Comprehensive economic analysis of economic activity. Comprehensive analysis of the economic activity of an enterprise. Main directions for increasing the efficiency of the organization's activities.

The meaning and tasks of complex analysis.

Formation and analysis of the main groups of indicators in the system of comprehensive economic analysis.

Margin analysis.

1.Comprehensive analysis provides for a comprehensive study of objects of analysis, which are described by a multiplicity of factors and reflect the cause-and-effect relationships of many interconnected aspects of the object, which is either a set of local analyzes of individual aspects of the object, or a final multifactor analysis of the entire object as a whole.

The importance of knowing the methodology of comprehensive economic analysis is determined by the following.

Ensuring the effective functioning of organizations requires economically competent management of their activities, which is largely determined by the ability to analyze it. With the help of a comprehensive analysis, development trends are studied, factors of change in performance results are deeply and systematically studied, business plans and management decisions are substantiated, their implementation is monitored, reserves for increasing production efficiency are identified, the results of the enterprise’s activities are assessed, and an economic strategy for its development is developed.

Comprehensive analysis of economic activity is scientific base making management decisions in business. To justify them, it is necessary to identify and predict existing and potential problems, production and financial risks, and determine the impact of decisions made on the level of risks and income of a business entity. Therefore, mastering the methodology of comprehensive economic analysis by managers at all levels is an integral part of their professional training.

A qualified economist, financier, accountant, auditor and other economic specialists must have a good command of modern methods of economic research and mastery of systemic comprehensive microeconomic analysis. Knowing the technique and technology of analysis, they have the ability to easily adapt to changes in the market situation and find the right solutions and answers. Because of this, mastering the basics of economic analysis is useful for anyone who has to participate in decision-making, either make recommendations for their adoption, or experience their consequences.

The purpose of the enterprise is profitability, i.e., the highest possible result in monetary terms for the period of time under consideration. The task of complex analysis is consider all private factors that provide a higher level of profitability.

Cash turnover, reflecting the real process of entrepreneurial activity, is recorded in a comprehensive accounting system, thanks to which an information base for comprehensive economic analysis is formed.

A comprehensive analysis requires:

detail(identifying the component parts) of certain phenomena to the extent that it is necessary to clarify their most significant and main characteristics;

systematization analyzed elements based on the study of their relationship, interaction, interdependence and intersubordination in order to build a model of the object (system) being studied, determine its main components, functions, subordinates, and reveal a logical and methodological scheme of analysis that corresponds to the internal connections of the factors being studied.

generalizations(synthesis) of the results of analysis from the entire set of studied factors, separating typical from random, main and decisive ones, on which the results of activity depend, from secondary ones;

development and use of a system of indicators, reflecting the complexity of systemic research, cause-and-effect relationships, the economic meaning of phenomena and processes in the economic activity of an enterprise.

Economic activity, which is the object of economic analysis, is an open system, acts as an integral part of a more complex economic system, therefore, a comprehensive economic analysis of economic activity in a market economy is carried out on the basis systematic approach.

Based on the information model of economic activity, i.e., the model of the formation of economic factors and indicators, a general block diagram of a comprehensive economic analysis is drawn up, factors and indicators are classified, and the connections between them are formalized.

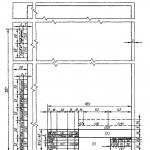

Let's consider the general scheme for the formation and analysis of the main indicators of economic activity in the system of comprehensive economic analysis (CEA).

The basis of all economic indicators of the enterprise’s economic activity lies the organizational and technical level of production, i.e., the quality of products and equipment used, the progressiveness of technological processes, the technical and energy equipment of labor, the degree of concentration, specialization, cooperation and combination, the duration of the production cycle and the rhythm of production, the level of organization of production and management.

The technical side of production is not directly the subject of economic analysis. But economic indicators are studied in close cooperation with production technology and technology, and its organization. Technical progress - a decisive factor in the rise of productive forces and the development of human society - leads to an increase in labor productivity and a decrease in the cost of goods. It is stimulated by the needs of economic development: the development of technology is progressive when it is economically efficient.

The level of economic indicators is significantly influenced by natural conditions. This circumstance plays an important role in a number of sectors of the national economy, especially in agriculture and the mining industry. The degree of use of natural resources largely depends on the state of technology and organization of production and is studied along with indicators of the organizational and technical level of production.

Economic indicators characterize not only the technical, organizational and natural conditions of production, but also the social living conditions of production teams, as well as the foreign economic relations of the enterprise, i.e. the state of the financing, purchase and sale markets. The degree of use of production resources depends on all these conditions: means of labor, objects of labor and labor itself. The intensity of use of production resources is manifested in such general indicators as labor productivity, capital productivity of fixed production assets, material intensity of production.

The efficiency of use of production resources, in turn, is manifested in three dimensions:

1) in the volume and quality of produced and sold products (and the higher the quality of the products, the larger, as a rule, the volume of products expressed in the selling prices of the enterprise);

2) in the amount of consumption or expenditure of resources for production, i.e. production costs;

3) in the amount of resources used, i.e., fixed and working capital advanced for economic activities.

A comparison of indicators of production volume and cost characterizes the amount of profit and profitability of products, as well as costs per 1 rub. products. A comparison of indicators of production volume and the amount of advanced fixed production assets and working capital characterizes the reproduction and turnover of production assets, i.e. capital productivity of fixed production assets and turnover of working capital. On the fulfillment of the profit plan and the financial plan as a whole, on the one hand, and on the turnover of working capital, on the other, depend financial condition and solvency of the enterprise. The obtained indicators, in turn, collectively determine level of profitability of economic activities.

2. The general indicators of each block are called synthetic. For example, the volume of products sold is a synthetic indicator for block 6, the total cost of this product is for block 7. The synthetic indicator of one block, which is the output for this block of the subsystem, for another, subordinate to it, will play the role of an input. In other words, through these general indicators the connection is made between individual blocks in the system of economic analysis. Each k, as a relatively isolated system, is formed as a system (of analytical indicators from which these generalizing indicators are made up.

In system analysis, special attention is paid to the study of the mutual connection and its conditionality - individual sections of indicators and factors of production. Therefore, in the process of a comprehensive economic analysis of economic activity, it is important to determine all the main relationships and factors that provide quantitative characteristics.

Let us consider block 6 in more detail. The input here will be synthetic indicators of blocks 3, 4 and 5: the average value of industrial production assets, output per 1 unit. fixed assets (capital productivity), cost of consumed items of labor, output per 1 unit. consumed items of labor (material productivity), the average number of workers and their labor productivity. The synthetic indicator (output) of block 6 is the volume of products sold.

The volume of products sold depends on the volume of products shipped and paid for, on changes in the balances of finished products in warehouses, the amount of work in progress, and, consequently, on the volume of gross output. Product output is largely determined by production factors (the degree of use of fixed assets (equipments of labor), objects of labor and labor resources). Non-production factors (related to supply and sales) affect production volume indirectly, through production factors.

preliminary review of summary indicators

Analysis of the organizational and technical level, social, natural and external economic conditions of production

Analysis of the use of fixed assets

Analysis of the amount and structure of advanced capital

Product cost analysis

Analysis of the use of material resources

Analysis of turnover of production assets

Analysis of profit and profitability of products

Analysis of labor use and wages

Analysis of volume, structure and quality of products

Analysis of profitability of economic activities

Analysis of financial condition and solvency

Summary performance assessment and analysis of economic incentive funds

General scheme for the formation and analysis of the main groups of indicators in the system of comprehensive economic analysis (CEA)

The use of production resources is influenced by the organizational and technical level of production through intensive and extensive factors that determine elementary analytical indicators of resource consumption. For example, such an elementary indicator of the use of labor resources is the average production rate. It is determined by the technical and energy equipment of labor, the qualifications of the worker, the level of specialization, cooperation, and the organization of production and labor. Thus, it is possible to determine an infinite number of factors influencing this indicator.

In practice, they are usually limited to considering a finite number of factors, which depends on which management body is conducting the analysis, on the tasks of the analysis itself, and technical capabilities.

In a system of comprehensive analysis, production factors are identified from the point of view of their influence on general indicators of economic activity, but it is also necessary to take into account feedback, i.e., the influence of these performance indicators on indicators characterizing individual aspects of the operation of enterprises. Let us assume that the degree of influence of the use of production resources on the volume of output, and therefore on the volume of products sold, has been established. The size and structure of products sold by an enterprise depend on fixed assets, material, labor resources, and the qualifications of the workforce and determine their size and structure. When conducting a system analysis, it is necessary to take into account these feedbacks, giving them, if possible, a quantitative form.

Based on information about the main indicators obtained during the FEA process of the economic system, its model is built. Specific data about the operation of an enterprise is entered into it and the model parameters are obtained in numerical terms.

Working with the model includes an objective assessment of the results of economic activity, a comprehensive identification of reserves for increasing production efficiency. This is the final stage of FEA, carried out on the basis of a systematic approach.

The main value of system economic analysis is that in the process of its implementation a logical and methodological scheme is built that corresponds to the internal connections of indicators and factors, which opens up wide opportunities for the use of electronic computer technology and mathematical methods.

First, a preliminary description of economic activity is given according to the system of the most important indicators (block 1), then the factors and reasons that determine these indicators are deeply analyzed, and on-farm reserves are identified (blocks 2-12). Based on this analysis, the activity of the enterprise is assessed, the formation and use of economic incentive funds is checked (block 13).

For an objective assessment of work, reporting indicators for periods of activity are adjusted based on the results of the analysis: amounts are subtracted (or added) that were influenced by external factors (changes in prices, tariffs, etc.), violations of government and economic discipline. The reporting indicators obtained in this way more fully characterize the activities of production teams. They are compared with the indicators of previous periods, with the plan.

The relationship between the main groups of economic activity indicators largely determines the sections and sequence of a comprehensive analysis. But both the names of the sections and the sequence of work in the analysis process may not coincide with the general flowchart.

Let us give an example of the composition and sequence of sections of an economic analysis of an enterprise’s activities.

1. Comprehensive review of general indicators of production and economic activity.

2. Analysis of the organizational and technical level of production and product quality.

3. Analysis of natural and cost indicators of the volume of production,

4. Analysis of the use of fixed assets and equipment operation

5. Analysis of the use of material resources.

6. Analysis of the use of labor and wages.

7. Product cost analysis.

8. Profit and profitability analysis.

9. Analysis of the financial condition and turnover of working capital.

10. General assessment of work and analysis of the effectiveness of economic incentives.

Thus, the main thing in a comprehensive analysis is consistency, linking individual sections - blocks of analysis with each other, analyzing the relationship and mutual dependency of these sections and outputting the results of the analysis of each block to general performance indicators.

Methodology of comprehensive economic analysis for management purposes should contain the following components:

Determining the goals and objectives of economic analysis;

A set of indicators to achieve goals and objectives;

Scheme and sequence of analysis;

Frequency and timing of management analysis;

Methods of obtaining information and processing it;

Methods and methods for analyzing economic information;

List of organizational stages of analysis and distribution of responsibilities between enterprise services when conducting a comprehensive analysis;

A system of organizational and computer equipment necessary for analysis;

The procedure for processing the analysis results and their evaluation;

Assessment of the labor intensity of analytical work, calculation of the economic effect of the analysis.

The main interest is in marginal analysis, analysis of the financial condition and financial results of the enterprise's economic activities, comprehensive analysis and rating assessment of the financial condition of the enterprise.

Margin analysis call the analysis of the relationship between three groups of the most important economic indicators: costs (expenses, expenses), volume of sales (production) of products and profit, and forecasting the value of each of these indicators for a given value of other indicators. This method of management calculations is also called break-even analysis or income assistance. It was developed in 1930 by the American engineer Walter Rautenstrach.

Margin analysis (break-even analysis) is widely used in countries with developed market relations. It allows you to study the dependence of profit on a small range of the most important factors and, on the basis of this, manage the process of forming its value.

Key Features Marginal analysis consists of defining;

Break-even sales volume (profitability threshold, cost recovery) at given ratios of price, fixed and variable costs;

Security (break-even) zones of the enterprise;

The required sales volume to obtain a given amount of profit;

The critical level of fixed costs at a given level of marginal income;

The critical selling price for a given sales volume and the level of variable and fixed costs,

With the help of marginal analysis, other management decisions are justified: the choice of options for changing production capacity, product range, price for a new product, equipment options, production technology, purchasing components, assessing the effectiveness of accepting an additional order, etc.

Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Posted on http://www.allbest.ru/

Posted on http://www.allbest.ru/

Federal state educational budgetary institution

higher professional education

"Financial University under the Government of the Russian Federation"

(Financial University)

Tula branch of the Financial University

Test

discipline: “Economic analysis”

Option #5

Completed: 5th year student

Faculty: FiK

Directions: Bachelor of Economics

Groups: daytime

Pereponova E.K.

ld. No. 11fld41649

Checked: Kalyanov A.Yu.

Tula 2014

Exercise 1

Task 2

Task 3

Task 4

Task 5

Task 6

Task 7

Bibliography

Exercise 1

Based on the balance sheet data (Appendix 1), analyze and evaluate the dynamics of the composition and structure of the organization’s assets and liabilities. Data on the property status and sources of financing of the organization's assets are reflected in table. 1.

Table 1

|

Structural and dynamic analysis of the organization’s assets and liabilities |

|||||||||||||

|

Index |

Balance balances, |

Changethousand roubles. (+,-) |

Growth rate |

Asset structure |

Change, % (+,-) |

||||||||

|

ASSETS |

|||||||||||||

|

I. NON-CURRENT ASSETS |

|||||||||||||

|

Intangible assets |

|||||||||||||

|

Research and development results |

|||||||||||||

|

Intangible search assets |

|||||||||||||

|

Material prospecting assets |

|||||||||||||

|

Fixed assets |

|||||||||||||

|

Profitable investments in material assets |

|||||||||||||

|

Financial investments |

|||||||||||||

|

Deferred tax assets |

|||||||||||||

|

Other noncurrent assets |

|||||||||||||

|

TOTAL for section I |

|||||||||||||

|

II. CURRENT ASSETS |

|||||||||||||

|

Value added tax on purchased assets |

|||||||||||||

|

Accounts receivable |

|||||||||||||

|

Financial investments (excluding cash equivalents) |

|||||||||||||

|

Cash and cash equivalents |

|||||||||||||

|

Other current assets |

|||||||||||||

|

TOTAL for section II |

|||||||||||||

|

BALANCE |

|||||||||||||

|

LIABILITIES |

|||||||||||||

|

III. CAPITAL AND RESERVES |

|||||||||||||

|

Authorized capital (share capital, authorized capital, contributions of partners) |

|||||||||||||

|

Own shares purchased from shareholders |

|||||||||||||

|

Revaluation of non-current assets |

|||||||||||||

|

Additional capital (without revaluation) |

|||||||||||||

|

Reserve capital |

|||||||||||||

|

Retained earnings (uncovered loss) |

|||||||||||||

|

TOTAL for section III |

|||||||||||||

|

IV. LONG TERM DUTIES |

|||||||||||||

|

TOTAL for section IV |

|

|

|

|

|

||||||||

|

V. SHORT-TERM LIABILITIES |

|||||||||||||

|

Borrowed funds |

|||||||||||||

|

Accounts payable |

|||||||||||||

|

revenue of the future periods |

|||||||||||||

|

Estimated liabilities |

|||||||||||||

|

Other obligations |

|||||||||||||

|

TOTAL for Section V |

|||||||||||||

|

BALANCE |

The data in Table 1 shows that the total turnover of business assets, that is, assets for the period 2011 - 2013. increased by 15,514 rubles. (88778-73264) or by 82% (73264/88778*100) due to an increase in the volume of non-current assets by 30,487 rubles. (62926-32439), although current assets, on the contrary, decreased by 14,973 rubles. (40 825-25 852) . In other words, the property mass increased mainly due to the growth of non-current assets; consequently, the organization is strengthening its material and production base. liability expense profit organization

If we compare only 2012 and 2013, we see the following situation: the total turnover of economic assets during this period decreased by 67 rubles. (88,778-88,845) or by 0.08% due to a decrease in the volume of non-current assets by 1,794 rubles. (62926-64720), but during this period there was an increase in current assets by 1,727 rubles. (25852-24125). This means that the more mobile part of the organization’s assets has increased, which has a positive effect on the liquidity of its funds.

Analysis of the passive part of the balance sheet shows that for the period 2011-2013. there was an increase in short-term liabilities by 6,925 rubles. (26831-19906) due to an increase in accounts payable, and capital and reserves in the amount of RUB 8,589. (61947-53358).

Task 2

Based on the financial results report (Appendix 2), generate the organization’s income and expenses, analyze and evaluate their structure and dynamics. These estimates of the organization's income and expenses are reflected in table. 2.

table 2 Analysis of the dynamics of income and expenses of the organization

|

Change |

|||||||

|

Index |

thousand |

thousand |

|||||

1. Income of the organization - Total,including: |

|||||||

|

1.1.Sales revenue |

|||||||

|

1.2. Interest receivable |

|||||||

|

1.3. Income from participation in other organizations |

|||||||

|

1.4. Other income |

|||||||

2. Organizational expenses-Total,including: |

|||||||

|

2.1. Cost of sales |

|||||||

|

2.2. Business expenses |

|||||||

|

2.3. Administrative expenses |

|||||||

|

2.4. Percentage to be paid |

|||||||

|

2.5. other expenses |

|||||||

|

2.6.Current income tax |

|||||||

|

Calculation of the main indicators for assessing the organization’s income and expenses |

|||||||

|

Change |

|||||||

|

1. Income per 1 rub. assets, rub. |

|||||||

|

2. Sales revenue of 1 rub. income |

|||||||

|

3. Income per 1 rub. expenses, rub. |

|||||||

|

4.Profitability of expenses,% |

|||||||

|

5. Sales consumption, rub. |

Calculations:

1. Income per 1 rub. assets is the ratio of an organization's income to the amount of its assets. The amount of income per 1 rub. the organization's assets in 2012 amounted to 0.59 rubles. (52374/88845), in 2013 this figure increased by 0.09 rubles. and began to amount to 0.68 rubles (60477/88778).

2. Sales revenue of 1 rub. income - It is the ratio of sales revenue to the organization's income. The amount of revenue per 1 rub. sales in 2012 were equal to 0.97 rubles, and in 2013 they decreased by 0.013 rubles. and began to amount to 0.96 rubles.

3. Income per 1 rub. expenses is the ratio of an organization's income to its expenses. The amount of income per 1 rub. expenses in 2013 decreased by 0.12 rubles. compared to 2012

4. Cost effectiveness - This is the percentage ratio of net profit to the organization's expenses. Cost profitability decreased by 1.25% in 2013 compared to 2012.

5. Sales consumption intensity is the ratio of the sum of cost of sales, selling expenses and administrative expenses to sales revenue. This ratio determines the share of total expenses in sales revenue. In 2012, the share of expenses in sales revenue was 0.89 rubles. in 2013 it increased by 0.026 rubles.

Based on the calculation of the main indicators for assessing income and expenses, we can say that in 2013, compared to 2012, the organization’s expenses increased, and their profitability decreased by 1.25%. Consequently, the organization’s income decreased.

Task 3

Using the data from the financial results report (Appendix 2), analyze the size, composition and structure of the organization’s profit.

The calculations are summarized in table. 3.

Ttable 3 Analysis of the organization's profit dynamics

|

Indicators |

Absolutevalue, rub. |

Pacegrowth(belownia),% |

Specific gravity (%) toarrived beforetaxation |

|||||

2012 |

2013 |

Treasontion |

2012 |

2013 |

Izmeopinion |

|||

1.Profit (loss) up totaxation |

||||||||

|

including: |

||||||||

|

2.Gross profit |

||||||||

3.Profit (loss) from |

||||||||

4.Financialresult fromother operations |

||||||||

5. Current taxon profit, reduced by the amountdeferred tax |

||||||||

6.Net profit |

71 ,38 |

Kd/r = All income / All expenses >1

Kd/r = (58092 +2375 +10) / (53210+117+4185+799)=

60477/58311= 1,04>1

Since the coefficient is greater than one, the activity of the enterprise for a given period is effective.

Task 4

According to the balance sheet (Appendix 1), the financial results report (Appendix 2) calculate the influence of factors on changes in profitability of assets: the share of current assets in total assets, the turnover ratio of current assets, return on sales (Table 4).

Table 4 Calculation of the influence of factors on changes in the profitability of an organization’s assets

|

Index |

Change- |

|||

|

Initial data |

||||

|

1.Profit (loss) from sales, thousand rubles. |

||||

|

2. Average annual value of current assets, |

||||

|

3.Revenue, thousand rubles. |

||||

|

4. Average annual value of assets, thousand rubles. |

||||

|

Calculated data |

||||

|

5. Return on assets, % |

||||

|

6. Share of current assets in the total value assets, coefficient |

||||

|

7. Turnover of current assets, vol. |

||||

|

8. Return on sales, % |

||||

|

Calculation of the influence of factors |

||||

|

9. Influence on changes in return on assets of factors - total, % including: |

||||

|

a) the share of current assets in total assets |

||||

|

b) turnover of current assets |

||||

|

c) profitability of sales |

-1, 69 |

|||

|

Balance of deviations, % |

Solution: Let us calculate the average annual value of current assets and the average annual value of assets for the initial data. We will take the volumes of net profit and revenue from the balance sheet (Appendix 1). Calculations are made using the formula (using assets as an example):

Where A- assets;

A N.G.- the amount of assets at the beginning of the corresponding year;

A K.G.- the amount of assets at the end of the corresponding year.

The change (+,-) is calculated using the formula (using assets as an example):

Let's calculate the calculated data:

1) find the return on assets

Where R P- revenue from sales.

This indicator characterizes the profitability of the organization and shows the efficiency of using assets.

2) the share of current assets in total assets

Where, IN- average annual values of current assets and assets.

This indicator characterizes the structure of assets.

3) turnover of current assets

Where N- sales revenue.

The turnover of current assets is measured in revolutions.

4) profitability of sales

Return on sales characterizes the efficiency of an organization.

The influence of factors on changes in return on assets will be calculated using the chain substitution method. Let's create a model:

Return on assets is the product of 3 factors.

1) Let’s find the influence of the share of current assets on return on assets:

2) find the influence of turnover of current assets:

3) find the effect of return on sales:

4) draw up a balance of deviations:

1.94 + 2.03- 1.69 = -1.6 (correct)

Thus, the change in return on sales had the greatest impact on the change in return on assets. A -2.6% drop in return on sales caused a drop in return on assets of 8.2%. The acceleration of turnover of current assets led to an increase in return on assets by 2.03%. The decrease in the share of current assets in assets reduced the return on assets by -1.94%. The cumulative impact of factors is negative and amounts to -1.6%.

Task 5

Based on the initial data (Table 5.1.), select the structure of production and sales of products in order to obtain the greatest profit (Table 5.2). Fixed costs for all options are the same and amount to 98 thousand rubles. Sales revenue for each of the three options is equal to 360 thousand rubles, 330 thousand rubles, 340 thousand rubles, respectively.

Table 5.1 Background information

|

Products |

Price, |

Variable expenses for unit, rub. |

Share in sales volume, % |

|||

|

Option 1 |

Option 2 |

Option 3 |

||||

Table 5.2 Calculation information

|

Products |

|||||

|

Share of marginal income in product price |

|||||

|

Option 1 |

|||||

|

income in revenue |

|||||

|

Revenue from sales |

|||||

|

Option 2 |

|||||

|

Average share of marginal income in revenue |

|||||

|

Revenue from sales |

|||||

|

Option 3 |

|||||

|

Average share of marginal income in revenue |

|||||

|

Revenue from sales |

Marginal income represents the sum of profit and fixed expenses. The essence of this category is that the full repayment of all fixed expenses involves writing off their full amount to the current results of the enterprise and is equated to one of the areas of profit distribution.

For the first option:

1. Share of marginal income in the price of the product, D s:

D y = (* SP A + * SP B + * SP B + * SP G)/100 = (0.25*20+0.429*30+0.167*10+0.4*40)/100=(5+12.87+1.67+16) /100=0.3554

3. Marginal income, MD:

360*0.3554= 127.944 thousand rubles.

4. Profit from sales for the first option is equal to:

P = - A = 127.944-98 = 29.94 thousand rubles.

For the second option:

for product A = (80 - 60)/80 = 0.25;

for product B = (140 - 80)/140 = 0.429;

for product C = (120 - 100)/120 = 0.167;

for the product D = (200 - 120)/200 = 0.4.

2. Average share of marginal income in revenue for the entire sales volume D y:

D y = (* SP A + * SP B + * SPs + * SP d)/100 =(0.25 * 30+0.429 * 25+0.167 * 20+0.4 * 25) /100=(7.5+10.725+3.34+10) /100=0.31565

330 * 0.31565= 104.1645 thousand rubles.

3.Sales profit for the second option is equal to:

P = - A=104.1645 -98 =6.1645 thousand rubles.

For the third option:

1. Share of marginal income in the price of the product, D s:

for product A = (80 - 60)/80 = 0.25;

for product B = (140 - 80)/140 = 0.429;

for product C = (120 - 100)/120 = 0.167;

for the product D = (200 - 120)/200 = 0.4.

2. Average share of marginal income in revenue for the entire sales volume D y:

D y = (* SP A + * SP B + * SPs + * SP d)/100 =(0.25 * 15+0.429 * 20+0.167 *35+0.4 * 30) /100=(3.75+8.58+5.845+12) /100=0.30175

Marginal income, MD, thousand rubles:

340 * 0.30175= 102.595 thousand rubles.

3.Sales profit for the third option is equal to:

P = - A=102.595 -98 =4.595 thousand. rub.

The first option for the structure of production and sales of products is more profitable from the point of view of obtaining the largest amount of marginal income and profit.

Sales profit is affected by changes in:

1. quantity and structure of goods sold;

2. price level;

3. level of fixed costs.

Task 6

Based on the balance sheet (Appendix 1), financial performance report (Appendix 2) and reference data (Appendix 4), analyze the indicators of intensification of the use of the organization's main resources. The calculations are summarized in table. 6.

Table 6Characteristics of the ratio of extensiveness and intensity of use of basic resources in the production process

|

Influence coefficients on sales revenue growth |

||||||||

|

Index |

Growth rate, % |

Increase in resource per 1% increase in revenue, % |

Ext-sti of the resource used (Kext.i x 100) |

Intensity of resource use (100-Kint.i x 100) |

||||

|

Remuneration including deductions for social needs, thousand rubles. |

||||||||

|

Material costs, thousand rubles. |

||||||||

|

Fixed assets, thousand rubles. |

||||||||

|

Working capital, thousand rubles. |

||||||||

|

Comprehensive assessment of comprehensive intensification |

||||||||

1. Gr. 5 = gr. 4 / gr. 3 H 100 - 100.

2. Gr. 6 pages 1 or 2 or 3 = gr. 5 pages 1 or 2 or 3 / gr. 5 page 4.

Gr. 6 page 6 = U gr. 6 to pages 1, 2 and 3/n.

3. Gr. 7 page 1 or 2 or 3 = gr. 6 H 100.

Gr. 7 page 6 = U gr. 7 to pages 1, 2 and 3/n.

4. Gr. 8 pages 1 or 2 or 3 = 100 - gr. 7 pages 1, 2 or 3

Gr. 8 page 6 = U gr. 8 to pages 1, 2 and 3/n.

From the data in Table 6 we can conclude that the organization is characterized primarily by extensive development; the share of extensiveness was 83%, i.e. in each percent of revenue growth, the share of extensiveness is 0.8309, and therefore, the share of intensity is 17%.

An 83% increase in sales revenue was achieved due to the involvement of additional resources in production, mainly for labor costs.

Relative overexpenditure in wages can be achieved both by increasing employee wages and by increasing the number of employees of the enterprise. At the same time, relative savings in other indicators indicate their effective use compared to the previous period.

Task 7

Based on the balance sheet data (Appendix 1), financial performance report (Appendix 2) and reference data (Appendix 4), calculate indicators for assessing the quality of the organization’s activities (Table 7.1). Conduct a comparative comprehensive assessment of the performance of organizations using the distance method, taking into account the significance score according to data for competing limited liability companies "Agat", No. 1, No. 2. Present the calculation results for the reporting period in table. 7.3

Table 7.1Initial information X

|

Index |

« Agate» |

Significance of the indicator, point (Kzn) |

|||

|

3. Return on sales, % |

|||||

|

6. Maneuverability factor |

|||||

|

7. Funding ratio |

|||||

1. Current ratio : ratio of current assets to current liabilities.

The current liquidity ratio shows the company's ability to pay off current (short-term) obligations using only current assets. The higher the coefficient, the better the solvency of the enterprise. This indicator takes into account that not all assets can be sold urgently.

2. Asset turnover ratio: the ratio of revenue to the amount of average annual balances of current assets.

The asset turnover ratio shows the number of complete product circulation cycles for the analyzed period. Or how many monetary units of sold products brought in each monetary unit of assets. Or in other words, it shows the number of turnovers of one ruble of assets during the analyzed period.

3. Return on sales % : percentage ratio of net profit to average annual revenue.

Return on sales shows how much profit the company receives from each ruble of products sold.

4. Return on equity, %: the percentage of net profit to the average annual balances of equity capital and reserves.

Return on equity shows the amount of profit that an enterprise (organization) will receive per unit of equity value.

5. Financial independence (autonomy) coefficient: the ratio of equity to the sum of all assets.

The financial independence ratio shows the share of the organization's assets that are covered by its own capital (provided by its own sources of formation). The remaining share of assets is covered by borrowed funds.

6. Maneuverability coefficient: the ratio of the difference between equity capital and non-current assets to equity capital.

The agility coefficient shows the ability of the enterprise to maintain the level of its own working capital and replenish working capital, if necessary, from its own sources.

7. Funding ratio: ratio of equity to debt capital.

The financing ratio shows to what extent the enterprise's assets are formed from its own capital, and to what extent the enterprise is independent of external sources of financing.

8. Current assets coverage ratio with own funds, %: the ratio of the difference between equity capital and non-current assets to current assets.

The coefficient of provision of current assets with own funds evaluates the speed of circulation of funds invested in current assets.

Table 7.2 Ratio coefficients indicators to the standard (Х/X max)

|

Index |

« Agat" |

Significance |

|||

|

1. Current ratio |

|||||

|

2. Asset turnover ratio |

|||||

|

3. Return on sales, % |

|||||

|

4. Return on equity, % |

|||||

|

5. Financial independence (autonomy) coefficient |

|||||

|

6. Maneuverability factor |

|||||

|

7. Funding ratio |

|||||

|

8. Ratio of provision of current assets with own funds |

Table 7.3Results of comparative rating assessment (X/X max)*Kzn

|

Index |

« Agat" |

|||

|

1. Current ratio |

||||

|

2. Asset turnover ratio |

||||

|

3. Return on sales, % |

||||

|

4. Return on equity, % |

||||

|

5. Autonomy coefficient |

||||

|

6. Maneuverability factor |

||||

|

7. Funding ratio |

||||

|

8. Ratio of provision of current assets with own funds |

||||

|

10. Place of organization |

Calculations 1-8: square of coefficients of the ratio of indicators to the standard multiplied by the significance coefficient.

Bibliography:

1. Analysis of financial statements: textbook / O.V. Efimova [and others] - M.: Omega-L Publishing House, 2013.

2. Analysis of financial statements: Textbook. - 2nd ed. / Under general ed. M.A. Vakhrushina. - M.: University textbook: INFRA-M, 2011.

3. Analysis of financial statements: textbook / edited by. ed. IN AND. Barilenko. - M.: K-NORUS, 2010.

4. Efimova O.V. Financial analysis: modern tools for making economic decisions: textbook. -M.: Omega-L Publishing House, 2010.

5. Comprehensive analysis of the economic activity of an enterprise: textbook / edited by. ed. prof. IN AND. Barilenko. - M.: FORUM. 2012.

6. Melnik M.V., Berdinkov V.V. Financial analysis: system of indicators and methodology: Textbook. - M.: Economist, 2006.

7. Theory of economic analysis: textbook / E.B. Gerasimova, V.I. Barilenko, T.V. Petrusevich. - M.: FORUM; SIC INFRA-M, 2012.

8. Official website of the Ministry of Finance of the Russian Federation. http://www.minfin.ru

Posted on Allbest.ru

...Similar documents

Analysis of the dynamics of the composition and structure of the enterprise's property. Assessment of real assets characterizing production capabilities. Dynamics of the composition and structure of sources of financial resources of the enterprise. Analysis of the composition and structure of profit before tax.

test, added 07/19/2010

Analytical balance for calculating financial stability ratios. Analysis of the composition, structure and dynamics of income and expenses of the enterprise. Features of the study of the level and dynamics of profitability of an organization's assets, taking into account the factors that determine it.

test, added 12/06/2011

Dynamics of the composition and structure of the organization's assets and liabilities. Grouping liabilities by urgency of payment. Intensification of the use of fixed resources and the current liquidity ratio. Comprehensive assessment of the organization's activities using the distance method.

test, added 12/02/2010

Analysis of the composition and structure of the organization's balance sheet. Grouping of current assets by risk level. Analysis of the dynamics of the organization's expenses. Calculation of the influence of factors on changes in return on equity. Return on investment index calculations.

test, added 11/16/2010

Analysis of the composition and dynamics of the organization’s profit, its growth rate. The impact on the change in profit from sales of sales volume, the essence of the method of absolute differences. Dynamics of the composition and structure of the enterprise's property, horizontal and vertical analysis of the balance sheet.

course work, added 01/10/2010

Assessment of the composition, structure and dynamics of the organization’s property and the sources of its formation. Key indicators of the financial stability of the organization. Liquidity indicators and assessment of the organization's solvency. Characteristics of financial condition.

test, added 07/21/2013

Assessment of the financial condition of the enterprise, use of production resources, business and market activity. Ratio analysis of an organization's assets to conduct a qualitative assessment of the property structure. Asset turnover indicators.

practice report, added 02/15/2011

Analytical balance for assessing the financial stability of an organization. Analysis of the composition, structure and dynamics of assets and liabilities, income and expenses, return on assets, sales revenue. Assessing the performance of organizations using the distance method.

test, added 01/31/2016

Main activities of the enterprise. Conducting an economic analysis of the enterprise. Analysis of the composition and dynamics of the organization's profit, profit from sales, profitability of production assets. Dynamics of the composition and structure of the enterprise's property.

test, added 07/06/2011

Analysis of the volume, composition, structure and dynamics of fixed assets. Characteristics of the technical condition of fixed production assets. Methods for calculating the number, composition and movement of labor resources, labor productivity. Profit structure analysis.

The concept of a comprehensive economic analysis of the financial and economic activities of an enterprise

From the point of view of internal content, the analysis process, as a whole, is a division into component parts. "Economic analysis is a systematized set of methods, methods, techniques used to obtain conclusions and recommendations of an economic nature in relation to a specific business entity." This approach assumes a predetermined orientation towards achieving a specific goal of analysis. Economic analysis is aimed at a comprehensive solution to the problems of assessing the financial and economic activities of an enterprise, which allows the enterprise to effectively use the conclusions obtained from the analysis regarding the current state of economic activity.

Let's consider another approach, according to which "an economic analysis of the financial and economic activities of an enterprise involves a consistent consideration of its states by function: economic activity, financial condition, as well as analysis of innovations and investments." Based on the results of the assessment of the economic activity of the enterprise and on the basis of the results of economic analysis, measures are taken to improve certain areas of the financial and economic activity of the economic entity. Thus, a comprehensive economic analysis makes it possible to identify and eliminate factors that negatively affect the results of the financial and economic activities of an enterprise.

Subject and content of comprehensive economic analysis

The subject of a comprehensive economic analysis of financial and economic activity is the process of establishing and assessing cause-and-effect relationships between factors and results in the process of choosing a method for implementing decisions and planning them.

The objects of complex economic analysis are individual economic entities and their financial and economic activities, expressed through economic results.

- Management analysis is concentrated in the field of intra-farm production, commercial, technological and labor processes.

- Financial analysis includes an assessment of the financial results and financial condition of the enterprise.

The results of a comprehensive economic analysis of the financial and economic activities of an enterprise and the development on their basis of measures to improve its efficiency make it possible to influence such categories as profit, capital, asset turnover, accounts receivable and payable, wages, dividends, investments, social expenses, etc.

The purpose and objectives of a comprehensive economic analysis of the financial and economic activities of an enterprise

The purpose of integrated economics is to prepare information for making management decisions related to the implementation of the main economic activities of an economic entity or certain financial and economic aspects of the current and future functioning of the organization.

In modern conditions, comprehensive economic analysis allows any enterprise to ensure effective management of financial and economic activities. In order to rationally manage the financial and economic activities of an enterprise, it is necessary to objectively and rationally apply the methodology and techniques of economic analysis, methods and methods for assessing the financial condition and economic activity, based on the results of which it is possible to develop effective ways and techniques for improving the indicators of the financial and economic activities of the enterprise.

A comprehensive economic analysis of the financial and economic activities of an organization is carried out in three main areas:

- assessment of the phenomena under study;

- diagnostics, i.e. establishing cause-and-effect relationships and assessing the “power of influence” of individual factors on the result;

- predicting the consequences of decisions made.

In accordance with this, we can identify the main tasks of a comprehensive economic analysis of the financial and economic activities of an enterprise.

Tasks of a comprehensive economic analysis of the financial and economic activities of an enterprise

Stages of comprehensive economic analysis

There are three main stages of a comprehensive economic analysis of the financial and economic activities of an enterprise:

- Determining the specific purpose of the analysis and the approach to its implementation;

- Assessing the quality of information submitted for analysis;

- Determining analysis methods, conducting the analysis itself and summarizing the results obtained.

At the first stage, the purpose of the analysis is determined in one of three ways:

- comparison of the enterprise’s indicators with the average indicators of the national economy or industry (such indicators are called “ideal” or “normative”);

- comparison of indicators of a given reporting period with indicators of previous periods, as well as with planned indicators for the reporting period;

- comparison of the enterprise’s performance with the performance of similar competing firms (inter-company comparative analysis).

At the second stage of comprehensive economic analysis, an assessment is made of the quality of information, which consists not only of a counting check of accounting data, but also of determining the influence of accounting methods on the formation of reporting indicators.

The third stage is the direct assessment of the financial and economic activities of the enterprise as a set of methods, methods and working techniques.

Scheme for assessing the main groups of economic activity indicators in the system of comprehensive economic analysis

Methods for conducting a comprehensive economic analysis of the financial and economic activities of an organization

conclusions

Comprehensive economic analysis provides an assessment of the main characteristics of the financial and economic activities of an enterprise using various indicators.

The results of a comprehensive economic analysis of the financial and economic activities of an economic entity using modern analysis techniques make it possible to identify problem areas in the financial and economic activities of an enterprise in order to then eliminate the identified problems and take measures to improve the economic activity and financial position of the enterprise.

A comprehensive assessment of the financial and economic activities of an enterprise is necessary to manage the movement of material, labor and financial resources within the framework of business entities carrying out their core activities.

A comprehensive economic analysis of the financial and economic activities of an organization is not an end in itself. Based on the results of the analysis, conclusions are drawn about possible ways to increase the efficiency of the financial and economic activities of the enterprise. Improving the financial and economic activities of an organization is based on a set of measures and recommendations that adjust the production, economic, commercial and financial activities of the enterprise.

The implementation of measures and the development of recommendations for optimizing financial and economic activities are aimed at improving the current position of the enterprise by optimizing financial transactions, economic mechanisms and production processes that take place at the enterprise. A set of measures can be implemented by developing an appropriate project, the purpose of which is to increase the efficiency of the financial and economic activities of the organization. In general, such a project directly includes a comprehensive economic analysis of the financial and economic activities of the organization, the development of recommendations for the implementation of measures and the implementation of the proposed measures in the practice of the financial and economic activities of the enterprise.

Literature

- Gerasimov B.I., Konovalova T.M., Spiridonov S.P. Comprehensive economic analysis of the financial and economic activities of the organization. – Tambov: TSTU Publishing House, 2008.

- Grishchenko O.V. Analysis and diagnostics of the financial and economic activities of the enterprise. – Taganrog: TRTU publishing house, 2012.

- Gubina O.V., Gubin V.E. Analysis of financial and economic activities. – M.: Infra-M, 2013.

- Zoroastrova I.V., Rozanova N.M. Economic analysis of the company and the market. – M.: Unitidana, 2009.

- Kogdenko V.G. Economic analysis. – M.: Unity-Dana, 2006.

- Lysenko D.V. Comprehensive economic analysis of economic activity. – M.: Infra-M, 2008.

- Lyubushin N.P. Comprehensive analysis of financial and economic activities. – M.: Finance and Statistics, 2012.

- Lyubushin N.P. Economic analysis. – M.: Unity-Dana, 2010.

- Tolpegina O.A., Tolpegina N.A. Comprehensive economic analysis of economic activity. – M.: Yurayt, 2013.

- Chechevitsyna L.N. Analysis of financial and economic activities. – Rostov-on-Don, Phoenix, 2013.

- Chueva L.N., Chuev I.N. Analysis of financial and economic activities. – M.: Dashkov and K, 2013.

- Sheremet A.D. Theory of economic analysis. – M.: Infra-M, 2011.

Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Similar documents

The concept of economic analysis, its tasks and types. Techniques and methods of economic analysis. Vertical and horizontal analysis of form No. 1 “Balance Sheet”, form No. 2 “Profit and Loss Statement”. Analysis of balance sheet liquidity and financial stability of the enterprise.

course work, added 10/16/2012

The concept of partner groups; their contribution to the economic activities of the enterprise. Vertical and horizontal analysis of the “Balance Sheet” and “Profit and Loss Statement” forms. Assessment of solvency, business activity and profitability of the organization.

course work, added 06/26/2014

Theoretical foundations of economic activity analysis. Analysis of the active part of the Balance Sheet (F№1). Analysis of the passive part of the Balance Sheet (F#1). Horizontal analysis of the Profit and Loss Statement (FNo. 2). Assessment of financial stability.

course work, added 02/09/2011

Study of the financial condition of an enterprise using the example of Amurpromservice LLC. Horizontal, vertical and trend analysis of the profit and loss statement of an enterprise. Ratio analysis of enterprise profitability. Factor analysis of profit.

course work, added 07/28/2010

Vertical and horizontal analyzes of the “Balance Sheet” and “Profit and Loss Statement” forms. Analysis of balance sheet liquidity, solvency, financial stability, business activity, profitability and probability of bankruptcy of Rodex Group OJSC.

course work, added 07/23/2011

Concepts and organizational and methodological foundations of a comprehensive economic analysis of economic activity using the example of OJSC Bashneftekhimsnab. Formation and analysis of groups of economic activity indicators, measures for its improvement.

course work, added 08/02/2011

Economic efficiency indicators. Assessing the efficiency of an enterprise's economic activities and the state of its balance sheet. Typology of types of economic analysis. Comprehensive economic analysis of Bratskenergoremont CJSC. Vertical balance sheet analysis.

thesis, added 07/06/2010