Determination of the market opportunities of the enterprise based on materials: LLC “Guardians of Order. Marketing research is the basis for determining the market opportunities of an enterprise. Formulating a market opportunity.

The second step of SWOT analysis is a kind of “terrain reconnaissance” - market assessment. This stage allows you to assess the situation outside your enterprise and understand what opportunities you have, as well as what threats you should be wary of (and, accordingly, prepare for them in advance).

The method for determining market opportunities and threats is almost identical to the method for determining the strengths and weaknesses of an enterprise:

1. A list of parameters is compiled by which the market situation will be assessed;

2. For each parameter, it is determined what is an opportunity and what is a threat to the enterprise;

3. From the entire list, the most important opportunities and threats are selected and entered into the SWOT analysis matrix.

Let's look at an example.

The following list of parameters can be taken as a basis for assessing market opportunities and threats:

1. Demand factors(here it is advisable to take into account the market capacity, the rate of its growth or contraction, the structure of demand for the enterprise’s products, etc.)

2. Competition factors(one should take into account the number of main competitors, the presence of substitute products on the market, the height of barriers to entry and exit from the market, the distribution of market shares between the main market participants, etc.)

3. Sales factors(it is necessary to pay attention to the number of intermediaries, the presence of distribution networks, terms of supply of materials and components, etc.)

4. Economic forces(the exchange rate of the ruble (dollar, euro), inflation rate, changes in the level of income of the population, state tax policy, etc. are taken into account)

5. Political and legal factors(the level of political stability in the country, the level of legal literacy of the population, the level of law-abidingness, the level of government corruption, etc. are assessed)

6. Scientific and technical factors(usually the level of development of science, the degree of introduction of innovations (new goods, technologies) into industrial production, the level of government support for the development of science, etc. are taken into account)

7. Socio-demographic factors(one should take into account the size and age-sex structure of the population of the region in which the enterprise operates, the birth and death rates, the level of employment, etc.)

8. Socio-cultural factors(usually the traditions and value system of society, the existing culture of consumption of goods and services, existing stereotypes of people’s behavior, etc. are taken into account)

9. Natural and environmental factors(the climate zone in which the enterprise operates, the state of the environment, public attitude towards environmental protection, etc. are taken into account)

10. And finally, international factors(among them, the level of stability in the world, the presence of local conflicts, etc. are taken into account)

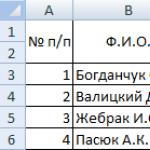

Next, as in the first case, the table is filled in (Table 2): the assessment parameter is written in the first column, and the existing opportunities and threats associated with this parameter are written in the second and third columns. The table provides examples to help you understand the list of opportunities and threats for your enterprise.

Table 2. Identification of market opportunities and threats

After filling out Table 2, as in the first case, you need to select the most important ones from the entire list of opportunities and threats. To do this, each opportunity (or threat) must be assessed on two parameters by asking two questions: “How likely is it that this will happen?” and “How much impact will this have on the business?” Those events are selected that are likely to occur and will have a significant impact on the business. These 5-10 opportunities and approximately the same number of threats are entered into the corresponding cells of the SWOT analysis matrix (Figure 2).

2.1 Market opportunity analysis

Market opportunity analysis involves identifying markets and assessing marketing opportunities. Businesses must be able to identify emerging market opportunities.

They derive most of their current income and profits from the sale of goods that they did not produce or sell.

Market identification .

The company analyzes markets based on the following approaches: 1) deeper penetration into the market; 2) expanding market boundaries; 3) product development; 4) diversification. Let's consider the listed approaches using the example of a company that produces detergents. This is to ensure sales growth to an established group of buyers without making any changes to the product itself. A company producing shampoo will work with products already produced in developed markets, but to increase sales, it will use a reduction in the price of shampoo, an increase in advertising costs, and distribution of shampoo through a larger number of stores. In essence, we are talking about competitively attracting consumers of shampoo from other brands, without losing their customers.

Expanding market boundaries - This is the introduction of an already produced product to new markets. The manager of the company's shampoo is searching for new markets. To do this you need to study demographically new markets (children, teenagers, youth, seniors) to encourage consumers to switch to branded shampoo and purchase it more actively. A review should be done market organizations(hairdressers, beauty salons) to find out whether it is possible to attract them as buyers. Review needed geographically new markets to see if they can be developed.

Product development - This is an offer of a new product to existing customers of the enterprise. A shampoo manager is looking for opportunities to offer new products to the company's customers.

You can master the production of branded shampoo in new packaging, either with a new scent or the inclusion of new components, or in new packaging.You can launch completely new brands of shampoos aimed at different groups of users, or other hair care products (for example, hair styling products).

Diversification is a combination of offering new products and new markets. An enterprise can develop or acquire completely new production facilities aimed at new markets. It may try to develop a new business - open beauty salons. Many businesses are eager to identify new, enticing industries. Half the secret of success is to be able to penetrate promising areas of activity. Assessing Marketing Opportunities.

It is not enough to just identify market opportunities; you must determine which ones are suitable for the enterprise.. Any enterprise pursues a certain range of goals. For example, if it is engaged in the production of hair care products, it most likely pursues the goals of achieving high levels of profit and distribution, increasing sales and winning the favor of customers. It is likely that these goals themselves exclude non-professional engagement in other types of activities, for example, computer production.

Resources companies. Even if the production of computers meets the company's goals, it probably will not have sufficient resources to successfully operate in this area. The computer industry requires specialists, knowledge of the secrets of technology, large capital and specific distribution channels.

Articles

Analysis of a company's market opportunities is one of the initial and, according to this, a particularly important stage in establishing the company's market opportunities. Each company must realistically assess its existing opportunities and new ones that are opening up in the market. This is especially significant since none of the structures operating in the market can constantly rely on the achieved place in the market, because, it is quite clear that the life expectancy of a service or product is insignificant. Each company or firm must realistically assess its potential capabilities, in particular, the strengths and weaknesses of its activities.

Analysis of market opportunities. Firn involves taking into account the following components:

o system of marketing research and marketing information;

o assessment of the marketing environment;

o analysis of individual consumer markets;

o enterprise market analysis

Analysis of a firm's market opportunities includes detailed study;

1) the socio-political state of the environment;

2) government restrictions on trade;

3) statistics of the country's markets;

4) competition in the existing market;

5) characteristics of consumer behavior;

6) the effectiveness of sales promotion means;

7) features of promotion and sales conditions;

8) standardization and quality requirements

The process of theoretical justification for assessing a firm’s market opportunities goes through a number of stages

Stage one - selection of specific goals from a set of goals (making a profit, achieving sales (revenue), conquering a geographic market)

Stage two - justification of the quality of one’s own resources (financial capital, technological know-how capabilities, marketing novelty)

Stage three - comparison of opportunities with the chosen mechanism for developing the sales market

Stage four - identifying the capabilities of the distribution system and trading network

Expanding the boundaries of the market involves studying demographic markets, in particular for various age groups of the population (possibly children and youth, etc.), reviewing the market of organizations - with the possibility of increasing their sales and geographic markets - markets of various territories and countries.

Identifying and assessing market opportunities generates a lot of ideas, among which you need to choose the best and most realistic one. This involves the use of statistical methods to evaluate different ideas

. Marketing opportunity for the company- this is the prerogative direction of marketing efforts in which a particular company can achieve a competitive advantage. First of all, it is necessary to assess how well the company's marketing opportunity matches the company's goals and resources. Each opportunity must be examined in terms of market size and opportunity (Table 103.3).

The firm's market opportunities are assessed using a system of indicators, which is divided into two groups. This allows you to objectively assess the process of the company’s market strategy in competition.

The indicators of the first group include:

o the share of the company selling goods and services on the market;

o dynamics (growth rates, increment) of revenue volumes by year or other periods of time;

o degree of customer satisfaction (structure of positive, negative and vague feedback on use)

The indicators of the second group include:

o profit volumes and its dynamics;

o rate of profit;

o level of labor productivity

. Table 103. Market opportunities of the enterprise

|

Production |

Sales |

Management |

Marketing |

Finance |

|

Production volumes, structure, growth rates |

Transportation of products |

Organization and management system |

Market research, sales channels |

Financial stability |

|

Technological level |

Inventory storage |

Personnel (number, professionalism, staff turnover) |

Innovations |

Solvency |

|

Flexibility of production lines |

Inventory turnover |

Performance Management |

Pricing |

Profitability |

|

Assortment (degree of renewal, width, depth) |

Availability and capacity of warehouses |

Corporate culture |

Loans, own funds |

|

|

Equipment availability |

Opportunity packaging and packing |

Communications |

Analysis of enterprise capabilities (by product, by market, by consumer) |

|

|

Power reserves |

Sales of goods (by individual goods, segments, consumers, etc.) |

Marketing budget |

||

|

Marketing plans and their implementation |

||||

|

Infrastructure |

Taken together, all these indicators determine the competitive advantages of this structure. The main indicator characterizing the market position of an enterprise is its market share. This indicator is determined by the ratio of the volume of sales of goods to the total volume of sales of goods in a certain market segment. After determining the listed indicators, it is advisable to find out what opportunities should be taken advantage of in order to obtain positive results that will contribute to gaining a strong position in the market.

Determining the competitiveness of a company is carried out using a set of methods, which include:

o comparative advantage method;

o method of equilibrium theory;

o method of the theory of effective competition;

o method of the theory of quality of goods and services;

o matrix combination method

The essence of the comparative advantage method is that firms apply it to the production of those goods for export that are the cheapest

When applying the method of equilibrium theory, firms gain benefits by taking into account comparisons of groups of indicators that characterize the relative costs of the main factors of production (bank loan rates, the relative cost of purchased equipment), and which are ultimately lower.

The method of the theory of effective competition is based on the development of a system of such indicators, the value of which allows the company to be at a high level in a competitive market (the level of profitability, return on investment, etc.).

The essence of the method of the theory of product quality is the application of parameters characterizing the system of consumer qualities of goods and services (economic, organizational, technological)

For a general assessment of the enterprise’s position against the background of competitors or market leaders, which will serve as the basis for the development of appropriate strategies and programs, the method of key (critical) success factors can be used, that is, significant resources and skills that create a competitive advantage for enterprises in the market and can be crucial to their success in the future. For this purpose, the methodology developed within the framework of the PIMS (Profil Impact of Market Strategies) program, which identifies 37 factors affecting the profitability of an enterprise, can be used.

By. Kotler, to assess competitive advantage, it is advisable to use the following 12 key factors:

o market share;

o sales growth rate;

o product quality;

o brand reputation;

o distribution network;

o effectiveness of communications;

o use of production capacity;

o production efficiency;

o unit cost of production;

o sources of supplies of raw materials;

o research and development expenses;

o management personnel

By comparing the funds of your own company with the funds of competitors according to the specified factors (Fig. 105), you can evaluate the position of your own company in the market against the background of competitors, using the so-called competition profile.

Fig 105 - . Competitiveness profile of the company(based )

The essence of the method of combining matrices is the use of mathematical matrices, where there are constant and variable quantities. All of these methods enable the consulting firm and the marketing service to objectively evaluate and identify the manufacturing company on the product market and beyond.

In marketing practice, another method of assessing a company’s position in the market has become quite widespread, which makes it possible to decide on the choice of one of the possible strategies for its activities:

o attack strategies in a favorable position (C,);

o defense strategy for an average, uncertain position (C2);

o retreat strategies in case of an unfavorable position (C). This method is called the strategic matrix

A strategic matrix is a spatial model that reflects a company's position in the market depending on a combination of two factors. In this case, they characterize the market situation and the company’s own capabilities. D. For each factor, a multidimensional average is determined, which gives an integrated characteristic of the factor.

The situation on the market can be characterized by the growth rate of the total volume of sales of goods on the market, inventory, price fluctuations, indicators of the intensity of competition, as well as market capacity, average profit margin, etc. The company's own capabilities or its competitiveness can be reflected by the share that the company occupies in the market , competitiveness of the product, credit and financial potential. The strength of the company, the efficiency of product distribution, the qualifications of the marketing service, the image of the company, etc. The noted set of factors is not static and can vary depending on the type of market, type of product, available information and other factors. Instead of calculating a multidimensional average, strategic indices can be used, which are determined using the formula:

Where. B - average score (strategic index) of the i-th set of factors; VI - a score assigned by an expert to each factor depending on its magnitude or strength of action; IV i-rank or weight of each factor depending on its significance and role in the complex of factors (determined by experts.

Figure 106 shows the algorithm of the strategic marketing matrix. In the presented coordinate system, the strategic index of the market situation (A) is placed on the ordinate axis; the strategic index is placed on the x-axis. Code of own capabilities (competitiveness) of the company (B). In this case, quantitative assessments can be replaced by qualitative ones, in particular by ranks. For example, good, high (rank 1), bad, low (rank 2). Based on the combination of family factors, the quadrant in which a given company falls is determined, which is the basis for making decisions about behavior in the market (C). In accordance with this, one of the following strategies can be applied:

o attack strategy (C,), in cases where the company takes a strong position;

o defense strategy (C2), when the company’s position is assessed as average;

o retreat strategy (C3), when the firm’s position is clearly unprofitable and weak. Strategic indices of the market situation and the company's own capabilities (competitiveness) are determined and serve as the basis for determining the company's ranking position. It is determined by the geometric mean:

Fig 106 - . Strategic Marketing Matrix Algorithm

where 0-A is the market situation;

0-B own capabilities (competitiveness) of the company

A summary assessment of the company’s position in the market is given in Table 104

Note that in practice, quite often, instead of integrated strategic indices, only two factors are used that most fully characterize the market situation and the company’s capabilities. Such factors are, most likely, the rate of sales growth and the market share of a given company, no less, and this approach requires certain calculations and information. We especially note that in practice it is very difficult to obtain data on volumes, market sales and the share of the company. In such cases, certain relative indicators are used, and information is obtained on the basis of expert ones. Rate it.

Table 104 - . Assessing the company's position in the market

The definition and detailed analysis of all of the above parameters using a set of methods will allow the company to objectively assess its own capabilities (advantages and disadvantages) in a complex, sometimes brutal and tough competitive environment in the product market and beyond.

No company can operate effectively unless it really assesses the market situation. Any long-term or short-term marketing decision made by a company can only be based on market conditions. Evaluatek.

Only after this, the company’s specialists begin to design a market strategy and product sales tactics for updating or capturing the market

Files: 1 file

COURSE WORK

in the discipline "Marketing"

on the topic: “Determining the market opportunities of an enterprise”

based on materials: LLC "Guardians of Order"

CONTENT

Introduction………………………………………………………………………………….…3

Chapter 1. Theoretical aspects of determining the market opportunities of an enterprise

1.1 Principles of market opportunities……………………………………………………………… ….….4

1.2 Methods for identifying market opportunities……………………… …………………6

1.3 Problems of identifying market opportunities in modern conditions…………10

Chapter 2. Determination of market opportunities of LLC "Guardians of Order"

2.1 Technical and economic characteristics of LLC “Guardians of Order”……………………13

2.2 Marketing analysis of LLC “Guardians of Order” ……………………………………………………….21

2.3 Problems of selection and methods for determining market opportunities of LLC “Guardians of Order”……………………………………………………………… …………………………..... 24

Chapter 3. Development of measures to develop market opportunities of Guardians of Order LLC

3.2 Participation in specialized exhibitions…… ………………………………….……..29

3.3 Assessing the effectiveness of measures to develop market opportunities………………………………………………………………………….31

Conclusion……………………………………………………………………………….34

List of sources used……………………………………………………….……..35

Introduction

The basis of a modern market economy is the marketing approach to organizing activities at the enterprise level. It seeks to use a new concept for itself in order to adapt to the existing, very difficult, conditions of the transition economy.

The relevance of the study of market opportunities is determined primarily by the enterprise’s orientation to primarily satisfy the needs of product consumers.

To carry out its activities, the enterprise has a set of economic resources. Of particular importance for the success of production activities is the availability of a certain range of services, or capital.

The purpose of the work is to determine the market opportunities of the enterprise "Guardians of Order" LLC.

Job objectives:

Study the theoretical aspects of determining market opportunities; market opportunity marketing

Study the principles and methods of identifying market opportunities;

Conduct an analysis of the financial condition of the enterprise;

Identify problems in identifying market opportunities in modern conditions;

Conduct technical and economic characteristics and analysis of marketing activities at Guardians of Order LLC.

Development of measures to improve methods for determining market opportunities of Guardians of Order LLC.

1. Theoretical aspects of determining the market opportunities of an enterprise

1.1 Market opportunity principles

The following principles are typical for determining market opportunities:

Orientation of all research and production and sales activities to the market, taking into account its requirements;

Ensuring a differentiated approach to the market;

Focus on innovation;

Flexible response to any change in market requirements;

Constant and targeted impact on the market;

Long-term orientation;

Effective leadership;

Orientation of the company's internal policy towards people.

1. Orientation of research and production and sales activities to the market, taking into account its requirements.

This voluminous, highly qualified research and practical work involves a deep and comprehensive study of market needs, market and general economic conditions. Market capacity, pricing system and price dynamics, consumer properties of the product, construction features and methods of work of partner firms in the economic and foreign economic spheres, sales channels, etc. are subject to analysis.

The production and sales capabilities of the enterprise itself are studied, including audits of the range of services provided, production capacities, logistics and supply systems, and the scientific and technical potential of the enterprise. An analysis is carried out of the structure and level of qualifications of personnel, financial capabilities, conditions for the formation and activities of supply, sales and commercial services.

2. Providing a differentiated approach to the market. The modern market is characterized by the presence of a large number of purchasing groups with different needs. Therefore, in most cases, when segmenting a market, it is necessary to divide potential consumers into groups, which, on the one hand, should be as homogeneous as possible in many essential characteristics, and on the other hand, sufficiently representative to organize sales activities in these segments. This division will allow adaptation to the specific needs of consumer groups. This approach is called segmentation; with its help, the principle of a differentiated approach to the market is implemented.

3.Orientation towards innovation. The result of the enterprise's program being aimed at satisfying rather rapidly changing consumer demands is the introduction of new services to the market or the development of new markets.

First of all, innovation involves the constant improvement of services and their modification, updating existing and creating new services, developing new technologies and new areas of R&D, but is not limited to this. The innovation policy includes the introduction of new forms and methods of entering new markets, the introduction of novelty in sales promotion and advertising activities, the formation of new services in enterprise management, and the identification of new channels for promoting services.

4. Flexible response to any change in market requirements. Currently, in order to strengthen its competitive position, an enterprise needs to link a strategy of active adaptation to changing market requirements with a simultaneous targeted impact on it. The enterprise is based on the principle of broad response to the provision of services to existing and potential demand, i.e. it assumes management mobility and the ability to quickly adapt the production, marketing and research activities of firms to changing market requirements. At the same time, it is necessary to influence the consumer in order to create in him a favorable attitude towards the company and its services, as well as in order to arouse his desire to purchase the services offered. To influence consumers, enterprises use various means: advertising, sales promotion.

5. Constant and targeted impact on the market. It affects the time aspect: the enterprise’s focus is not on immediate, but on long-term results. In contrast to the concept of intensifying commercial efforts, when the foreground is often a short-term increase in sales of services through the efforts of intermediaries, lower prices, etc., with a marketing orientation, an enterprise requires longer periods of time to plan and implement its activities. First, they make a thorough analysis of sales markets, then lay the foundations, for example, develop appropriate new service products, and after that, perhaps, the services are introduced to the market. Years can pass between the emergence of an idea and its success in the market. Thus, the typical task of marketing is rather the long-term retention of markets for services.

6. Long-term orientation. This principle in no way contradicts the principle of flexible response to changing market requirements, but is closely linked to it and is its logical continuation and addition. The implementation of the principle of long-term orientation in combination with the use of strategic management methods provides the opportunity for the development of a company in conditions of increasing levels of instability in the external environment, providing for the use of appropriate mechanisms for effective adaptation to a changing situation.

7.Effective leadership. One of the operating principles of companies that ensures success in the market is the orientation in personnel policy towards outstanding managers. The prosperity of a company depends on intelligent and aggressive management. The manager must establish relationships with employees that motivate them to do their jobs more effectively. Managers must be able to see the needs of the company as well as the tasks of departments, be able to plan for future development, and be open to new ideas.

8. Orientation of the company’s internal policy towards people. This is the basic principle of many companies. Marketing thinking involves creating and maintaining a microculture in the organization that will ensure the unity of the way employees act, stimulating their desire for excellence. This principle presupposes, first of all, respect for the person - the main value of the company, liberation of his creative energy, giving him the opportunity to show initiative, independence and entrepreneurship. 1

1.2 Methods for identifying market opportunities

In order to get a clear assessment of the company's strengths and the market situation, there is a SWOT analysis.

SWOT analysis is the identification of the strengths and weaknesses of an enterprise, as well as the opportunities and threats emanating from its immediate environment and opportunities.

The SWOT analysis technique is an extremely effective, accessible, cheap way to assess the state of the problem and management situation in an enterprise. The technology for working with the material obtained during a SWOT analysis is extremely simple.

This is an extremely universal method that can be used to analyze the activities of specific departments. In some cases, it can be used to assess the strengths, weaknesses, opportunities and threats in personnel work and when making management decisions. In addition, the use of SWOT analysis technology by the marketing service when assessing the main competitors creates excellent preconditions for developing competitive tactics and ensuring competitive advantages. In this case, the maximum degree of detail in each of the quadrants of the SWOT analysis is extremely important.

For a manager at any level in an organization, the SWOT analysis technique is an excellent aid in practical activities, allowing one to systematize problem situations and better understand the structure of resources that should be relied upon in improving the activities and development of the organization.

Fig. 1 - Sequence of SWOT analysis

SWOT analysis helps answer the following questions:

1. Does the company use internal strengths or differentiating advantages in its strategy?

2. Are the company's weaknesses its competitive vulnerabilities or do they prevent it from taking advantage of certain favorable circumstances?

3. What opportunities give a company a real chance of success by leveraging its skills and access to resources?

4. What threats should a manager be most concerned about and what strategic actions should he take to ensure a good defense?

In general, conducting a SWOT analysis comes down to filling out the matrix, Table 1, the so-called “SWOT analysis matrix.”

Table 1 - SWOT analysis matrix

The strengths and weaknesses of the enterprise, as well as market opportunities and threats, must be entered into the appropriate cells of the matrix.

The first step of a SWOT analysis is to assess your own strengths. The first stage allows you to determine what the strengths and weaknesses of the enterprise are.

Short description

The purpose of the work is to determine the market opportunities of the enterprise "Guardians of Order" LLC.

Job objectives:

- Study the theoretical aspects of determining market opportunities; market opportunity marketing

- Study the principles and methods of identifying market opportunities;

- Conduct an analysis of the financial condition of the enterprise;

- Identify problems in identifying market opportunities in modern conditions;

Luke Williams Chapter from the book “Coup. Proven Market Capture Methodology"

Publishing house "Mann, Ivanov and Ferber"

Thus, Apple used its chance to give people a tangible sense of control over high technology by establishing close physical contact between the user and the computer.

Think again about the words “we are not afraid of what we want to touch.” Such insight is only possible with the constant attention and observation of those involved in high technology. To develop insight and the ability to identify new market opportunities, you need to learn to notice situations that show how customers feel and help you understand their motivations (regardless of what people say).

In the first chapter you identified several stereotypes. You rejected some, turned others around, and for others you expanded the scope - and as a result, three breakthrough ideas appeared. But hypotheses do not exist in a vacuum. The people you want to pitch your ideas to must believe they will benefit from the change. So as you consider how to put your hypotheses into action, keep in mind the people involved and their needs.

Why is this so important? Because a breakthrough for the sake of a breakthrough will cause nothing but irritation. The reason most hypotheses die early is not that they are too radical; it's just that the benefits of a breakthrough aren't very clear. In other words, the reason is not a lack of creativity on the part of the entrepreneur, but a lack of understanding of consumer needs.

To truly gain insight (and I will definitely teach you this), you need to immerse yourself in the world of your clients and try to look at the situation through their eyes. You need to observe, not convince. Let's start by taking a hard look at the real world in which you want to test your hypothesis. Who lives in it? What are these people's needs? What is the motivation? At this stage, hypotheses are turned into market opportunities.

Fast and easy

Formally, the environmental research methods I describe in this chapter can be defined as ethnographic and contextual research. The definition is not that important. This research, whatever you call it, should be quick and informal, intuitive and thorough, and most importantly, accessible. It should not take more than two to three days, and in many cases can be completed in two to three hours.

Of course, no one prevents you from spending several months and tens of thousands of dollars on detailed studies of demographic and psychographic market segmentation, conducting focus groups and quantitative research. But, in my opinion, you will get much more information (especially if you are just trying to create something new) by observing people and asking them thoughtful questions. In most cases it won't cost you anything. This is what I want to emphasize: Anyone can (and should) feel empowered to start their own business and produce products or services without the risk of drowning in the sea of complexities associated with typical market research.

To be clear, I'm not trying to prove that my method is all-encompassing. Yes, he doesn’t pretend to be. But it is an effective way to develop observation skills. Once you make your observations, you can immediately check whether they are correct. Once you are sure of this, you can move on to the next step. If it turns out that the results do not meet expectations, you can conduct the observations again without spending a lot of time and money.

Once you have gathered the necessary information and determined the environment in which you will be working, you will organize your observations, analyze them and prioritize them - this will ensure that you understand the situation.

What are your observations?

Before you delve into the research, you need to clearly formulate the main questions that you would like answered. This does not mean that these are the questions you will ask clients. (You may ask some questions, but most of the information will come from simple observations.) The objectives of the study are driven by the provocative hypothesis discussed in the first chapter, and the analysis itself focuses on consumer relationships with a particular industry, segment, or category.

How and where do your customers interact with existing products and services in your industry, segment or category?

What steps do they have to take to purchase products or services?

How does an industry, segment, or category make consumers feel?

What are the social contacts of consumers?

How loyal are consumers to existing products, services, brands?

What support is offered to customers?

Of course, before you can actually make observations, let alone ask questions of people, you need to have a general idea of who you would like to observe and ask. Without a doubt, your target group is what business consultant Robert Gordman refers to as “essential customers”—the consumers with common characteristics who currently generate the biggest profits in your market. Assess people based on demographic characteristics (gender, age, marital status, education), as well as specific characteristics (for example, they may include food lovers, trendsetters, technophobes). Just try not to force yourself into a standard framework. Also, don't forget about outsiders - a category of customers that no one in your industry is currently interested in. Maybe they will end up being your main customers.

For example, I recently participated in a project to develop a new remote control for a TV. The frog design marketing team visited different homes. We spent many hours observing people, trying to understand what they didn't like about their existing remote control and what they were happy with. In addition, another group of marketers met with blind people, observing how they used remote controls, asking them what they liked about remote controls and how they would prefer to arrange the buttons.

If market research was done using traditional methods, no one would bother with the blind. However, the information received turned out to be invaluable. Remember how many times you were watching TV in the dark and instead of turning up the volume, you changed the channel because you couldn't see the buttons?

Once you have determined the goals of your research, your next task is to decide how exactly to conduct your observations. Below I will describe three of my favorite methods.

1. A survey by prior arrangement, during which observations are carried out. This type of research is the most widespread. As the name suggests, by asking questions that cannot be answered with a clear yes or no answer, you are at the same time observing what your interlocutor is doing in the environment in which he lives or works. This is the method Intuit used in its “Follow me home” program when it developed Quicken, a financial management computer program. Engineers spent many hours in the homes of real customers, observing their behavior and understanding their needs. And then, returning to the office, they used the data obtained to create a new version of the program.

“When the Quicken team showed up at my house, I thought they wanted to know what kind of advertising would work best for me and others like me, but that wasn’t the case at all,” says Wendy Padmos, one of dozens of volunteers who took part in the program. - The engineers were focused on the client. They wanted to know how I use their product, what is important to me and what is not. I said I wanted to be able to compare my current expenses with my average expenses over the last 12 months, and the new version has this feature!”

2. Unobtrusive observations. Because there are time and access restrictions, you may have to conduct observations in public places without obtaining prior permission. Such observations, especially in crowded places, can provide a lot of information. Since you're working in a public place, there's no need to stick to a specific schedule (and it's generally best to avoid it).

A wonderful example can be given. Architect Louis Kahn, who designed the green areas between the buildings of the Salk Institute (La Jolla, California), did not include pedestrian paths through the lawns in the original version of the plan. After observing the way people walked, he laid paths exactly where it was convenient to walk. (Remember how many times you have seen well-trodden paths that do not match the paved paths.)

3. Interception. This approach involves visiting a store, observing the shopping process, observing customer behavior, and talking with customers. Your goal is to figure out exactly how people decide to buy (or not buy) right through the process.

The surveillance methods you will use depends on several factors such as available budget, time, and target audience. For example, if your target audience is elderly diabetics, then you will no doubt have to allocate a certain time for home visits. You can also visit teenagers at home, but it’s better to chat with them in shopping centers or at an evening screening of a new film about vampires.

So what am I looking for?

The question most often asked by those unfamiliar with contextual marketing research is, “So what am I looking for?” The most common answer to this is: “Painful spots.” Unfortunately, in most cases this answer is incorrect. Business people are trained to focus only on problems - what isn't working and what needs to be fixed. They adhere to the principle “what isn’t broken doesn’t need fixing.” Leaders who can quickly identify major problems, analyze masses of data, and offer a clearly reasoned solution are most valued.

Most managers are real specialists in this, because they are motivated (including with considerable bonuses) precisely for their ability to draw conclusions and make decisions as quickly as possible. I think most marketers are also focused on finding problems that can be solved.

It is the insignificant and, at first glance, aspects that do not need improvement that can turn out to be the most fruitful in terms of innovation.

However, usually attempts to quickly identify the problem stall the entire process. The marketer is so busy looking for the “break” that he completely ignores everything else. Looking for problems is very tempting - because they are usually visible.

Customers' disappointment is obvious, and even from the outside it evokes sympathy. But more often than not, it is the minor and seemingly unimproveable aspects that can turn out to be the most fruitful in terms of innovation. Usually these are unpleasant little things that interfere for a long time, but they are not paid attention to. And they are ignored precisely because they do not change. Take, for example, a simple paint can. For many years, these cans were made of tin, with a lid that could be opened with a screwdriver. But now Dutch Boy Paint comes to market with the "Twist and Pour" can, a one-gallon plastic container with an easy-to-screw lid and a convenient spout that won't leak. Thanks to the molded handle, it is much more convenient to carry the can and pour paint. Dutch Boy Paint Marketing Director Adam Chafe explains: “Customers tell us that the Twist and Pour paint can is an innovation that should have been introduced to the packaging market a long time ago.” As this example shows, the usual way of doing something (for example, opening a can of paint with a screwdriver) is not always optimal.

That is why, instead of looking for serious problems, it is worth paying attention to smaller ones - insignificant “moments of tension”; they are so minor that they are not even considered a problem. Unfortunately, such moments are often difficult to identify: they are not paid attention to. They do not present themselves as “real” problems. These are just ordinary inconveniences that people are used to putting up with.

It will be much easier to identify these “moments of tension” if you know what you are looking for. I will give four types of such problems.

1. Workaround maneuvers. These are quick and effective solutions aimed at combating symptoms, not the problem itself. Sidestepping maneuvers can even be dangerous, because as the symptoms disappear, the motivation to solve the problem itself disappears. And over time, the problem becomes more serious, and someone proposes a new workaround. In systems thinking, this vicious circle is called problem shifting.

Seth Godin has his own term for flanking maneuvers; Here's what he writes on his blog: “Has global warming become a problem? Shave the bears' heads. This “shave of the bears” is the elimination of symptoms instead of treating the disease. One Japanese public service advertisement showed a girl shaving a bear so that it could withstand global warming.”

When frog design was working on a project for a car company, we heard project manager Mike Lavigne say, “A car is about more than just driving.” Mike and his team found that people in the car often check email, make phone calls, and work on the computer, even though the car is not designed for such activities. Open your eyes and you will see how many workarounds people have found to get around the usual inconveniences (for example, they came up with sticky notes that cling to the computer screen).

2. Values. Human values play an important role in motivating actions. What do people value? What is important to them and what is not? For example, women and men shop differently. Numerous studies show that women are interested in connecting with a knowledgeable manager. Men are more likely to make a purchase if they find parking near the store entrance. When a product, service, or condition conflicts with values, tension occurs. This is what can help determine the qualities that consumers consider important.

In an article entitled "The Enough Revolution" published in Wired magazine, Robert Capps describes a shift in consumer values that he calls the "MP3 effect":

The MP3 format, like other “good enough” technologies, took over the market because we began to value other qualities. These changes are so serious that it is no longer possible to approach new technologies using old standards... Now we value flexibility more than accuracy, convenience more than characteristics; and we will prefer a nondescript, but high-speed device to a brilliant, but slow one. Getting what you want here and now is more important than getting a perfect product. The changes that have taken place are so deep and wide that now even the concept of “high quality” is given a different meaning.

Capps cites netbooks, e-readers, Skype, Kaiser Permanente's "microclinics" and even the MQ-1 Predator drone as examples of the "MP3 effect."

Separate high and low priority values. Has the consumer's attitude towards your products or services changed? What does the client value in them now? Is there a gap between what the consumer wants and what is available in the market?

3. Inertia. In general, the more stable people's habits, the higher the inertia, that is, the harder it is to get consumers to consider other options. For example, many bank clients say that they hate their bank and would gladly switch to another. But the prospect of closing all accounts in one place and then opening them in another is so frightening that people never move anywhere. The same is true in other industries, for example in telephony and television. If clients, due to inertia, find themselves hostage to a situation that does not suit them, tension arises. Look for situations in which consumers act a certain way simply out of habit. This is where there may be a chance to overcome the force of inertia.

In October 2005, Bank of America sought to encourage customers to open new accounts. The bank identified where inertia comes into play: people often round up financial transactions to the next whole dollar, because it’s faster and more convenient. But is it possible to overcome the force of inertia by offering clients, instead of the habit of losing money, the habit of saving it? The result is the "Your Change" program, which rounds up the amount each time a transaction is made through Bank of America to the next whole dollar, but deposits the difference into the customer's savings account. Since the launch of the program, more than 700 thousand people have opened spending accounts with the bank, and a million clients have opened savings accounts.

4. Pleasant and useful. People often have difficulties. Many of us find ourselves faced with a choice between what is pleasant (which is what we dream about at the moment) and what is useful (which promises to bring us more benefit in the long run). Dan and Chip Heath, a columnist for Fast Company magazine, argue that "people need to be saved from themselves, and that's exactly what can open up market opportunities." They cite research by Katherine Milkman, a graduate student at Harvard Business School who studied how people struggle with pleasure and usefulness, and suggested combining the two.

For example, Dan and Chip Heath write: “Exercising is good for you. What if your sports club offered you a subscription to your favorite magazines for these activities? You'd love to read the new issue of Vanity Fair, but to do so you'd have to do something useful - hit the gym. What if Blockbuster offered you a free box of popcorn (nice) for every documentary you rented (nice)?”

Try to identify where the tension arises, think about where people usually have to choose between what they want and what they should. Consider that all clients are highly motivated to do not what is useful, but what is pleasant. Maybe they need help to “protect them from themselves”?

Ideally, market research should be carried out in teams of two or three people, rather than alone: one will ask people questions, and the other will observe and record.

And remember: the expert in the area you are interested in is the consumer, and it is he who plays the leading role in the conversation, and you simply listen and ask leading questions. This dialogue will allow you to clarify details and understand how and why people act.

Focus on observations. Of course, you will ask some questions, but unfortunately this is not always the best way to gather information. On the contrary, it can often mislead you. People will only tell you what they know and what they have dealt with. They can outline problems and inconveniences, but are unlikely to offer new ideas. But there are not only obvious human needs, and it is the unobvious needs that often provide rich material for the birth of ideas.

Record all results in at least two ways. Take notes (by hand or on a computer), photographs, video and audio recordings; material received from research participants can take the form of graphs, records, reports, including on digital media. At the very least, take notes and photographs. Lastly, don't edit anything. Later you can throw away what you find unnecessary.

What did you find out?

Once you have conducted your fieldwork and recorded your observations, you need to organize the material you collected. Observations are of no use if they remain only in your head or on the computer. They must be “tangible”, they need to be pulled out into the real world. There are many ways to do this, but in any case, your observations should be on paper. You can take sheets of regular format, or cards, or yellow sticky notes for notes - whatever you like. There should be one observation on one sheet or card.

And don't forget to print the photos you take. At frog design we call this data grounding. The next step is to collect all the sheets, photographs and other materials (for example, notes made on napkins, brochures, business cards) and move them to the so-called visual board. In frog design we use a large cork board (3–3.5 m high, 1–1.5 m wide), which we lean against the wall. (You're unlikely to need such a huge board - use a simple white board or a large sheet of Whatman paper; even a regular kitchen table will do.) A visual board will allow you to collect all your observations in one place.

I understand perfectly well that the method I described seems terribly outdated (and it is). With the help of some programs you can do approximately the same thing. But our goal is to make you turn off your computer. When you write down your ideas on paper, and then hold the pieces of paper in your hands and rearrange them, changing places, the whole process becomes more real. In addition, it is much easier to organize your own thoughts and not get confused.

In their book The Myth of Paperless Work, sociologists Abigail Sellen and Richard Harper argue that paper has an advantage over the computer for some creative tasks:

Since paper is the physical embodiment of information, information written on paper will be more obvious to colleagues... For comparison, watch someone reading a document on their computer. What is he looking at? How immersed in the document? Does he really read all email? This is very important to know, because it makes it easier to coordinate the discussion in the group and achieve mutual understanding regarding the object being discussed.

Once your observations have taken real shape, they should be sorted into topics. Where to start? After conducting field research, people have several ideas in their heads - several key observations, in their opinion, that make them very happy. They are the ones people talk about most often; they are the ones they will name if someone asks: “Well, what did you find out?” Unfortunately, the joy of such discoveries can blind and distract attention from everything else. Perhaps the team will discuss other observations, but will still invariably return to the key ones. And once key observations completely captivate you (this happens subconsciously), it is no longer possible to change your point of view, which means you will not be able to recognize the cliches.

Since key observations are still impossible to get out of your head, start working with them. Go through your notes, looking for connections between your key observations and all the others, and then group them together. As you work, you will definitely find that there are other observations that are connected. Group them too. After a while you will realize that the groups are combined into topics.

For example, in the automotive project, we identified a broad theme that we tentatively called “Ready for Anything”; it included such observations.

- The driver always takes things “just in case” (gloves, a first aid kit, a camera, and also wires so that you can “light a cigarette” if the battery runs out).

- Has with him some things for a stop (a can opener, a rug, games).

- Carry with you what will make the trip more comfortable (music discs, napkins, hygienic lipstick, water).

When grouping observations, it's a good idea to use, say, cards of different colors or sizes to differentiate topics. I use sticky notes of different colors and sizes for notes, but you can choose what you like best - the main thing is that it is immediately clear. For example, at first you can take notes on yellow pieces of paper. When you identify key observations, write them down on blue pieces of paper. Having grouped your observations by topic, mark them with green leaves.

Grouping observations by topic is necessary in order to lay the foundation for further insight.

Let's get to the heart of it

The New Yorker magazine published a wonderful article called “The Eureka Hunt.” This is the story of a firefighter named Wag Dodge, who escaped death in the terrible Mann Gulch fire in 1949. Thirteen of his fellow firefighters died in the fire.

But Dodge was saved by a brilliant idea. When all the firefighters began to run away from the fire, Dodge suddenly stopped and set fire to the grass in front of him. As soon as the grass burned out, he lay down on the smoking ashes and began to breathe the oxygen that remained near the ground. The flames of the fire, having reached this place, rushed over Dodge, and after a few terrible minutes the fireman “rose from the ashes” almost unharmed. Only a madman would come up with the idea not to run away from the fire, but to light another fire! But if you know something about fire and oxygen (this knowledge, of course, is not acquired in a year or two), the idea will not seem crazy to you at all.

The Mann Gulch firefighter's case is, of course, extreme. You're probably wondering what conclusions you can draw and whether you'll have to wait too long for insight. You won't have to wait.

Sometimes insight occurs spontaneously, but mostly the process requires organizing observations, sifting, prioritizing so that conclusions can be drawn, and most importantly, used. In other words, insight is a product of synthesis. It may seem like the penetration happened on its own. But once you think about it, in retrospect everything becomes clear and logical. What's going on? You (often unconsciously) identify some patterns, and this forces you to change your perspective - and then you, hitting yourself on the forehead, exclaim: “How did I not think of this before?” Albert Einstein described this very accurately and succinctly: penetration “occurs unexpectedly and intuitively. But intuition is nothing more than the result of preliminary mental activity.” Even the most trivial observations can lead to unexpected, but quite logical conclusions. You just have to learn it.

It is important to distinguish between observation and insight, because they are not the same thing. Observations are raw materials, a gradual accumulation of information that you collect consciously and carefully, exactly as you saw or heard it, without trying to interpret it. Insight is an unexpected insight; this is the moment when you exclaim "Hurray!" or “Eureka!”, and this moment comes as soon as you begin to interpret your observations and find patterns in them. It is these patterns that reveal the discrepancy between what exists and what people want: between the surrounding reality and human desires. This is a discrepancy between the way things are now and the way people think things should be done.

A classic example of how to identify such a discrepancy is called “detail bloat”: new functions are constantly being added to a certain technology, which is by no means simple. Do you have a video camera? How many of its features do you actually use? Which ones are really important to you? Most people are content with the ability to shoot, zoom in and out of an object, record it on a hard drive or upload it to YouTube.

Home electrical company Pure Digital has found a way to make life easier for consumers. Previously, home video cameras were expensive and complex, but the company decided that there would always be people who wanted to buy a cheap and simple camera. To fill a gap in the market, Pure Digital has come up with the Flip Ultra camera, a device that only has On/Off, Zoom In/Out buttons, and a USB input. The camera runs on regular batteries.

If there is tension [observation] somewhere, then there is a gap in that market. Once you identify the gap [insight], you can fill it [market opportunity].

Look for oddities and ask, “Why is this happening?”

You should already have several thematic groups of observations on your board. Since it's impossible to cover the entire board at once, think about where you'll start.

It is very important to decide where to start because the conclusions may vary. We tend to first of all take on the most obvious - that which confirms everything we know today. This is fine. But if you're obsessing over the obvious, chances are you're just trying to reinforce your view of something, not change it. If you see only the obvious, insight will not happen. It comes in a completely surprising way: these are conclusions from unexpected observations. These are observations that, so to speak, do not catch the radar: these are things that people who are faced with a certain situation every day do not notice. Drexel University psychologist John Cuños defines insight as “cognitive reflection transformed by serendipitous, unexpected connections.”

In 1992, several residents of the small Welsh town of Merthyr Tydfil took part in a clinical trial of a new drug for sore throat. Unfortunately, the drug created by the pharmaceutical company did not help much with a sore throat. However, in men it caused a host of side effects, including back pain, stomach upsets, and erection problems. If everyone at Pfizer focused only on finding a cure for sore throat, then, having stopped testing, the new drug would simply be forgotten. But at a certain point, someone managed to switch attention from the obvious to the unexpected - from the desired effects to the side effects. And an insight occurred that made it possible to develop one of the most popular drugs today - Viagra.

When you discover something unexpected, take your time: observe more and try to identify connections. Then ask questions: “What patterns can be traced? Why are they unexpected? - and most importantly, what does this mean? By asking questions, you can discover relationships between different observations and begin to interpret them.

Let's talk, for example, about the most common cleaning of floors.

At the request of Procter & Gamble, the Boston consulting firm Continuum took on an unusual task: its employees studied the dirt, observed the cleaning process, and washed the floor themselves. As you might expect, the obvious conclusion was obvious: people considered cleaning their floors an unpleasant necessity. But an unexpected observation was made: it turns out that water does not cope with dirt very well. Asking the question “What does this mean?”, consultants discovered a discrepancy between what people expect from cleaning floors and what they get from cleaning. Water doesn't so much wash away dirt as smear it. On the other hand, dry rags become electrified - and also do a poor job. Consumers don't want mops that increase the effectiveness of water as a cleaning agent. Consumers want clean floors.

This insight presented a market opportunity: a need for detergents that can be used without water. The Swiffer brand, which later became famous, immediately gained extraordinary popularity: in the first year, Procter & Gamble sold $200 million worth of this detergent. Today, Procter & Gamble earns $500 million annually from its “dry” detergents, and the idea remains unexpected: customers never cease to be amazed at how they can clean without water.

To achieve such insight, you need to learn to identify patterns. In other words, you are not simply writing a report of your observations. Rather, you, based on your knowledge and experience, look for patterns and interpret them. Insight is new knowledge that allows both you and those around you to look at the situation from a different, unexpected angle - and identify inconsistencies that no one paid attention to before.

We unite

Write down conclusions (what you understand) as they form in your head and pin them on the board (use different colored pieces of paper for this). Don't stop until you have covered all the intended topics. For each topic, you must make at least one conclusion.

As you draw together and write down your findings, be careful about the words you use. Often your “insight” contradicts accepted norms and expectations. In such cases, using “but” and “while” in a sentence will help draw attention to the contradictions and support your conclusion. For example, here's how Continuum formulated its findings in connection with another project.

- Drivers of high-speed cars are nervous not because of driving speed, but because of parking.

- Men who buy expensive stereos like to display them in the living room, while women try to hide them behind plants or furniture.

- Consumers are not interested in locks, but in the things that locks are designed to protect.

Finally, insight is always a risk. Your conclusions will not always be correct, but they should be thought-provoking. In marketing research, too often the analyst is required to be absolutely certain, so he can neither rely on intuition nor use an unexpected approach. So it's important to remember that the research doesn't end with insight: the findings are used to identify a market opportunity that can bring your hypothesis to fruition.

To summarize: the first goal of your research is observation, which will help to detect “moments of tension.” The second goal is insight, the ability to understand what the discrepancy is between the existing order of things and how things could be. The third goal is to identify a market opportunity that will help overcome this contradiction.

Breakthrough Market Opportunity

Once you have a few insights (insights), it's time to synthesize them and identify the key areas where you have a market opportunity. To do this, you need to return to your breakthrough hypothesis - again ask the three stupid “What if?..” questions that were discussed in the first chapter.

Again, the reason you start by formulating a breakthrough hypothesis, not by doing field research, is because you need to identify stereotypes in your industry and look at the situation from a different angle. Provocative questions help you point out things you might not have noticed before, allowing you to interpret research data in a completely different way.

If you skip the first step - generating a hypothesis - it may not occur to you that in the situation you are considering, you can offer another solution that is completely acceptable (for example, hourly car rental or mismatched socks).

But as I said at the beginning of this chapter, it's not enough to come up with a breakthrough hypothesis—your hypothesis must lead to a radical solution that benefits people. And this is only possible if you understand the customers' point of view and turn your hypothesis into a market opportunity.

Let's formulate it this way: hypotheses are the basis of observations. Observations are the basis of insight. Insight is the foundation of market opportunity.

From insight to market opportunity

A market opportunity involves three important things: It is someone's chance to bring some benefit to fill some gap.

In the case of cars, this can be formulated as follows:

There is an opportunity to improve the performance of the person behind the wheel in a way that is both safe and optimal for driving.

To move from insights to possibilities, you need to make the most appropriate hypothesis/insight pairs. Select findings that can potentially help turn your hypothesis into reality. The conclusion must prove that the hypothesis can bring benefits to people.

Let's go back to the car example.

- Hypothesis.

- Insight into the essence. People don't just drive in a car, a lot happens in them, but cars are not designed for other types of activities.

Once you have identified the appropriate pairings, review the findings to find one major benefit in each question. (Hourly car rentals provide freedom. Mismatched socks allow for self-expression.)

You work in, say, the soft drink industry and have come up with a breakthrough hypothesis that water should taste disgusting. Can you find evidence that even such a hypothesis can have benefits for the consumer? And if your hypothesis is that your product should cost much more than the competition, can you gather evidence that this also has a benefit for the consumer?

Let's go back to the car example. The first part of the insight is “people don’t just drive in cars, many other things happen in them.” This insight came from the observation that modern drivers check email, make phone calls, and use the computer while driving.

Let's imagine that cars are not used for driving; Ask yourself what else a car can be used for, and you will come to the conclusion: you can turn a car into an office on wheels and thus increase productivity.

- Hypothesis. What if cars weren't used for driving?

- Insight into the essence. People don't just drive in a car, a lot happens there (checking email, making phone calls, working with a computer).

– Market opportunity. Provide drivers [consumers] with productivity-enhancing conditions [benefits].

The next step is to figure out what gap needs to be filled. If the gap is not obvious at first glance, remember what “moments of tension” you observed. If necessary, refer to the four categories detailed above.

1. Workaround maneuvers. Will this lead to solving the problem itself, and not just eliminating its symptoms?

2. Values. Will this lead to a change in consumer values?

3. Inertia. Will this lead to disruption of the usual order?

4. What is desired versus what should be. Will this lead to the ability to turn what is needed into what is wanted or what is wanted into what is needed?

In the cars example, the second part of the insight is: “but cars are not designed for other activities.” This conclusion was made on the basis that drivers in cars are still doing something. Here's a gap that needs to be filled: cars are not designed for the activities that modern people engage in in them. In this way, additional functions optimized for driver safety address as yet unmet needs. Let's see how this example fits into the scheme that we managed to familiarize ourselves with in the first and second chapters.

– Stereotype. Cars are meant to be driven.

- Hypothesis. What if cars weren't for driving?

- Insight into the essence. People don’t just drive in a car, a lot happens there, but cars are not designed for other types of activities (modern drivers check email in the car, make phone calls, use a computer).

– Market opportunity. Helping drivers [consumers] improve performance [benefit] in a way that is both safe and optimal for driving [a gap that needs to be filled].

Formulating a Market Opportunity

Remember that you are conducting market research to discover new market opportunities. Perhaps the resulting opportunities will be different from your hypothetical assumptions. Then you will have to abandon the original hypothesis or reformulate it so that it matches the conclusions you have drawn.

This is fine. Market opportunity is entirely context dependent. Too often, when we come up with a hypothesis, we think that we understand the situation very well and that all our assumptions are correct. However, if the research yields insights beyond the original hypothesis, follow through with your findings. The new direction may be both correct and effective, because now you know the context better. To identify a market opportunity, sometimes you have to take a couple of steps back and to the side. When formulating a market opportunity, it is important to choose the right words to highlight the unexpected discrepancy between what is desired and what is actually achieved, to clearly outline the benefit, and to accurately describe potential customers. Insights must be consumer-focused.

Once you've stated your market opportunity in one sentence, back it up with key observations and conclusions you've drawn from your research. If we return to the car example, the research team reinforced the market opportunity to “increase productivity” with this observation: “All drivers believe that talking on the phone while driving is prohibited, but they continue to talk anyway. Constantly". Other observations were cited in support: all drivers believe that the time spent in the car can be usefully spent making phone calls; Moreover, the driver here, as a rule, is alone, he is in a familiar environment, and “he has nothing to do” (except for driving the car, of course).

In conclusion, here is an example with Swiffer “dry” detergents:

– Stereotype. People use mops and water to clean floors.

- Hypothesis. What if there were mops that clean without water?

- Insight into the essence. The low quality of floor cleaning is not due to a lack of water, but to its excess. (Water only spreads the dirt.)

– Market opportunity. Give homemakers [consumers] a more convenient way to clean [benefit] without using water [a gap that needs to be filled].

Lastly, a market opportunity is not a solution. You've identified a benefit and a gap that can be filled, but not a way to bring the idea to life. The next step is to come up with some ideas on how to take advantage of the opportunity. This will be discussed in the third chapter.

Breakthrough Opportunity

As I already mentioned, it is very important to immerse yourself in the world of consumers, try to look at things from their point of view. That's exactly what Jonah and his partners did. Their target audience was middle school age girls (8–12 years old). By asking the students questions and carefully analyzing their answers, the researchers made important observations that led to insights. It turned out that girls at this age consider themselves no longer children, but not yet adults; They are confident in their wisdom and maturity, but at the same time they want to have fun and be children a little more.

It was these findings that made it possible to see a market opportunity: there are socks for children, there are socks for adults, but nothing interesting is offered for teenagers. But mismatched socks are an opportunity for fun self-expression. If these mismatched socks also appear “adult” and are of premium quality, we can fill a gap in the market.

Let's act

(What are your observations?)

To plan your field study and make the necessary observations, follow this sequence.

1. Decide what information you want to obtain and create a list of questions accordingly.

2. Determine your target audience, which will include the most likely consumers, potential consumers, and even those you don’t really count on.

3. Find out how much time you need. This will depend on the complexity of the task, but your immersion in the consumer environment should be rapid: allow 2-3 hours for short informal research, and 2-3 days for more serious research.

4. Conduct surveys and observations specifically in the environment in which consumers buy products or use services in your area of interest.

5. Collect information in different places, in different environments - and your material will be richer.

6. Complete at least two of the suggested actions.

Let's act

(Prepare insight)

To organize your observations, evaluate information, and draw key conclusions, use the following tips.

1. Record the collected data. You can type them or write them by hand. Print photos, your notes - whatever you've collected.

2. Prepare a visual board. It should be large enough so that you can freely arrange, group, and move your observation notes and other demonstration materials on it.

3. Group observation notes into topics. State the title of each topic in one or two words. Write down the names of the topics on pieces of paper of different colors. For example, observations that drivers have a lot of things in the car “just in case”, carry with them everything they need for an unplanned stop, and always have with them something that will make the trip more comfortable, can be combined into the topic “Prepared for anything.”

4. Notice unexpected patterns. If something surprises you while observing, check to see if you have come across anything similar before.

5. Look for the answer to the question “Why is this happening?” and draw conclusions. When trying to understand patterns you notice, rely on your intuition. Note the discrepancy between expectations and actual results. (For example, using water, we do not wash away dirt, but only smear it.)

6. Formulate the meaning of penetration. Record your observations by adding information to the visual board. You must cover all topics. Make at least one conclusion for each topic.

7. Insight must leave an impression. Paradoxical language (using “but” and “while”) will help draw attention to the gaps you have identified.

Let's act

(Identify market opportunity)

By taking the following steps, you can use insight to identify emerging market opportunities from which you can then select one.

1. Compare the insight results with the hypotheses. Are there any couples who have a clear connection?

2. Analyze the results and hypotheses. Determine what the benefits could be for customers.

3. Group and rearrange the notes. You need to find a strong insight-hypothesis pairing.

Use the prompts below to formulate a market opportunity.

1. Describe the opportunity. Formulate it in one sentence, consisting of three parts. By limiting yourself to one proposition, you will focus on the expected benefit to the customer, rather than on how to make it happen. (For example: “The market opportunity involves improving productivity without compromising safety, with a clear benefit to drivers.” This does not go into detail or indicate how productivity can be improved.)

2. Logically justify what key observations and insights prove that your idea will benefit the customer. (For example: “Observations show that modern drivers use cars for other purposes, regardless of whether the cars are equipped for this purpose or not.”)

Survey professionals can offer a large database of potential research participants, and their services are often indispensable, especially if you're researching an unfamiliar market or if you don't have the time/resources to conduct the research yourself. Start by searching for professionals working in the field you are interested in and find out the prices for services. In the US, you'll have to pay $125-$150 for each participant recruited, plus $100-$150 per hour for the participant. Equipment rental will cost $500-1000 for half a day, $1000-1500 for a day. Don't forget that preparation also takes time. If you are conducting an international study, prices may vary (check locally). Finding participants is not so much expensive as it is labor-intensive.