Such a check can be carried out using the services of the tax service and other resources, and without any financial costs.

Do you have a partner?

Any business activity is subject to mandatory state registration in Russia. Information on the registration of legal entities and individual entrepreneurs is contained in the unified state register of legal entities (individual entrepreneurs) - Unified State Register of Legal Entities/Unified State Register of Entrepreneurs. A huge number of intermediaries offer access to these databases for money - from 400 rubles. for one statement. You can do this on the Federal Tax Service website absolutely free of charge. The register data will allow you to obtain information that is current at the time of the request about the founders of the company, the executive body, its types of activities, location, the date of initial registration and registration of the latest changes in the organization, the method of formation of the legal entity and other information that may be useful.

Come out of the shadows

The previous action, however, does not provide a 100% guarantee that the company and its managers are engaged in any activity and are a reliable business partner. It may well happen that the company is undergoing reorganization (liquidation), and its manager has already been replaced (or this procedure has just begun). In order to find out what is happening with the company in this direction, you can go to a special service of the Federal Tax Service, which allows you to check whether there is information about a legal entity or individual entrepreneur in respect of which documents for state registration have been submitted. In addition, it is useful to check whether the company is being liquidated by decision of the Federal Tax Service and whether it is in a state of bankruptcy. It is also recommended to check this information in the service of the Supreme Arbitration Court. Here you can see how many legal disputes an organization or entrepreneur is involved in, the subject of the dispute, the progress of the case and the result.

Suspicious address

If a legal entity is registered at the place of “mass” registration (more than 10 companies at one address), this may raise suspicions - such companies can be identified by another service of the Federal Tax Service. (Of course, the mere fact that an organization indicates its location at the place of “mass” registration does not in itself indicate that the partner is unreliable). There are also cases when the constituent documents indicate a non-existent address of the location of the legal entity. Suspicion should also be raised by the discrepancy between the actual address of the organization and the address indicated in the constituent documents of the legal entity. If the partner himself did not report such a discrepancy (which happens very often in practice), companies that the Federal Tax Service could not contact at the address they provided can be found using another tax service.

Suspicious people

If the company’s founders include persons who are also founders in a large number of other organizations (especially if there is only one founder), such a company can be suspected of dishonesty. The same applies to the executive body of the organization. You can also check the counterparty in this regard on the Federal Tax Service website. It is also useful to make sure that the general director of the partner company has not been disqualified by the court.

Enemy of the State

If a potential partner submits zero reports or does not submit reports at all, or has tax debts, this is definitely a bad sign. You can check information about a company’s tax debts or those that have not submitted reports for more than a year using the Federal Tax Service service. When checking the counterparty for payment discipline, it is worth going to the website of the bailiff service, which maintains a database of enforcement proceedings: with its help you can find out whether the partner has other outstanding debts.

Banking cleanliness

Finally, it would be useful to find out whether a decision has been made regarding a potential business partner to suspend banking operations on the account. If you have information about your partner’s bank(s), such information can also be obtained from the Federal Tax Service. To obtain this information, you need to know the TIN and BIC of the counterparty bank.