Declaration of conformity for SMEs. Declaration of membership in the SMP: how to take part in public procurement. What is indicated in the declaration of affiliation with small businesses

Here we will provide a sample according to which you can fill out a declaration of belonging to small businesses in accordance with Part 3 of Article 30 of 44-FZ. This declaration is necessary for participation in procurement procedures that have limited participation only to SMP, SONKO, etc. The declaration must be completed at letterhead organizations.

Declaration of SMP according to 44-FZ sample 2018. Download the form.

You can download a sample in .doc format for filling out yourself at the end of the article by clicking on the link.

Declaration

on the belonging of Romashka LLC to small businesses.

By this declaration we confirm that:

In accordance with Article 4 Federal Law dated July 24, 2007 No. 209-FZ “On the development of small and medium-sized businesses in Russian Federation» Romashka LLC is a small business entity and meets the following conditions:

1) The total share of participation of the Russian Federation, constituent entities of the Russian Federation, municipalities, foreign legal entities, public and religious organizations (associations), charitable and other funds in the authorized (share) capital (share fund) of Romashka LLC does not exceed twenty-five percent, the share of participation owned by one or more legal entities that are not subjects small and medium-sized businesses does not exceed twenty-five percent.

2) Average number employees of Romashka LLC for the previous calendar year do not exceed one hundred people inclusive.

3) The revenue of Romashka LLC from the sale of goods (work, services) excluding value added tax or the book value of assets (residual value of fixed assets and intangible assets) for the previous calendar year does not exceed 800 million rubles.

CEO _________________ Ivanov I.I.

Download from our website in Word (.doc) format - Option 1, Option 2

Current for 2018. From August 1, 2016, instead of this declaration (or jointly), an extract from the unified register of SMEs should be attached (if information about this legal entity/entrepreneur is included in it).

SME reporting (reporting of small and medium-sized businesses)

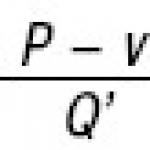

Specify costcalculated

individually

The cost of SMSP reporting depends on the amount of waste

Reporting deadline

— from 2 working days (excluding approval from the Rosprirodnadzor SZU)

Document validity period

Grounds for generating SMSP reporting

Small and medium-sized businesses, which include legal entities and individual entrepreneurs as defined by the Federal Law of July 24, 2007.

How to draw up an SMP declaration under 44-FZ in 2018

N 209-FZ “On the development of small and medium-sized businesses in the Russian Federation”, just like other legal entities, are required to comply with the requirements of environmental legislation regarding waste management.

Environmental legislation regarding waste management takes into account the characteristics of small and medium-sized businesses and provides for the following:

- Based on clause 3 of Article 18 of the Federal Law of June 24, 1998 No. 89-FZ “On Production and Consumption Waste” (as amended on December 30, 2008), it was determined that small and medium-sized businesses are exempt from the development of draft waste generation standards and limits for their placement (PNOOLR).

- In accordance with the Order of the Ministry of Natural Resources of Russia dated February 16, 2010 No. 30, small and medium-sized businesses are required to take into account and report on waste generation. Order No. 30 of the Ministry of Natural Resources of Russia dated February 16, 2010 approved the Procedure for submitting and monitoring reporting on the generation, use, neutralization and disposal of waste (with the exception of statistical reporting).

Requirements for submitting SMSP reports, approved by Order of the Ministry of Natural Resources of Russia dated February 16, 2010 No. 30

- Reporting is based on data primary accounting formed, used, neutralized, transferred to other legal entities and individual entrepreneurs, received from other legal entities and individual entrepreneurs or individuals, as well as disposed waste.

- OSMSP must be submitted to the territorial body of Rosprirodnadzor at the place of implementation of its economic activity. In the case of several places of activity, it is necessary to provide several reports, breaking them down by territorial basis and submitting data for each place of activity to the relevant territorial bodies of Rosprirodnadzor, or provide a single report for the Russian Federation to each of territorial bodies Rosprirodnadzor.

- Reporting must be submitted by January 15 of the year following the reporting period of one calendar year.

- Reporting is prepared on on paper(2 copies) and on electronic media (1 copy).

Download Order No. 30 of 02.16.10. "About the Small Business Waste Report"

When compiling SME reports on their own, managers of small and medium-sized businesses experience considerable difficulties when filling out information such as:

- balance of masses of waste generated, used, neutralized, transferred to other legal entities and individual entrepreneurs, received from other legal entities and individual entrepreneurs or individuals, disposed of waste during the reporting period;

- data on the masses of waste transferred to other legal entities and individual entrepreneurs are presented in total for each type of waste and broken down by mass of waste intended for use, neutralization, storage (broken down by mass of waste transferred with the transfer of ownership, and by masses of waste transferred without transfer of ownership), for disposal (broken down by mass of waste transferred with transfer of ownership, and by mass of waste transferred without transfer of ownership);

- data on the masses (in tons) of transferred waste, grouped by each type of waste, indicating its name, code according to the federal classification catalog of waste, hazard class, purpose of transfer (use, disposal, disposal).

We offer you qualified assistance in the preparation, presentation and monitoring of reports on the generation, use, disposal and disposal of waste (with the exception of statistical reporting).

Thank you for visiting our site.

We hope that our proposals will interest you and that our cooperation will be long-term and fruitful.

How to fill out the Declaration of SMP according to 44 Federal Laws example

Not all companies need to keep accounting records. However, every enterprise must submit reports; however, small businesses have their own simplified form. For example, in balance sheet There are only 11 lines left: 5 for assets and 6 for liabilities. In addition, you need to fill out a report on financial results and submit these 2 documents to the tax service and Rosstat by March 31.

Reporting to the state on the results of its activities is the responsibility of any enterprise (Federal Law dated December 6, 2011 N 402-FZ).

And this must be done in a timely manner. Failure to submit reports entails fines and increases the likelihood of a tax audit.

Small Business Reporting

Accounting requirements are given in Federal Law No. 402-FZ dated December 6, 2011. The basis financial statements prepares a balance sheet and income statement. It is also necessary to draw up explanatory note, if necessary.

The financial statements of small businesses can be complete or simplified.

A simplified form can be used:

- small business;

- non-profit organizations.

This can only be done if the field of activity is not on the list of exceptions. In particular, the company does not belong to microfinance companies, legal advice, notary and law offices.

Small Business Criteria

Companies are classified as small businesses if:

- their revenue excluding VAT for the last calendar year amounted to 800 million rubles;

- the average number of employees did not exceed 100 people;

- share of the state, funds, large companies up to 25%.

Rice. 1. Small business

In this case, it does not matter at all what taxation system the company uses, because Only the requirements for financial reporting and accounting depend on this status. Tax accounting is different.

However, in 2015, all simplified enterprises are automatically equated to small businesses. It’s simple: in order to apply the simplified tax system, revenue should not exceed 64 million rubles. per year and this value is included in the limit of 800 million rubles. But, again, if the company matches the share of the state/funds. The composition of the founders is important in this matter.

Small business status is assigned to a company if it meets the above criteria for three consecutive years. For example, 2013, 2014 and 2015. In order for a company to be classified as a small business, you do not need to submit any documents anywhere.

If the company has just registered, then in the first year, subject to the limit on operations, the number of employees and a suitable composition of founders, the enterprise automatically belongs to a small business.

Accounting documents

Small companies can generate reporting using a simplified scheme. But they also have the right to do this on a general basis. Each enterprise resolves this issue independently. In addition, you can develop the form yourself.

In both cases, 2 documents must be submitted (download the reporting form for 2015):

- balance;

- income statement (formerly profit and loss statement).

The difference between them is the need for detail. In the simplified version, you don’t need to write everything down item by item; in general, this needs to be done. In the first case the form is simpler, in the second it is more complex.

Before filling out the documents, you must make final entries for the year and close all company accounts.

Rice. 2. Balance sheet form for small businesses

For comparison: the full form of the passive section “V. Short-term liabilities" of OJSC "Gazprom" for 2014.

Rice. 3. Example of one section of the full form

In the simplified form, unlike the full form, there is only one line.

Rice. 4. Financial results report form

If you need to specify Additional information, without which it is impossible to evaluate financial condition organization, or is required to disclose accounting policies and other important information, constitute an appendix.

How to fill out forms

The basis for filling out forms is data accounting. Before filling it out, you must make all entries and close open accounts (download the completed example).

Changes cannot be made. If it is not possible to write in a simplified form necessary information, the general form should be used.

Errors can be corrected. How to do this is explained in the video:

When aggregating indicators, the line code must indicate the one from the group whose share is larger.

To whom to report

If an enterprise is registered after September 30, then it must report not in next year, and after a year and for the entire period from the start of business.

You need to report for the year; there is no need to fill out intermediate forms. But this can be done for self-checking or at the request of the company management.

Reports must be submitted to 2 authorities:

- tax office;

- Rosstat.

Note: For For small businesses, accounting can be done independently (saving on an accountant) using the “My Business” Internet service.

Peter Stolypin, 2015-09-05

Questions and answers on the topic

No questions have been asked about the material yet, you have the opportunity to be the first to do so

Declaration of a company's affiliation with the SMP: structure of the document What exactly should be reflected in the submitted document? The most important thing is to record in this declaration the fact that the company has the status of “SPM”. This is done by listing all the criteria that are specified in the legislation, namely: its ongoing activities; nuances of distribution of shares in the ownership of the organization; number of employees; average monthly revenue. At the same time, there can be quite a lot of criteria that a given organization belongs to the SPM. Since quite a lot of concepts and norms can fit under them. In order to better understand it is necessary to expand on this topic in more detail.

Declaration of conformity for small businesses (sample)

- purchasing works of art from the author or rights holder;

- obtaining assistance in organizing membership in various events that are held for a group of government agencies;

- when purchasing services related to the imminent arrival of representatives of government agencies from abroad;

- when purchasing a set of services related to technical and copyright supervision;

- acquisition of goods necessary for the continued operation of places under state protection;

- at the time of buying medical supplies etc.

InfoWhat is a declaration of membership in a small business enterprise? A declaration of membership in small businesses is a document used to participate in government procurement. It is somewhat of an advantage when it comes to identifying the best supplier.

We study the SMP declaration under Federal Law 44

Federal Law of July 24, 2007 N 209-FZ (as amended on December 29, 2015) “On the development of small and medium-sized businesses in the Russian Federation”5) Restriction on the total share of participation of foreign legal entities and (or) legal entities that are not subjects small and medium-sized businesses, does not apply to companies with limited liability, meeting the requirements specified in subparagraphs “c” - Art. 4 of the Federal Law of July 24, 2007 N 209-FZ (ed.

Declaration of affiliation with small businesses (SMB)

This procedure is again entrusted to the company filling out the paper, and it is necessary to indicate:

- seal;

- manager's signature.

What is indicated in the declaration of belonging to small businesses You can prove that an entrepreneur belongs to the required category by declaring a form in your own style, however, there is a list of criteria that must be indicated in it, confirming that the company is in the small business sector. Note! The criteria by which the status and affiliation of a company are determined are constantly changing.

Replacements and additions are made on a regular basis. For 2017, this list of requirements is valid, related to the quantitative composition of companies and the amount of income they receive excluding value added tax.

searching results

Table 1.

Declaration of affiliation with small businesses

TIN/KPP, OGRN, legal address) represented by General Director Egorov Sergey Leonidovich, (position and full name of the head/representative of the legal entity or individual entrepreneur) declares to belong to small businesses on the following grounds.

- The total share of participation of the state and its subjects, municipalities, foreign organizations and citizens, public and religious associations, charitable and other foundations in the authorized capital - 42% (not more than the legal limit of 49%).

- The average number of employees for the previous calendar year was 100 people (within the legal norm for small enterprises of 100 people).

- Annual revenue from sales of goods (works, services) – 764 million rubles. (within the normal range for a small enterprise up to 800 million rubles.

AttentionPayment terms It should be separately noted that if such a restriction is established, the payment period for SMP under 44 Federal Laws is almost two times less than in other orders. In this case, the time for payment of SMP under 44 Federal Laws is 15 days (working days, not calendar days, please note this) from the moment of fulfillment of obligations under the contract.

Whereas the payment period for other contracts is 30 calendar days. Who belongs to the SMP according to 44 Federal Law? These are registered in in the prescribed manner legal entities (business entities, partnerships, peasant farms) and individual entrepreneurs (Law No. 209).

Criteria have been established for the belonging of certain persons to such entities.

The business company, business partnership received the status of a project participant in accordance with the Federal Law of September 28, 2010 N 244-FZ "On innovation center Skolkovo yes (no) - 3.4 Founders (participants) economic company, economic partnership are legal entities included in the list of legal entities that provide state support approved by the Government of the Russian Federation innovation activity in the forms established by Federal Law of August 23, 1996 N 127-FZ “On Science and State Scientific and Technical Policy”6.

Reading time: 6 min

Participants in procurement under 44-FZ and 223-FZ must confirm their compliance with the tender requirements. To do this, they submit declarations of conformity as part of applications for participation in procurement.

Dear readers! Each case is individual, so check with our lawyers for more information.Calls are free.

Concept

Declaration of compliance with uniform requirements is a document that must be attached as part of the application for participation and confirms compliance with the requirements of the procurement documentation. The need to declare their compliance with certain rules applies to procurement participants within the framework of the law on contract system, as well as on individual legal entities. This is due to the fact that participants under both 44-FZ and 223-FZ are subject to general requirements.

To participate in procurement under 44-FZ, suppliers submit one of the declarations:

- Declaration of conformity with uniform requirements for participants.

- Declaration of confirmation of the country of origin of goods(if the goods are purchased according to the requirements).

- Declaration of the company's affiliation with small businesses or socially oriented NPOs.

The first type of this document is submitted by all participants who plan to compete for victory in tenders. The requirements for them, which are presented by customers, are divided into uniform, additional and optional.

1 2 3 4 5 6 7 8 9 … 14

| No. | Attribution criterion | Small businesses | Medium enterprises | Index |

| 1 | 2 | 3 | 4 | 5 |

| 1. | only for legal entities:

Total share of participation in the authorized (share) capital: Russian Federation, constituent entities of the Russian Federation, municipalities, foreign legal entities, public and religious organizations (associations) |

no more than 25% | Indicated as a percentage | |

| 2. | only for legal entities:

Share of participation in the authorized (share) capital of legal entities that are not small and medium-sized businesses |

no more than 25% | Indicated as a percentage | |

| 3. | Average number of employees for the previous calendar year (determined taking into account all employees, including those working under civil contracts) | up to 100 people | From 101 to 250 people | Indicated

number of persons |

| up to 15 people – micro enterprise |

||||

| 4. | Revenue from the sale of goods (work, services) excluding value added tax or book value of assets (residual value of fixed assets and intangible assets) for the last completed year | 400 million Sample declaration of affiliation with small businesses 2018 |

1,000 million rubles. | Indicated in millions of rubles |

| 60 million rubles. – micro-enterprise | ||||

_________________________________ ___ ___________________________

(Signature of authorized representative) (Name and position of signatory)

M.P.

COMPLETION INSTRUCTIONS

- These instructions should not be reproduced in documents prepared by the procurement participant.

- This form is filled out and submitted as part of the application for participation in the procurement if it is indicated in Form 1 that the procurement participant belongs to small and medium-sized businesses, according to the classification criteria (columns 2-4) in accordance with Article 4 of the Federal Law of July 24, 2007 No. 209-FZ “On the development of small and medium-sized businesses in the Russian Federation.”

- The procurement participant provides the number and date of the application for participation in the procurement, to which this form is an appendix.

- The procurement participant indicates its corporate name (including its legal form). Also, procurement participants, as part of the application for participation in the procurement, provide completed Form 1.1 for the involved procurement participant subcontractor (co-executor)/manufacturer , if so subcontractor (co-executor)/manufacturer is a small and medium-sized enterprise. Onmanufacturer, which is a small and medium-sized business, form 1.1 is filled out and submitted as part of an application for participation in the procurement only if a manufacturer is involved to perform work on the manufacture of goods directly by the procurement participant, without involving official dealers etc.

- Form 1.1 as part of the application for participation in the procurement is provided in two formats: *pdf. with signature and seal, as well as in editable format *.doc or *.xls.

1 2 3 4 5 6 7 8 9 … 14

Manual, instructions for use

Declaration of SMP according to 44-FZ sample 2018. Download the form.

Thus, the provision of the declaration in question from legal entities and individual entrepreneurs has nuances. Declaration form What might a declaration of belonging to a small business entity look like? A sample of it is presented below. It is worth noting that the official form of this source has not been approved in the legislation of the Russian Federation. An economic entity can form it in any convenient structure. But it is important that the declaration of affiliation with small businesses, its sample used by a particular company, reflect the information that we discussed above: the structure of the distribution of shares in the ownership of the enterprise, the size of the staff, as well as the amount of revenue of the organization within the threshold criteria, established by federal legislation.

How to fill out the SMP declaration under 44 Federal Law example

TIN/KPP, OGRN, legal address) represented by General Director Sergei Leonidovich Egorov (position and full name of the head/representative of a legal entity or individual entrepreneur) declares membership in small businesses on the following grounds.

- The total share of participation of the state and its subjects, municipalities, foreign organizations and citizens, public and religious associations, charitable and other foundations in the authorized capital is 42% (not more than the legal limit of 49%).

- The average number of employees for the previous calendar year was 100 people (within the legal norm for small enterprises of 100 people).

- Annual revenue from sales of goods (works, services) – 764 million rubles. (within the normal range for a small enterprise up to 800 million rubles.

Declaration of affiliation with small businesses (SMB)

Guidelines for filling out a declaration of affiliation with a private enterprise for LLCs and individual entrepreneurs

The average number of employees of Romashka LLC for the previous calendar year does not exceed one hundred people inclusive. 3) The revenue of Romashka LLC from the sale of goods (work, services) excluding value added tax or the book value of assets (residual value of fixed assets and intangible assets) for the previous calendar year does not exceed 800 million rubles. General Director Ivanov I.I. M.P. Download from our website in Word (.doc) format - Option 1, Option 2 Current for 2018. From August 1, 2016, instead of this declaration (or jointly), an extract from the unified register of SMEs should be attached (if information about this legal entity/entrepreneur is included in it).

Declaration of conformity for small businesses (sample)

Attention

Payment terms Separately, it should be noted that if such a restriction is established, the payment period for SMP under 44 Federal Laws is almost two times less than in other orders. In this case, the time for payment of SMP under 44 Federal Laws is 15 days (working days, not calendar days, please note this) from the moment of fulfillment of obligations under the contract. Whereas the payment period for other contracts is 30 calendar days.

Who belongs to the SMEs under 44 Federal Laws These are legal entities registered in the established order (business companies, partnerships, peasant farms) and individual entrepreneurs (Law No. 209). Criteria have been established for the belonging of certain persons to such entities.

SMP Declaration (sample)

It is worth noting that the list of criteria that confirm the fact that the enterprise is a subject of the NSR, and reflected in the document under consideration, can be very wide. Let's study the specifics of this list in more detail. Classification of a company as an SME entity according to the declaration: criteria The relevant criteria can be classified into the following main categories: - distribution of shares in the ownership of the organization; - the size of the company's staff; - revenue indicators. Also, the law may establish other conditions under which a particular company has the right to indicate in a document such as a declaration of belonging to a small business entity (44-FZ assumes that the business entity will reflect reliable information in this source) that it belongs to the SME legally.

Declaration of affiliation with small businesses: sample

sample). You can find out more about the SMP declaration in this article.

Sample of filling out the SMP declaration

Criteria for classifying a company as an SMP: distribution of shares in the ownership of the organization. If the economic entity is a legal entity, then it can be classified as a SMP if: - the total share of state and municipal authorities, foreign companies, public structures, religious organizations, as well as charitable and other foundations, ownership of the company does not exceed 25%; - the total share of legal entities that are not subjects of the SMP in the ownership of the company also does not exceed 25%. However, the application of these legal norms is characterized by a number of nuances. Determining the shares of a business company: nuances First of all, when determining the first criterion - from those given above - assets belonging to investment and mutual funds are not taken into account.

We study the SMP declaration under Federal Law 44

Criteria for classifying a company as an SMP: revenue Another criterion for classifying a company as an SMP is revenue. In accordance with federal legislation, the threshold value of an organization's income, which gives it the right to classify itself as a small and medium-sized business, is: - for micro-enterprises - in the amount of 120 million rubles; - for small businesses - 800 million rubles; - for medium-sized businesses - 2 billion rubles. A declaration of belonging to a small business entity of an LLC or, for example, an individual entrepreneur, can also be filled out taking into account other criteria for determining the status of an economic entity, which are established by Russian legislation.

Declaration of affiliation with small businesses (SMB) - sample

Let's study them. Classifying a company as an SME: other conditions If we talk about other conditions under which a company can be classified as a medium or small enterprise, then first of all it should be noted that the above criteria are considered only within 2 calendar years in a row.

Winner” (the company is fictitious, all matches are random), as well as download Declarations for LLCs and individual entrepreneurs. An important addition: the article is relevant in 2018. Example of completion: “Declaration of compliance of the participant with the requirements established by Article 4 of the Federal Law of July 24, 2007 No. 209-FZ “On the Development of Small and Medium-Sized Businesses in the Russian Federation” The auction participant, Pobeditel LLC, is classified as a small business entity subject to the following conditions: 1 The total share of participation of the Russian Federation, constituent entities of the Russian Federation, municipalities, foreign legal entities, foreign citizens, public and religious organizations (associations), charitable and other funds in the authorized (share) capital (mutual fund) does not exceed twenty-five percent (with the exception of the assets of joint-stock investment funds and closed-end mutual investment funds).

How to fill out a SMP declaration for LLC sample

Relevant declaration legal entity must be supplemented, first of all, with a certificate of registration as an SMP entity, and in its absence: - accounting documents; - tax return; - forms reflecting the average number of employees of the company for the 2 previous calendar years; if the company is a joint-stock company - an extract from the register reflecting information on shareholders; if the enterprise is an LLC, then a list of participants in the organization indicating their citizenship will be required. Documents in support of the declaration for individual entrepreneurs The declaration of an individual entrepreneur about his belonging to the SSE can also be supplemented by a certificate of inclusion in the register of SSE entities, and in its absence: - a form reflecting the value average number employees for the 2 previous calendar years; - declaration in form 3-NDFL; - tax declaration.

The declaration is completed in accordance with Art. 4 of the Federal Law of July 24, 2007 No. 209-FZ, clause 11 of the Regulations, approved. Government Decree No. 1352 dated December 11, 2014, Order of the Ministry of Economic Development No. 262 dated May 31, 2017, clarifications of the Ministry of Economic Development.

In the declaration, depending on compliance with the criteria, it is necessary to confirm the classification as a small or medium-sized enterprise. In this case, in relation to the declarant it is necessary to indicate:

- name of the procurement participant;

- location address;

- TIN/KPP, number and date of issue of the registration certificate;

- OGRN;

- information on compliance with the criteria for classification as an SME, as well as information on the goods, works, services and types of activities produced (in tabular form).

The declaration can be submitted in paper or in electronic format. In paper form, the declaration is filled out in black, purple or blue ink. Filling electronic form The declaration must be made in capital letters in Courier New font with a height of 16 - 18 points.

Items 1 to 11 are required to be completed in the table.

In paragraphs 1 and 2, if the criteria specified therein are met, column 5 is indicated by “yes” or “does not exceed at the time of filling out.” If desired, you can indicate the actual indicator in column 5.

SMEs that are not LLCs put dashes in the indicated columns.

In paragraphs 3 to 6, you must indicate “yes” or “no” depending on compliance with the conditions given therein.

In paragraphs 7 and 8, only cells 7-4 and 8-4 are filled in with actual values, respectively.

Clause 9 contains information about licenses listing all data from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs: series and number of the license, date of issue, start date, expiration date, name of the licensed type of activity for which the license was issued, information about the address of the place of implementation of the licensed type of activity , name of the licensing authority that issued or reissued the license, information about the suspension of the license, state registration number and the date of entry in the Unified State Register of Legal Entities (USRIP) containing the specified information. If there are no licenses, “no” is indicated.

Paragraph 10 of the table contains data from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs, listing the OKVED2 and OKPD2 codes.

In paragraph 11, it is necessary to indicate the types of activities actually carried out, the goods produced by the subjects of the NSR, the work performed, the services provided, listing the OKVED2 and OKPD2 codes.

Inaccurate information in the SME declaration

The inclusion of inaccurate information in the SME declaration may lead to:

- removal of a SME participant from participation in the determination of a supplier (contractor, performer) or refusal to conclude a contract with the winner of the determination of a supplier (contractor, performer) at any time before the conclusion of the contract;

- termination of the concluded contract with recognition of the SME person as having evaded concluding the contract;

- adoption by the customer of a decision to unilaterally refuse to execute a procurement contract;

- inclusion of a SME in the register of unscrupulous suppliers in the event of termination of a procurement contract.