The procedure for changing the founder in an LLC: step-by-step instructions. Procedure for the simultaneous change of founder and general director What is a change of founder of a legal entity

Re-registration of an LLC is usually called changes that, in accordance with Federal Law No. 129, are recorded in the constituent documentation. Whatever the reason: change of name, sale of shares or change of manager, it is important to formalize this legally correctly and draw up the necessary documents so that these changes can come into force.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

Wind of change at the enterprise

In the process of operation of any organization, changes may arise in connection with the replacement of the director or founders and the redistribution of their equity participation in the total capital, which should be evidenced by new entries in the organization’s charter.

Replacing founders is an official procedure that can be carried out by selling shares or by removing its participants from the organization and introducing new ones. In accordance with existing legislation, the replacement of members of an organization can be carried out in different ways.

Replacement of founder, withdrawal from membership

All information about LLC members is entered into the constituent documents and into the Unified State Register of Legal Entities.

State registration of a legal entity is accompanied by entering the following data about it into the Unified State Register of Legal Entities:

- registration information at the address of residence;

- passport details;

- what share is allocated to him from the total authorized capital.

According to Federal Law No. 129, you can replace members in an organization as follows:

- through alienation of a share in favor of another person;

- leave a share in the organization.

The first option for replacing members of an organization is the simplest and is achieved by transferring the share to another person. The transfer of the share is carried out by selling or donating the willing citizen to any person who is not currently a member of the LLC.

This is formalized by a purchase and sale transaction of a share in an LLC or by concluding a gift agreement.

According to the law, such a transaction (purchase, sale or gift) must be certified by a notary. Such a transaction is formalized accordingly and paid at the price established by the notary's tariffs.

The second option for replacing a participant is carried out by transferring a share to the organization, without resorting to drawing up a notarized document.

You can replace the founders of an LLC, as well as re-register shares in the organization through:

- direct transfer of a share under a purchase and sale or donation agreement certified by a notary;

- an alternative option that does not require the services of a notary, which can be documented in different ways:

- output of the previous member;

- resale of shares within the organization between its participants;

- sale of this share among the LLC participants under an agreement.

The withdrawal of one founder from the company is carried out as follows: he informs about his decision to leave the organization in writing and asks to pay him the amount corresponding to his share in the authorized capital. Then the participant’s decision to leave the organization is documented, and his share in the authorized capital is divided among the remaining participants or remains on the organization’s balance sheet.

Making a sale from founder to founder is possible within the organization without the participation of a notary.

To do this, it is necessary to draw up an appropriate written agreement in any form.

When an organization has a share of a former participant on its balance sheet and the remaining members of the organization decide to sell it to a third party, an agreement is drawn up in form P14001 indicating a change in the owner of the share and documents confirming payment are attached to it.

Certain types of activities require not only investments, but also special knowledge. Find out how, without having a pharmaceutical education,...

Certain types of activities require not only investments, but also special knowledge. Find out how, without having a pharmaceutical education,...

The TORG-12 consignment note is used regularly in business activities. Sample filling in .

New CEO

The general director is a legal entity that can perform any actions on its own behalf. Its powers are established by the organization’s Charter and legislation.

Depending on the size and focus of the organization’s work, it can be managed by the general director alone or by redistributing responsibilities among members of the board of directors responsible for a certain type of work.

A change in the general director of an enterprise can occur for the following reasons:

- because of ;

- in connection with death;

- by decision of the general meeting due to loss of confidence;

- in connection with .

The replacement of the founder occurs after the transfer of his share or the acceptance of a new member; as for the general director, he can be replaced only after a positive decision has been made by the general meeting.

The process of changing a director occurs in several stages:

- The present director draws up a letter of resignation.

- The future director submits an application for employment.

- Both statements are submitted to the general meeting.

- A meeting of LLC members is held.

- After the meeting makes a decision to replace the director, a corresponding entry is made in the Unified State Register of Legal Entities, but in this case the constituent documents do not need to be changed.

- The new director signs the application and has it certified by a notary.

- The notary receives an extract from the Unified State Register of Legal Entities.

- The previous director submits the documentation on the transfer and acceptance certificate.

- The director and the organization enter into an employment contract, the contract with the ex-director is terminated and a corresponding entry is made in his work book.

- The director issues the first order on behalf of the head of this organization, which informs him of his acceptance of the new position.

Entering a new participant and redistributing shares

A new participant can be included in the LLC after making the necessary changes to the Unified State Register of Legal Entities. In this way, one or more new members may appear in the organization.

Registration of the admission of a new participant to the LLC is carried out without the participation of a notary. His share in the authorized capital is also registered without a notarized donation or sale agreement.

The entry of a new participant into the LLC must be registered with the Federal Tax Service; its data is also transmitted to the local executive committee with an indication of the change in the composition of participants.

In order for a new member to become a member of an LLC, it is necessary to obtain the approval of all its members. Anyone wishing to join the organization must write an application for further consideration by the general director and his members, who can accept him and allocate him a part in the total capital.

The admission of a new participant to the company is due to the desire of its members to increase the authorized capital by adding new funds or property to it, or by increasing it by all the founders.

The latter is possible both in equal shares proportional to the amount of capital, and in disproportionate shares.

After accepting a new member, a general meeting is held to allocate him a share in the common capital. In this regard, there will be a change in the size of the shares of the remaining participants, data about which is currently available in the Unified State Register of Legal Entities.

Data about the new LLC member will be registered in the Unified State Register of Legal Entities, after which he will be given equal rights with other founders. He will also bear equal responsibility with the other founders corresponding to his participation in the authorized capital.

A new founder can be accepted into the organization in the following ways:

- by increasing the authorized capital;

- no change in capital;

- by selling his share without notary participation.

All actions, including changes in the membership of the organization and transactions with shares, are limited in time in accordance with Federal Law No. 312:

- 1 month in advance, an amount must be deposited into the organization’s account, with the help of which the share of the new participant will be determined;

- The entire reorganization procedure should take 6 months.

Re-registration of LLC upon change of founder

In accordance with existing legislation (Federal Law No. 129), all changes made to the composition of LLC participants must be documented in the Unified State Register of Legal Entities, and this information is transferred to the territorial body of the Federal Tax Service.

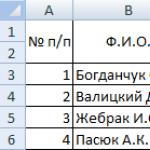

The cost of the procedure for changing the founders of an LLC, the price of introducing a new participant depends on the number of founders, stages of registration and the need for notarized documents. For example, Moscow law firms involved in the preparation of such documents have set the following prices:

Paperwork

In order to make the necessary changes to the Unified State Register of Legal Entities you will need:

- Consider the issue at a general meeting and make a positive decision of all LLC founders.

- Enter changes into the constituent documentation.

- Collect the necessary documents to submit to the registration authority:

- decision of the meeting to change the composition of the founders;

- a new constituent document with a new list of participants;

- certificate of state registration of LLC;

- certificate of assignment of TIN;

- agreement on transfer of share;

- decision on the appointment of a director;

- documents for verifying payment of the share (bank receipt or certificate signed by the director and chief accountant);

- a description of the method of entry or exit of a participant into the LLC;

- copies of passports of all founders, including the general director;

- title documents on the transfer of shares;

- when drawing up a share purchase and sale agreement: notarized consent of the spouse.

- application in form No. P14001.

- receipt for payment of state duty.

Changes will be made to the Unified State Register of Legal Entities within 5 days; an extract of these changes must be submitted to the Federal Tax Service.

The organization will be issued new constituent documents, a certificate of amendment and a new document - an extract from the Unified State Register.

Notarization of the transaction

The need to register a notarial transaction when changing the participants of an LLC arises in cases where the participant’s share is re-registered:

- in connection with a purchase and sale agreement;

- by inheritance;

- through donation.

The notarial method of re-registering the share of an LLC participant includes:

- notarization of the transaction;

- payment for notary services;

- registration of the spouse’s consent to the purchase or sale of a share;

- sending the necessary documents for further registration by post.

Documents for a notary:

- application form P 14001;

- extract from the minutes of the meeting of founders;

- LLC charter;

- certificate of state registration;

- spouse's permission with a notary stamp;

- consent of the remaining founders.

Re-registration of an LLC when one or more founders changes is carried out taking into account the regulations of Federal Law No. 129. In this article we will tell you how the re-registration of an LLC takes place when the founder changes in 2018, and we will consider the stages of the procedure.

Features of the procedure for re-registration of an LLC when the founder changes

From a legislative point of view, the procedure is based on different motivating reasons:

- Selling your part of the authorized capital to one, several persons or a company.

- Gradual replacement of the founder (for example, the successor of the former founder takes over).

Re-registration includes the preparation of documents and their transfer to the tax authorities at the place of registration. Documents can be submitted to tax authorities in person, remotely on the Federal Tax Service website if you have an electronic signature, or by sending a registered letter with an inventory. The procedure can be carried out independently or with the help of specialized organizations. In the latter case, third-party assistance can significantly reduce the re-registration time.

Methods for re-registering an LLC when a founder changes: the main advantages and disadvantages

A one-time replacement of all founders is prohibited by law. Replacing one founder in an LLC is carried out in one of two ways. The use of each of them depends on the root cause of the LLC re-registration.

| Method of replacing the founder | Conditions of use | pros | Minuses |

| Through notary services | One founder sells his part of the authorized capital; legislation gives the priority right to purchase shares to co-founders and a business company; following the order of priority, if the founders and the business company refuse to buy out the share, the “seller” has the right to sell it to third parties and organizations | One transaction is drawn up (a contract of purchase and sale, gift or transfer of a share by inheritance); an authorized person of the notary is engaged to complete the transaction, who professionally resolves all issues; the whole procedure takes a minimum of time | Before the transaction (except for donation and inheritance), you must first notify of the intention to sell the share of all founders and LLCs who can exercise the right of priority to acquire the share; the transaction must be notarized; high cost of services of an engaged qualified notary specialist due to his increased involvement |

| Without involving a notary | Phased transfer of shares (exit of the old and entry of a new founder) | The participation of a notary will be needed only for some actions, therefore this option is the least expensive | It takes a lot of time, because the procedure is carried out gradually, in several stages |

From January 1, 2016, all documents that relate to changes in the structure of the constituent assembly and are submitted to the tax authorities for making changes to the Unified State Register of Legal Entities must be certified by a notary.

Sale of a share of the authorized capital by the founder of the LLC to a third party

If the co-founders of the LLC refuse to purchase the share being sold, the founder seller has the right to sell it to a third party. In this case, a purchase and sale agreement is concluded with the obligatory involvement of a notary. To re-register you will need the following documents:

- Application according to the standard form P14001.

- Certificate of state registration.

- Amended LLC Charter.

- Extract or minutes of the meeting of the founders of the LLC with the decision to sell part of the capital, consent of the founders.

- Notarized document of purchase and sale.

- Extract from the register of a legal entity (valid for up to a month).

- Consent of the spouse to sell part of the capital, formalized by a notary.

- Receipt for payment of state duty.

The notary will need to draw up a purchase and sale agreement (by the way, the contract of gift or transfer of a share by inheritance is also certified there), certify the refusal of the founders, LLC from the priority purchase of the share with a statement, and formalize the consent of the husband (wife) to sell the share. The representative of the notary himself submits the required documents to the tax authorities to register all changes.

Notary services are paid by the applicant.

The procedure for a phased change of founder involves the sequential withdrawal of the current participant and the introduction of a new one.

| Stages of replacing a founder without involving a notary | Features of the event |

| A new participant writes an application for inclusion in the LLC | The text of the appeal is drawn up in any form; the application is reviewed by the general director and members of the LLC, approved or not |

| Allocation of a share to a new participant in the total authorized capital | Carried out at the general meeting of founders; a new participant can be admitted to the LLC without changing the capital, by increasing it or by selling a share without the participation of a notary |

| A new participant makes a property or monetary contribution | This action is necessary for the new participant to receive a share in the capital; payment deadline - month |

| Entering information about the new founder into the Unified State Register of Legal Entities | The following documents are submitted to the Federal Tax Service for consideration:

after entering the data, the new founder will have all the rights on an equal basis with other founders and bear full responsibility |

| The retiring founder notifies of his intention to leave the LLC and asks to pay him the amount of his share | It is drawn up in writing with the participation of a notary; the text of the application indicates the amount of the share transferred to the LLC; the consent of the co-founders to exit is not required unless this is provided for in the constituent documentation |

| A decision is made on the withdrawal of the founder from the LLC | Payment of the share amount to the withdrawing participant is made no later than 3 months from the date of filing the application |

| The share of the retired participant becomes the property of the LLC and is divided among the remaining founders | The division of shares is carried out at a general meeting, a proper decision is drawn up |

| The retirement of the old founder is registered with the Federal Tax Service | The head of the LLC submits documents to the tax authorities:

New data is entered into the Unified State Register of Legal Entities within 5 days |

The re-registration procedure without the participation of a notary can last up to six months, but no more.

Common mistakes when re-registering an LLC with a change of founder

Most often, mistakes are made when making changes to the constituent documents. Typos and distorted information entered into the Unified State Register of Legal Entities due to the fault of the LLC representative (tax officials) are subject to correction. The procedure is as follows:

- The error was detected immediately. Contact the employee who issued the documents and explain the essence of the error. He is obliged to record the comments made in a special form and give it to the applicant, indicating the time of issue of the document without errors. Reported errors are usually corrected within 3-4 days.

- The error was discovered some time after receiving the documents. The recipient of the documents writes a cover letter describing the error, and draws up an application R 14001 (marked with clause 2.3 “Changing information about a legal entity in case of errors”; the State Registration Number where there is an error is entered in it). The first 3 sheets certified by a notary are taken from the form, the sheets from the form with the error are attached and, together with the letter, are submitted to the registration authority. Corrections are made within 5 days, after which the correct version of the documents can be picked up in person or sent by mail to the legal entity. LLC address.

Incorrect information discovered by the applicant immediately after receiving documents from the tax office is easier to correct. This includes: inaccuracies in the full name, legal address of the LLC, the amount of the authorized capital and shares of the founders. Errors in the indication of passport data and other distortions that are not displayed in the Unified State Register of Legal Entities extract, as a rule, are identified later. Nevertheless, such errors can also be corrected in the manner described above.

Typical reasons for refusal to re-register an LLC when the founder changes

Refusal to re-register an LLC when replacing the founder does not mean a ban on re-registration. This means that the applicant must identify the reason for the refusal and correct the violation.

| Typical reasons for refusal to re-register an LLC | What should an applicant do if refused? |

| Not all documents have been handed over to the tax authorities; incorrect filling or design (outdated form, no notarization, typo and inconsistency of information in the submitted documents, not all seals, stamps are affixed, etc.) | Errors must be corrected and the correct version of all documents must be submitted. |

| The founder is disqualified by court decision | Comply with the requirement: all LLC founders must be real persons with no limited rights |

| The state duty has not been paid, and the documents have been submitted to the wrong registration authority | Submit a receipt for payment of the state fee along with all documents; You need to contact the tax office to which the LLC belongs |

The applicant has the right to go to court if he receives an unfounded refusal from the tax office. But you should be aware that false data provided during registration can lead to a fine of 5,000 rubles. or disqualification for up to 3 years (Administrative Code, Article 14.25).

Example 1. Refusal to re-register an LLC with a change of founder (the procedure is carried out without the participation of a notary)

In order to enter data about the new founder of the LLC in the Unified State Register of Legal Entities, the following documents were submitted to the tax authorities:

- amended Charter;

- form P 14001, P 13001;

- decision of the founders of the company on the updated composition;

- registration certificate of a legal entity;

- extract from the Unified State Register of Legal Entities.

The applicant received a refusal indicating the reasons: the application form was not certified by a notary, there was no receipt for payment of the state fee.

Example 2. Correction of an error in the Unified State Register of Legal Entities made when making changes about the new founder of the LLC

While taking the documents from the tax authorities, the applicant, upon reading, noticed errors in the surname and authorized capital, which he immediately reported to the employee who issued the documents. He recorded everything in a special form and gave it to the applicant. After 3 days, the founder took the correct version of the documents.

Answers to frequently asked questions

Question No. 1. Does the founder have the right to sell his part of the authorized capital immediately to a third party without offering anything to the co-founders?

If the “seller” immediately sold his part of the capital to a third party, such a transaction is considered illegal and can be challenged in court within three months from the date of its completion.

Question No. 2. If the co-founders refused to buy the proposed share of capital, who else could it be offered to?

If one of the founders refuses to purchase a share, the remaining participants of the LLC have the right to purchase it together. The distribution of the purchased part of the capital can be carried out according to any criteria (for example, according to existing shares in the business).

Question No. 3. From what moment is it considered that a participant has left the LLC when the founder is gradually replaced?

For this purpose, he needs to write a statement. As soon as it is accepted by the company, the participant will be considered to have left the LLC.

Question No. 4. What is the deadline by which the share of the withdrawing participant must be distributed among the remaining participants?

Question No. 5. Can an application for correction of errors and related documents be submitted to the Unified State Register of Legal Entities by an authorized person?

Yes, but to carry out such actions you will need a power of attorney. The appeal will be considered as a postal item, and the response will be sent to the legal address of the LLC.

Instructions for changing the composition of LLC founders

Option 1. Entry/withdrawal of the founder from the LLC through an increase in the LLC’s capital

This registration option is more convenient in the event of a change of several participants at once, as well as in the event that the participant is unable to come to the notary for the transaction.The procedure for changing the founder of an LLC is carried out in two stages:

- Registration of the entry of the founder into the list of participants of the LLC with the attraction of an additional contribution to the authorized capital (Increase in the capital);

- Registration of the withdrawal of the former/former participants from the LLC. Transfer of his/their share to the company with subsequent distribution among the remaining participants:

Option 2. Purchase and sale of shares in a management company LLC. Registration of a transaction by a notary

According to the requirements of the law, transactions aimed at the alienation by a company participant of a share or part thereof in the authorized capital of an LLC to third parties require notarization, after which the notary who certified such a transaction, within the period specified by law, performs a notarial act of transferring the documents to the registering authority on the basis of which the registering authority makes changes to the Unified State Register of Legal Entities.

INDEPENDENT CHANGE OF FOUNDERS OF LLC STEP-BY-STEP INSTRUCTIONS THROUGH INCREASING THE MC

In the process of carrying out its activities, an LLC may encounter the need to change the composition of the company’s founders. To carry out this procedure, you will need to choose where to start: first, introduce a new founder into the list of LLC participants, and then withdraw the participant from the LLC, or vice versa - remove the founder and then include a new participant in the company. Both options are used for different situations. In this instruction, we will consider the process of changing the composition of the founders of an LLC through input-output, that is, through an initial increase in the number of participants and an increase in the size of the authorized capital with the subsequent withdrawal of a participant from the LLC.

Registration of changes in the composition of the founders of a limited liability company is regulated by the following legislative act: N 129-FZ “On state registration of legal entities and individual entrepreneurs”;

Legislatively, the procedure for registering a change of founders of an LLC through input-output in Moscow does not differ from the procedure for registering similar changes in another region of the Russian Federation. Despite this, for one reason or another, the requirements for the process of registering a change of LLC founders, imposed by the Moscow registration authority (MIFTS No. 46 for Moscow), may differ from the requirements of other tax inspectorates.

Registration of a change of LLC founders, step-by-step instructions through input-output

The entire registration procedure is divided into 2 stages:

- Introducing a new participant into the LLC founders.

- Withdrawal of the old participant from the LLC.

STAGE 1: INCLUSION OF A NEW PARTICIPANT IN THE FOUNDERS OF THE LLC

STAGE 1: INCLUSION OF A NEW PARTICIPANT IN THE FOUNDERS OF THE LLC

After the decision has been made to include a new participant in the LLC, it is necessary to make changes to the company’s charter and to the Unified State Register of Legal Entities, as well as prepare and submit to the MIFTS within three days a set of documents to register the changes. For this you will need: - Preparation of a set of documents for registering a change in the composition of the founders of the LLC;

- A visit to a notary to certify the authenticity of the signature of the head of the company on the application in the form P13001, P14001;

- Submitting a set of documents to the registration authority;

- Obtaining documents on registration of changes in the Unified State Register of Legal Entities and the company's charter;

- Checking documents for errors made by the registration authority (if there are any, they are submitted for correction on the same day);

The initial action that is recommended to be taken immediately before the start of the registration procedure for changing the composition of founders is to obtain a “fresh” extract from the unified state register of legal entities. Firstly, using this extract, you can compare the data contained in the Unified State Register of Legal Entities with documents located in the company, and in case of discrepancies in the information, they can be eliminated in parallel with the registration procedure. Secondly, to certify the authenticity of the signature of the head of the organization by a notary (in the application required for registration), an extract from the Unified State Register of Legal Entities is required, the issuance period of which does not exceed 10 (ten) or 30 (thirty) days, depending on the requirements of the notary’s office.

Preparation of documents for registration of the entry of a new founder into the LLC.

Preparation of documents for registration of the entry of a new founder into the LLC.

For state registration of changes in information about LLC participants (introduction of a new founder into the company), the registration authority is provided with:

COMPLETING APPLICATIONS FOR STATE REGISTRATION OF CHANGES IN THE USRLE AND CONSTITUTIONAL DOCUMENTS OF THE COMPANY

GENERAL RULES FOR COMPLETING AND REGISTERING DOCUMENTS.

The application, notification or message form (hereinafter referred to as the application) is filled out using software or manually.

Filling out the application form manually is done in black ink with capital block letters, numbers and symbols

To facilitate the filling out of documents, the Federal State Unitary Enterprise GNIVC FTS has developed a special “program for the preparation of documents used for registration of legal entities” (PPDRUL). The program is completely free. You can download the program from the website of the Federal Tax Service (new website http://www.nalog.ru/) or directly from the website of the State Scientific Research Center of the Federal Tax Service.

Using the PPDRUL program, you need to reliably enter all the data, and at the end you will receive a ready-made application form.

CHARTER OF THE COMPANY

CHARTER OF THE COMPANY

Charter - a set of rules governing the organization and procedure of activities. The Charter of the Company is approved by its founder (founders) and defines the tasks, principles of formation and activities of the organization.

From the point of view of Russian legislation, namely Article 52 of the Civil Code of Russia, the Charter is a constituent document on the basis of which a legal entity operates.

The rules on the charters of legal entities are regulated by Art. 52 of the Civil Code, as well as laws on various types of legal entities, in this case the Federal Law “On Limited Liability Companies”.

The company's charter must contain:

- full and abbreviated company name of the company;

- information about the location of the company;

- information on the composition and competence of the company's bodies, including on issues that constitute the exclusive competence of the general meeting of the company's participants, on the procedure for making decisions by the company's bodies, including on issues on which decisions are made unanimously or by a qualified majority of votes;

- information on the size of the company's authorized capital; rights and obligations of company participants;

- information about the procedure and consequences of the withdrawal of a company participant from the company, if the right to leave the company is provided for by the company’s charter;

- information on the procedure for transferring a share or part of a share in the authorized capital of the company to another person;

- information on the procedure for storing company documents and on the procedure for the company providing information to company participants and other persons;

The company's charter may also contain other provisions that do not contradict current legislation. At the request of a company participant, auditor or any interested party, the company is obliged, within a reasonable time, to provide them with the opportunity to familiarize themselves with the charter of the LLC, including amendments.

The Charter must be printed in two copies; two originals of the Charter must be submitted to the registration authority. The charter need not be sewn together.

There are many examples of the Charter. Internet search engines will help you find exactly what suits you.

PAYMENT OF THE STATE FEES FOR REGISTRATION OF CHANGES IN THE COMPOSITION OF FOUNDERS

PAYMENT OF THE STATE FEES FOR REGISTRATION OF CHANGES IN THE COMPOSITION OF FOUNDERS

When registering changes to the Charter, a state fee is paid. The state fee can be paid at any cash desk of Sberbank of Russia, as well as in the MIFNS hall. Details for filling out receipts in Moscow can be found on the website of the Federal Tax Service.

The state fee for registration is 800 rubles.

In the payer column, the full name and address of the applicant must be indicated, and not of another person paying for the state. duty. A fundamentally important point! From March 12, 2014, it is not necessary to submit it (according to the administrative regulations of the Federal Tax Service), but in fact it is better to submit at least a copy of the receipt.

APPLICATION OF A THIRD PARTY ON INCLUSION INTO THE LLC

A potential participant draws up and submits to the executive body of the company an application for admission to the founders of the LLC. This application must necessarily reflect the size of the share claimed by the new participant, as well as exactly what amount he will contribute to the authorized capital of the company.

The application accepted from the potential participant is considered at the general meeting of the founders (or by the sole founder) and a decision is made on it. If the decision is positive, then the new participant is included in the company and his contribution increases the authorized capital.

SUBMISSION OF DOCUMENTS FOR STATE REGISTRATION OF INTRODUCTION OF THE FOUNDER INTO THE LLC

SUBMISSION OF DOCUMENTS FOR STATE REGISTRATION OF INTRODUCTION OF THE FOUNDER INTO THE LLC

After all documents have been prepared and certified by a notary, the applicant, or his representative, acting on the basis of a notarized power of attorney, must submit the documents to the registration authority.

Registration of legal entities, as well as registration of changes in the Unified State Register of Legal Entities and constituent documents of legal entities in Moscow, is carried out by the Inspectorate of the Federal Tax Service of Russia No. 46.

MIFTS No. 46 for Moscow is located on the territory of a complex of buildings along with IFTS No. 33, MIFTS No. 45,46,47,48,49 and 50, in building No. 3.

According to the LLC Law, the executive body is obliged to notify the MIFTS about this event within 1 month from the date of receipt of the official application for withdrawal from the LLC.

Payment of the actual value of the share to the participant leaving the LLC

Payment of the actual value of the share to the participant leaving the LLC

Within three months from the date of filing an official application to withdraw from the LLC (unless a longer period is specified in the LLC charter), the withdrawing participant must receive the actual value of his share, that is, the company must fully reimburse him the corresponding amount proportional to his share in the authorized capital of the LLC. Payment can be made either in cash or in property. Reimbursement of the cost of a share by services is not allowed, and if it is intended to be received with the property of an LLC, then only with the written consent of the recipient.

If the LLC is officially declared bankrupt and cannot pay the share to the withdrawn participant, then it is obliged to return the rights to his share to him - to restore him as a participant in the LLC - no later than 3 months from the expiration date of the possible compensation (that is, 6 months after receiving the application for exit from LLC).

When determining the total amount of payment, the size of the LLC’s net assets is taken into account as of the end of the last reporting tax period (for the last month) in accordance with the share of the withdrawing participant. For example, if the net assets of an LLC are 100,000 rubles, the authorized capital is 10,000 rubles, and the share of the withdrawing participant is 50%, then the amount of the payment must be calculated as follows - 100,000 (net assets) X 5000 (participant’s share in the authorized capital) / 10,000 (amount of authorized capital).

Conclusion

Thus, the process of changing the founder of an LLC can be completed quite quickly - in 14-20 days. Moreover, it is not at all necessary to formalize the purchase and sale transaction of a share in the management company with a notary - you can initially expand the composition of the founders, and then reduce it.

In conclusion, I would like to say that registering a change in the composition of the founders of an LLC by entering/withdrawing a participant is, in principle, a simple process, and if you have the necessary time, attention in working with documents and, most importantly, desire, then everything will work out for you!

Well, if you have neither the time nor the desire to wander around the authorities and delve into the intricacies of registration, studying laws, recommendations, etc., then perhaps it makes sense to turn to “registrars” companies, for example, Exclusive Processing LLC , which will take care of all the hassle for little money and help you complete all the necessary registration steps in the shortest possible time. In any case, we wish you success!

CHANGES IN THE PROCEDURE FOR CHANGING PARTICIPANTS IN LLC SINCE JANUARY 1, 2016

CHANGES IN THE PROCEDURE FOR CHANGING PARTICIPANTS IN LLC SINCE JANUARY 1, 2016

- An application for withdrawal from the membership of an LLC is subject to notarization;

- The protocol and decision to increase the authorized capital of the LLC are certified by a notary.

- A share or part of a share in the authorized capital of an LLC passes to its acquirer from the moment the corresponding entry is made in the Unified State Register of Legal Entities

If there is more than one participant in the LLC, the notary must certify the fact that a decision was made to increase the authorized capital. According to legislators, these changes will make it more difficult for corporate raiders to take over companies, but, of course, will increase the costs of transactions with shares. The cost of notary services cannot be called low; the average price for certification of a protocol on increasing the capital capital and an application for leaving the LLC is 8,100. Attention: from March 23, the decision of the sole participant in the LLC to increase the capital capital is also subject to notarization

The procedure for certifying a transaction for the purchase and sale of a share in an LLC

The procedure for certifying a transaction for the purchase and sale of a share in an LLC

The entry into force of Federal Law No. 312-FZ of December 30, 2008 introduced a number of key changes to the process of registering a change of members of the Company and changes made to the Unified State Register of Legal Entities and the constituent documents of limited liability companies. According to the requirements of the law, transactions aimed at the alienation by a company participant of a share or part thereof in the authorized capital of an LLC to third parties require notarization, after which the notary who certified such a transaction, within the period specified by law, performs a notarial act of transferring the documents to the registering authority on the basis of which the registering authority makes changes to the Unified State Register of Legal Entities.

Change of founder by selling a share or donating it to a third party. In this case, the transaction is formalized by a notary.

This registration process involves:

- obtaining the consent of the spouses for the purchase and sale of shares in the LLC;

- collection of necessary documents for certification of the purchase and sale transaction by a notary;

- execution by a notary of a contract for the sale and purchase of a share in an LLC;

- payment of notary services;

- payment for submission of documents by a notary to the tax office or sending documents by mail with receipt of documents by mail to the seller’s home address:

SERVICES FOR CHANGE OF PARTICIPANTS IN LLC

1 If there is more than one participant in the company.

2 To register amendments to the Unified State Register of Legal Entities and the constituent documents of the organization, the personal presence of the head of the company is necessary in order for a notary to certify the authenticity of his signature in the documents, after which the registration documents are submitted to the registering authority. You can submit documents to the registration authority using a notarized power of attorney

Show as:

Step-by-step instructions for changing LLC founders in 2019, including all the latest changes in legislation. Changing the founders of an LLC with step-by-step instructions will be useful both for self-registration of changes and for general familiarization with the procedure for changing company participants.

How to change the founders of an LLC

You can change the composition of the company's participants in two ways:

- Sell your share to a third party through a purchase and sale agreement, with mandatory notarization. A notarized sale and purchase has several advantages over another method: it is a change of owner and share from the moment of notarization of the agreement, the deadline for registering changes with the tax office is 5 business days from the date of filing the documents. But the cost of this method makes it not acceptable, because... in addition to paying for legal services, notarization of the registration application and notarized power of attorney, the applicant must pay for the purchase and sale agreement. The cost of a notary agreement in Moscow per participant: 25 - 35 thousand rubles, plus a change of general director - 7 thousand rubles.

- Changing the company's participants using an alternative method, by introducing a new participant with an increase in the authorized capital and withdrawing the old participant with the distribution of his share. This method is the most common and economical, because The method is simple and there is no need to pay for a notary purchase and sale.

Changing founders step by step

The first stage of changing the composition of founders is the introduction of a new participant into the LLC with an increase in the authorized capital.

First step : Preparation of documents

To register changes, you will need to prepare the following documents:

- Application for acceptance of new members. A future member of the company must write an application addressed to the general director about his acceptance as a member of the founders of the LLC. This statement must reflect the size of the share that the new participant wishes to have, as well as the amount that he will contribute to the authorized capital of the company.

- Minutes of an extraordinary general meeting of participants or a decision to increase the authorized capital. Please note that in the first stage, when a new participant is introduced, a new version of the charter is created, therefore, with the replacement of the charter, you can combine a change of legal address, change the general director, change the occupancy codes, bring the charter into compliance, and indicate a shortened legal address. We also reflect all actions in the protocol or decision. The founders' shares can be indicated both as percentages and fractions; to simplify the calculation of shares, indicate the shares in fractions. Please note that since 2017, the protocol and the decision of the sole participant to increase the authorized capital are subject to mandatory notarization.

- Develop a new edition of the charter (2 copies) or create a list of changes to the current charter. The new edition will reflect the new amount of the authorized capital, as well as all your changes that you decide to make.

- Prepare and fill out an application according to form No. P13001. The statement also reflects everything that we wanted to change.

- Prepare a document certifying payment of the share of the authorized capital of the new founder. This can be a bank certificate confirming payment for the capital account, or a cash receipt order for depositing the capital account into the company's cash desk. Within 3 working days after payment of the Criminal Code, it is necessary to have the documents certified by a notary and submit for registration to the tax office

- Receipt of payment of the state fee for registration of changes. Currently, the state duty is 800 rubles. You can pay through a Sberbank branch, or at the tax office when submitting documents at the terminal, which will be faster and more convenient.

Second step:

Any registration of changes will require notarization of registration documents. The applicant will always be the current general director of the company; in the event of a simultaneous change of general director, the applicant will be the new director, and all current participants of the company will also be required, because in 2019, the decision or protocol when increasing is required to be notarized.

Before visiting the notary, you will need to sign all prepared documents by all current and new members of the company, prepare a folder with documents, the notary will require a complete set of documents for the company, including newly created documents, as well as your constituent documents.

It is also necessary to take into account the fact that most notaries require a current extract from the Unified State Register of Legal Entities, so you will need to order it from the territorial tax office (the state fee for an urgent extract is 400 rubles, issued the next day from the date of filing the application).

The notary must certify the signature of the applicant (general director) on the application in form No. P13001, if a proxy will submit and receive, then a notarized power of attorney and a copy of the right to submit and receive documents will be required. Average cost of notary services: RUB 1,700. for certification of the form + 2,400 rubles. power of attorney (for submitting and receiving documents without your participation), 1,500 rubles for certification of the decision.

If there are two or more founders in the company, then the protocol on increasing the authorized capital will need to be notarized; the average cost is 8,500 rubles and will require the presence of all participants in the company.

Third step : Submitting documents to the tax office

Next, you need to go to the registration authority, pay the state fee at the terminal, if you have not paid in advance, receive a coupon in the electronic queue and submit the prepared documents for registration of changes. Registration of companies and changes in Moscow is carried out by the Federal Tax Service No. 46, which is located at the address: Moscow, Pokhodny Proezd, building 3, building 2. (Tushino District).

Submitting documents yourself is not a quick process; on average, it will take you about three hours.

After submitting documents for registration of changes, the inspector will give you a Receipt for Acceptance of Documents, which will indicate the date of receipt of the completed registration documents.

Fourth step: Receiving ready documents

On the sixth working day from the date of submission of documents, you must come to the tax office with a receipt and receive the completed documents.

At the tax office you will receive:

- Unified State Register of Legal Entities;

- A new version of the charter (1 copy), certified and marked by the registering authority.

At this point, the first stage “Entering a new participant” is completed.

Fifth step: Preparation of documents for registration of changes in the participant's output

- Statement on withdrawal of participants. A company participant leaving the founders must write a statement addressed to the general director about leaving the LLC founders. This statement must reflect the size of the share of the authorized capital that will be transferred to the company. Please note that the participant’s withdrawal application must be notarized.

- Minutes of an extraordinary general meeting of participants or a decision on the distribution of the company's share. The main agenda in the minutes is the distribution of the share in the authorized capital of the Company owned by the Company among all participants of the Company.

- Prepare and fill out an application according to form No. P14001. Please note that when submitting form No. P14001, the state fee is not paid. A new edition of the charter is not required in this case, because all changes to the charter have been made.

Sixth step: Certification of documents by a notary

The sixth step fully corresponds to the second step from the first stage. The applicant is also the general director; all documents of the company will be required.

The cost of notary services is: 1,700 rubles. for certification of the form + 3,100 rub. for certification of the participant’s withdrawal application.